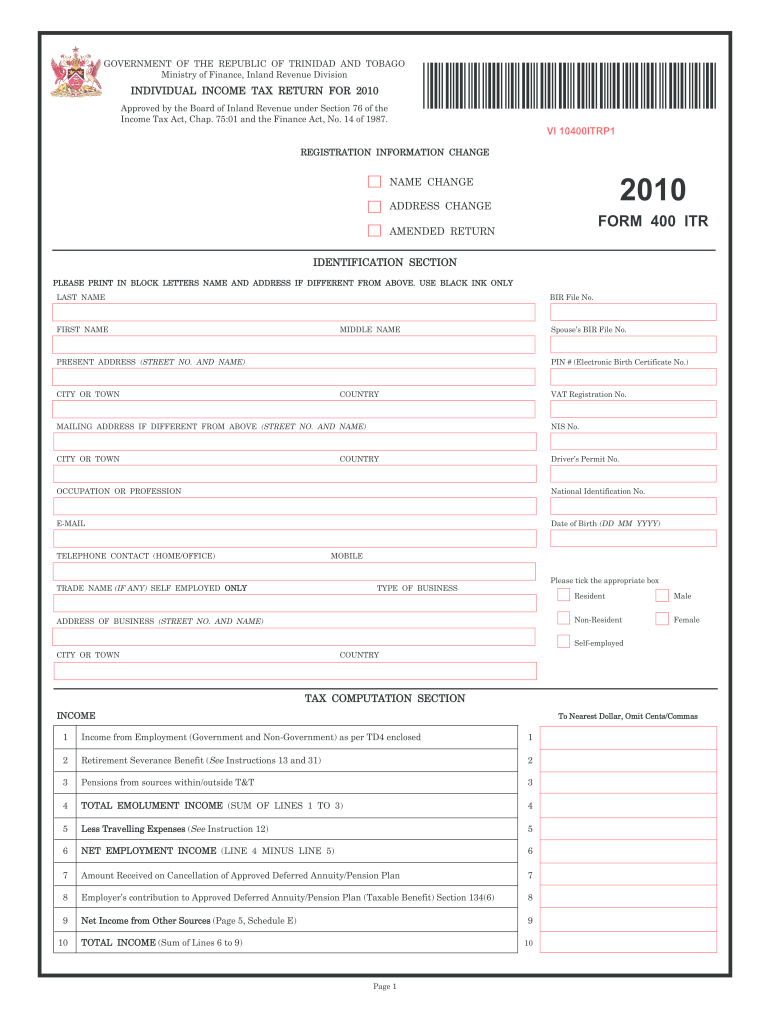

Tax Return Form Trinidad and Tobago 2010

What is the Tax Return Form Trinidad And Tobago

The Tax Return Form Trinidad And Tobago is a crucial document used by individuals and businesses to report their income, expenses, and other tax-related information to the government. This form is essential for determining the amount of tax owed or the refund due to the taxpayer. It includes various sections that require detailed information about income sources, deductions, and credits applicable to the taxpayer's situation. Understanding this form is vital for compliance with tax laws and for ensuring accurate reporting.

How to use the Tax Return Form Trinidad And Tobago

Using the Tax Return Form Trinidad And Tobago involves several steps to ensure accurate completion. First, gather all necessary documentation, including income statements, receipts for deductions, and any relevant financial records. Next, carefully fill out the form, ensuring that each section is completed with accurate information. It is advisable to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of filing.

Steps to complete the Tax Return Form Trinidad And Tobago

Completing the Tax Return Form Trinidad And Tobago requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim deductions and credits that apply to your situation.

- Calculate your total tax liability or refund.

- Review the form for accuracy and completeness.

- Submit the form through your chosen method.

Legal use of the Tax Return Form Trinidad And Tobago

The legal use of the Tax Return Form Trinidad And Tobago is governed by specific regulations that ensure compliance with tax laws. To be considered valid, the form must be filled out accurately and submitted within the designated filing deadlines. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that eSignatures are legally binding. Understanding these legal requirements is essential for avoiding penalties and ensuring that your tax return is processed correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Return Form Trinidad And Tobago are critical for compliance. Typically, the deadline for submitting the tax return is April 15 of the following year. However, it is important to check for any extensions or specific dates that may apply. Missing the deadline can result in penalties and interest on any taxes owed, making it essential to stay informed about these important dates.

Required Documents

To complete the Tax Return Form Trinidad And Tobago, several documents are required. These typically include:

- Income statements (W-2s, 1099s)

- Receipts for deductible expenses

- Records of any tax credits

- Previous year's tax return for reference

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Tax Return Form Trinidad And Tobago can be submitted through various methods. Taxpayers have the option to file online using secure e-filing services, which is often the quickest method. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its advantages, and choosing the right one depends on personal preference and urgency.

Quick guide on how to complete tax return form trinidad and tobago 2010

Effortlessly Complete Tax Return Form Trinidad And Tobago on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly without complications. Manage Tax Return Form Trinidad And Tobago on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Tax Return Form Trinidad And Tobago with Ease

- Find Tax Return Form Trinidad And Tobago and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details thoroughly and then click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Return Form Trinidad And Tobago and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return form trinidad and tobago 2010

Create this form in 5 minutes!

How to create an eSignature for the tax return form trinidad and tobago 2010

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Tax Return Form Trinidad And Tobago?

The Tax Return Form Trinidad And Tobago is an official document that taxpayers must complete to report their income, expenses, and other relevant financial information to the government. Completing this form accurately is essential to ensure compliance with local tax laws and to avoid penalties.

-

How can airSlate SignNow help with the Tax Return Form Trinidad And Tobago?

airSlate SignNow provides a straightforward platform for businesses and individuals to fill, sign, and complete the Tax Return Form Trinidad And Tobago electronically. This streamlines the process, making it easier to manage your tax documents and ensuring they are submitted correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the Tax Return Form Trinidad And Tobago?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for businesses that frequently handle the Tax Return Form Trinidad And Tobago. Prices are competitive, and the platform provides substantial value by saving time and automating document handling.

-

What features does airSlate SignNow offer for completing the Tax Return Form Trinidad And Tobago?

Key features of airSlate SignNow include electronic signatures, document templates, and real-time editing capabilities for the Tax Return Form Trinidad And Tobago. These tools help ensure that all necessary information is captured accurately and allow users to collaborate seamlessly.

-

Are there any integrations available with airSlate SignNow for the Tax Return Form Trinidad And Tobago?

Yes, airSlate SignNow integrates with numerous business applications, allowing for a smoother workflow when completing the Tax Return Form Trinidad And Tobago. This includes integrations with popular accounting software and document management systems, enabling users to access their files easily.

-

What are the benefits of using airSlate SignNow for the Tax Return Form Trinidad And Tobago?

Using airSlate SignNow for the Tax Return Form Trinidad And Tobago helps reduce errors, save time, and improve document security. The platform also enhances transparency in the signing process and provides a reliable audit trail for all transactions.

-

Can I access airSlate SignNow on mobile devices for the Tax Return Form Trinidad And Tobago?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing access to the Tax Return Form Trinidad And Tobago on various devices. This flexibility ensures you can manage your tax documents anytime and anywhere.

Get more for Tax Return Form Trinidad And Tobago

- Property disclosure statement form

- Change of name form 6566995

- Meldezettel 327737260 form

- Appearance or withdrawal new hampshire judicial branch form

- Minnesota marriage license form

- Can you be a doctor with a criminal record uk form

- Instructions expungement of eviction record form

- District courts minnesota state legislature form

Find out other Tax Return Form Trinidad And Tobago

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF