Hmrc Ca8421 Form 2011

What is the Hmrc Ca8421 Form

The Hmrc Ca8421 Form is a specific document used for tax purposes in the United Kingdom, primarily related to claims for tax relief. It is essential for individuals and businesses who wish to report certain financial situations to HM Revenue and Customs (HMRC). This form helps taxpayers ensure compliance with tax regulations and facilitates the processing of their claims. Understanding this form is crucial for anyone navigating the complexities of tax obligations.

How to use the Hmrc Ca8421 Form

Using the Hmrc Ca8421 Form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents that support your claim. Next, carefully fill out the form, ensuring all required fields are completed with accurate information. Once the form is filled, review it for any errors or omissions. Finally, submit the form according to the guidelines provided by HMRC, either online or via traditional mail, depending on your preference.

Steps to complete the Hmrc Ca8421 Form

Completing the Hmrc Ca8421 Form requires a systematic approach:

- Gather necessary documents, including income statements and previous tax returns.

- Download the form from the official HMRC website or obtain a physical copy.

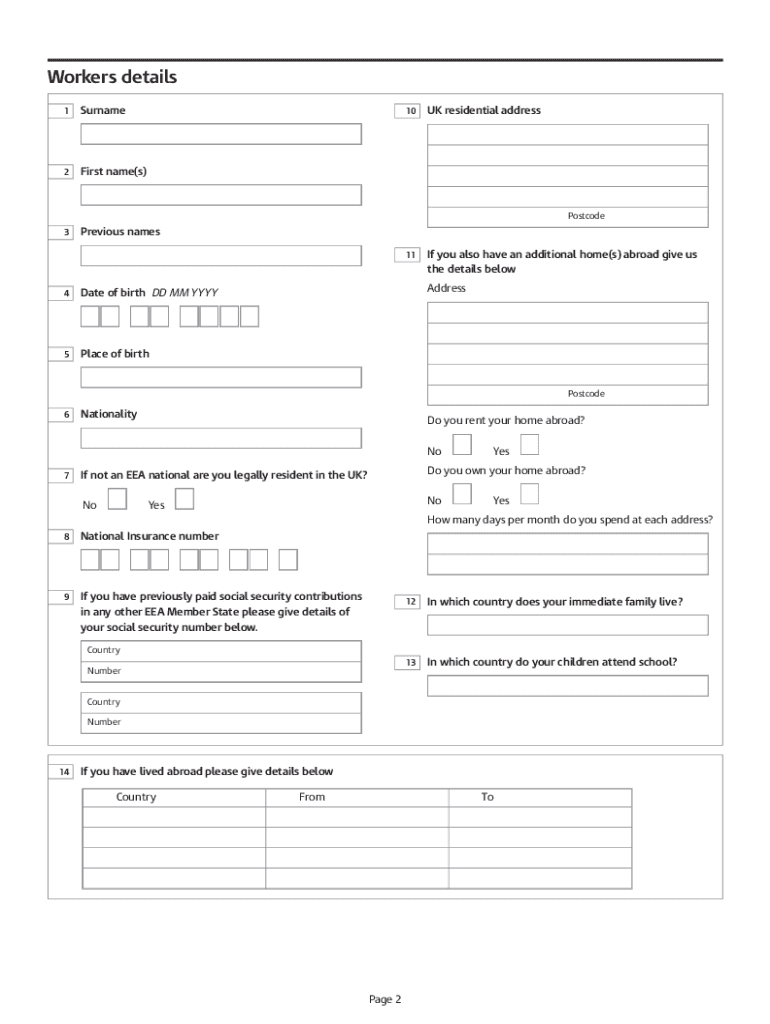

- Fill in personal details, including your name, address, and National Insurance number.

- Provide specific information regarding your claim, ensuring accuracy.

- Double-check all entries for completeness and correctness.

- Submit the form as per HMRC guidelines, ensuring you keep a copy for your records.

Legal use of the Hmrc Ca8421 Form

The Hmrc Ca8421 Form holds legal significance as it is utilized to report tax-related claims to HMRC. When filled out correctly, it serves as a formal request for tax relief or adjustments, making it a legally binding document. Compliance with the instructions and regulations set out by HMRC is crucial to ensure that the form is accepted and processed appropriately. Failure to adhere to legal requirements may result in delays or rejections of claims.

Key elements of the Hmrc Ca8421 Form

Several key elements are integral to the Hmrc Ca8421 Form:

- Personal Information: This includes your name, address, and National Insurance number.

- Claim Details: Specifics regarding the nature of your claim must be clearly outlined.

- Supporting Documentation: Any additional documents that substantiate your claim should be attached.

- Signature: Your signature is required to validate the information provided.

Form Submission Methods

The Hmrc Ca8421 Form can be submitted through various methods, depending on your preference and the guidelines set by HMRC. The primary submission methods include:

- Online Submission: Many taxpayers opt for electronic submission through the HMRC website, which allows for quicker processing.

- Mail: Alternatively, you can print the completed form and send it via postal mail to the designated HMRC address.

- In-Person: Some individuals may choose to submit the form in person at local HMRC offices, although this option may be limited.

Quick guide on how to complete hmrc ca8421 2011 form

Easily Prepare Hmrc Ca8421 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Hmrc Ca8421 Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Hmrc Ca8421 Form Effortlessly

- Locate Hmrc Ca8421 Form and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides for that specific function.

- Formulate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Hmrc Ca8421 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hmrc ca8421 2011 form

Create this form in 5 minutes!

How to create an eSignature for the hmrc ca8421 2011 form

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the HMRC CA8421 Form?

The HMRC CA8421 Form is a document required for various financial transactions with HMRC. It is essential for businesses to understand its purpose and how it impacts their compliance. Using airSlate SignNow, you can easily manage and eSign the HMRC CA8421 Form in a secure and compliant manner.

-

How can airSlate SignNow help with the HMRC CA8421 Form?

airSlate SignNow offers an intuitive platform to send and eSign the HMRC CA8421 Form. With its user-friendly interface, you can streamline your document management process, ensuring timely submissions and reducing the risk of errors. This means that your business can focus on growth while we handle the paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. We provide affordable options that help businesses of all sizes effectively manage documents like the HMRC CA8421 Form. You can choose a plan that best suits your budget and requirements, ensuring you get value without compromising on essential features.

-

Are there any integrations available for processing the HMRC CA8421 Form?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to enhance your workflow for the HMRC CA8421 Form. Whether it's CRM systems, email clients, or cloud storage services, our integrations ensure that you can manage documents effectively. This connectivity helps you maintain a smooth operation while handling important forms.

-

What security measures does airSlate SignNow implement for the HMRC CA8421 Form?

airSlate SignNow prioritizes security with robust measures to protect documents like the HMRC CA8421 Form. We utilize encryption, secure servers, and access controls to ensure your sensitive information remains safe. You can eSign and manage your forms with peace of mind, knowing they are well-protected.

-

Can I track the status of my HMRC CA8421 Form using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for documents, including the HMRC CA8421 Form. You will receive notifications and updates about the status, ensuring you are always informed. This feature enhances your document management experience, allowing you to stay organized and proactive.

-

Is training available for using airSlate SignNow with the HMRC CA8421 Form?

Yes, airSlate SignNow offers training resources to help you effectively use our platform for the HMRC CA8421 Form. Our extensive tutorials and customer support can assist you in mastering the features. This ensures that you can navigate the platform with confidence, maximizing your productivity.

Get more for Hmrc Ca8421 Form

- Yuma medical center medical records form

- Governance white paper indd university of oxford form

- Nj guardianship ez accounting form 79158134

- Multi vaccine addendum texas department of state health services dshs state tx form

- Instructions for filling out your financial management plan military form

- Owner supplied material disclaimer form

- Application for ada paratransit service access alameda form

- Musical performances awards ampampamp honors the bands of

Find out other Hmrc Ca8421 Form

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement