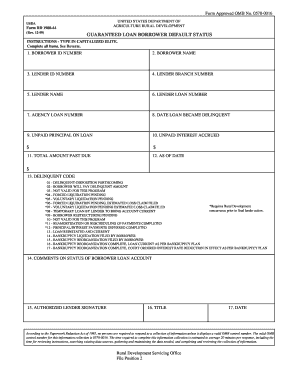

Guaranteed Loan Default Form

Understanding Guaranteed Loan Default

A guaranteed loan default occurs when a borrower fails to meet the repayment obligations outlined in their loan agreement. This situation can arise from various factors, including financial hardship, loss of income, or unforeseen circumstances. When a borrower defaults, it can lead to serious consequences, such as damage to their credit score and potential legal action from lenders. In the context of government-backed loans, like the RD 1980 44 form, the implications of default can also affect the lender's ability to recover funds through government guarantees.

Steps to Complete the Guaranteed Loan Default Form

Completing the RD 1980 44 form requires careful attention to detail to ensure that all necessary information is accurately provided. Here are the essential steps to follow:

- Gather all required documentation, including personal identification and financial records.

- Fill out the borrower information section, ensuring that all names and addresses are correct.

- Detail the loan information, including the loan amount, purpose, and repayment history.

- Provide a clear explanation of the circumstances leading to the default.

- Review the form for accuracy and completeness before submission.

Legal Use of the Guaranteed Loan Default Form

The RD 1980 44 form is legally binding when completed and submitted according to the regulations set forth by the U.S. Department of Agriculture (USDA). It is essential to understand that this form serves as a formal declaration of default, which can initiate various legal processes. Borrowers should ensure compliance with all applicable laws and guidelines to avoid potential penalties or further complications.

Key Elements of the Guaranteed Loan Default Process

Understanding the key elements involved in the guaranteed loan default process is crucial for borrowers. These elements include:

- Notification: Borrowers must be officially notified of their default status by the lender.

- Documentation: Proper documentation must be submitted to support the claim of default.

- Government Involvement: The USDA may step in to assist with the resolution of the default, depending on the circumstances.

- Potential Remedies: Options such as loan restructuring or repayment plans may be available to borrowers facing default.

Eligibility Criteria for Guaranteed Loan Default Assistance

To qualify for assistance related to a guaranteed loan default, borrowers must meet specific eligibility criteria. These typically include:

- Proof of financial hardship or inability to make payments.

- Compliance with all previous loan terms and conditions.

- Submission of the completed RD 1980 44 form within the designated timeframe.

Penalties for Non-Compliance with Guaranteed Loan Default Regulations

Failing to comply with the regulations surrounding guaranteed loan defaults can result in significant penalties. These may include:

- Increased financial liability due to late fees and interest charges.

- Legal action taken by lenders to recover the owed amount.

- Negative impact on the borrower's credit score, affecting future borrowing opportunities.

Quick guide on how to complete guaranteed loan default

Complete Guaranteed Loan Default effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your paperwork swiftly and without delays. Handle Guaranteed Loan Default on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign Guaranteed Loan Default with ease

- Obtain Guaranteed Loan Default and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Guaranteed Loan Default and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the guaranteed loan default

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a borrower default and how does it affect my business?

A borrower default occurs when a borrower fails to meet the legal obligations or conditions of their loan agreement. This situation can signNowly impact your business by affecting cash flow, increasing risk, and possibly leading to legal action. Understanding borrower default is essential for developing effective risk management strategies.

-

How can airSlate SignNow help with borrower default documentation?

airSlate SignNow provides an easy-to-use platform for managing documents related to borrower default. With features like eSigning and document tracking, you can ensure that all necessary agreements are processed efficiently, minimizing delays and potential disputes. This streamlined approach helps safeguard your business against borrower default scenarios.

-

What are the pricing options for airSlate SignNow if I’m concerned about borrower default?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to mitigate risks associated with borrower default. Our cost-effective solutions provide all the necessary tools to manage and sign important documents, ensuring you stay compliant and prepared. You can choose a plan that fits your budget while effectively managing borrower default risks.

-

Does airSlate SignNow integrate with other systems to manage borrower default data?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems, allowing you to track and manage borrower default data efficiently. By connecting your workflows, you can streamline processes related to borrower default notifications, documentation, and compliance, enhancing overall productivity.

-

What features does airSlate SignNow offer to prevent borrower default issues?

To help prevent borrower default issues, airSlate SignNow offers features such as secure eSigning, automated reminders, and templates for compliance. These tools allow you to stay organized and maintain clear communication with borrowers, signNowly reducing the chances of default through proactive management.

-

Can I customize documents to address borrower default scenarios with airSlate SignNow?

Absolutely! airSlate SignNow allows for extensive customization of documents, enabling you to create specific agreements tailored to different borrower default scenarios. This flexibility helps ensure that all legal obligations are clearly outlined and agreed upon, reducing the risk of misunderstandings and defaults.

-

How does airSlate SignNow ensure security during borrower default negotiations?

airSlate SignNow prioritizes security by using advanced encryption and authentication measures during all document transactions, including those related to borrower default negotiations. This commitment to security helps protect sensitive information and ensures that all agreements are secure and tamper-proof.

Get more for Guaranteed Loan Default

- Dom of information act request form tinley park il tinleypark

- Det 014 afrotc form 48 planned academic program single uwf

- Withdrawal request form

- Rookie teacher of the year miami dade form

- Nebraska llc certificate of organization template form template for certificate of organization for nebraska llc

- About the program landlord eligibility how it can help form

- Boat slip rental agreement template form

- Where to send national ucc financing statement wyoming form

Find out other Guaranteed Loan Default

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter