Ir8a Form 2013

What is the Ir8a Form

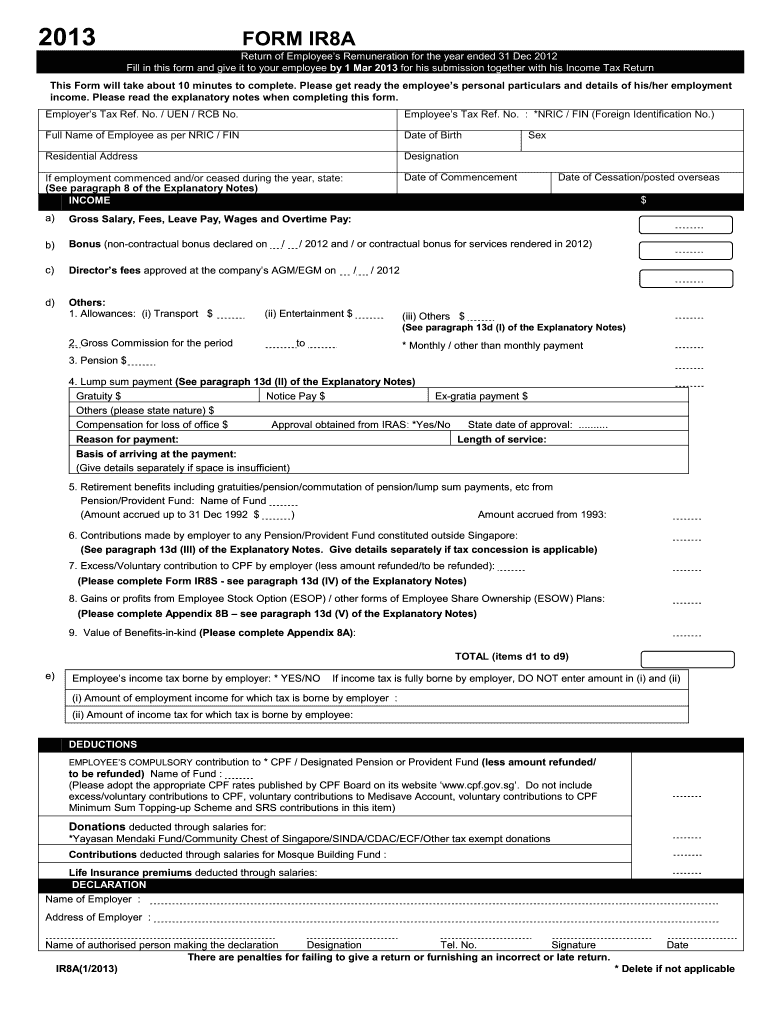

The Ir8a Form is a crucial document used for reporting income and tax information in the United States. It is primarily utilized by businesses and organizations to report payments made to non-resident aliens or foreign entities. This form helps ensure compliance with IRS regulations regarding income reporting and tax withholding. The Ir8a Form captures essential details about the payee, including their identification information, the nature of the payments, and any applicable tax withholding rates.

How to use the Ir8a Form

Using the Ir8a Form involves several key steps to ensure accurate completion and compliance with tax regulations. First, gather all necessary information about the payee, including their name, address, and tax identification number. Next, enter the relevant payment details, specifying the type of income and the amount paid. It is also essential to determine the appropriate tax withholding rate based on the payee's residency status. Finally, submit the completed form to the IRS as part of your tax reporting obligations.

Steps to complete the Ir8a Form

Completing the Ir8a Form requires careful attention to detail. Follow these steps for accurate submission:

- Collect payee information, including name, address, and tax identification number.

- Identify the type of payment being reported, such as wages, royalties, or other income.

- Determine the applicable tax withholding rate based on the payee's residency status.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the specified deadline.

Legal use of the Ir8a Form

The Ir8a Form serves a vital legal function in the realm of tax compliance. It is designed to ensure that payments made to non-resident aliens are reported correctly, thereby fulfilling the obligations set forth by the IRS. Proper use of this form helps avoid penalties associated with non-compliance and ensures that the correct amount of tax is withheld from payments. Organizations must adhere to the legal requirements surrounding the Ir8a Form to maintain transparency and accountability in their financial dealings.

Filing Deadlines / Important Dates

Timely filing of the Ir8a Form is crucial to avoid penalties. The IRS typically sets specific deadlines for submission, which may vary depending on the type of payment and the method of filing. Generally, the form must be submitted by the end of January following the tax year in which the payments were made. If you are filing electronically, ensure that you comply with the electronic filing deadlines as well. Staying informed about these important dates helps maintain compliance and avoid unnecessary complications.

Who Issues the Form

The Ir8a Form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that businesses and organizations understand their reporting obligations. It is essential for filers to refer to the official IRS documentation when completing the Ir8a Form to ensure compliance with current tax laws and regulations.

Quick guide on how to complete ir8a form

Effortlessly Prepare Ir8a Form on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without any disruptions. Manage Ir8a Form across all platforms with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Ir8a Form seamlessly

- Obtain Ir8a Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Ir8a Form to guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir8a form

Create this form in 5 minutes!

How to create an eSignature for the ir8a form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Ir8a Form and why is it important?

The Ir8a Form is a crucial document that businesses must submit to outline their annual employee remuneration. Understanding the significance of the Ir8a Form is essential for compliance and accurate reporting. Utilizing solutions like airSlate SignNow can streamline the process of sending and signing this form securely.

-

How can airSlate SignNow help with the Ir8a Form?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign the Ir8a Form. Our solution enables businesses to manage their documents seamlessly, ensuring that the required fields are correctly filled out and securely signed. This reduces the chances of errors and speeds up the submission process.

-

Is airSlate SignNow cost-effective for managing the Ir8a Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes, making it budget-friendly for handling the Ir8a Form. By minimizing paper usage and streamlining the signing process, companies can not only save money but also enhance efficiency. Explore our pricing to find the plan that best fits your needs.

-

What features does airSlate SignNow offer for the Ir8a Form?

airSlate SignNow includes features such as templates, real-time collaboration, and secure cloud storage to manage the Ir8a Form effectively. Users can track document statuses and receive instant notifications when the form is signed. These functionalities help ensure that your document processes are efficient and organized.

-

Can I integrate airSlate SignNow with other software for Ir8a Form management?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and more. This means that you can manage the Ir8a Form alongside your current software tools, ensuring a smooth workflow and enhanced productivity for your team.

-

What are the benefits of using airSlate SignNow for the Ir8a Form?

Using airSlate SignNow for the Ir8a Form provides numerous benefits, including faster processing times and reduced paperwork. The electronic signing process enhances security, ensuring that sensitive information is protected. Additionally, our solution promotes compliance with regulations and improves overall document management.

-

Is the eSignature valid for the Ir8a Form if I use airSlate SignNow?

Yes, eSignatures created using airSlate SignNow are legally valid and recognized in many jurisdictions for the Ir8a Form. Our platform complies with eSignature laws, ensuring that your signed documents are enforceable. This adds peace of mind when sending important tax-related forms.

Get more for Ir8a Form

- Envy is it helping or hurting aow christinaeng weebly com form

- New mexico journeyman electrician license application form

- Sample project work plan sample project work plan bphc hrsa form

- Pto membership form template

- Chubb pro e o 14 03 0557 form

- Pdf form fulbright program for foreign students laspau harvard

- Report no 42 national endowment for the humanities form

- Installment sale contract template form

Find out other Ir8a Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney