P14P60 End of Year Returns 10 Sage 2014-2026

What is the P14P60 End Of Year Returns 10 Sage

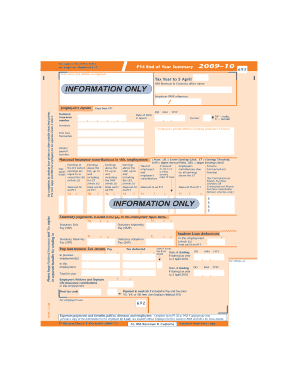

The P14P60 End Of Year Returns 10 Sage is a specific tax form used in the United States for reporting end-of-year financial information. This form is typically utilized by businesses to summarize their income, expenses, and other relevant financial data for the year. It plays a crucial role in ensuring compliance with tax regulations and helps businesses accurately report their earnings to the Internal Revenue Service (IRS).

How to use the P14P60 End Of Year Returns 10 Sage

Using the P14P60 End Of Year Returns 10 Sage involves a series of steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering the relevant financial data in the designated fields. It is important to double-check all entries for accuracy before submission. Once completed, the form can be filed electronically or mailed to the appropriate tax authority.

Steps to complete the P14P60 End Of Year Returns 10 Sage

Completing the P14P60 End Of Year Returns 10 Sage requires careful attention to detail. Follow these steps:

- Collect all financial records from the year, including income and expense reports.

- Access the P14P60 form through your accounting software or download it from a reliable source.

- Fill in the form with accurate financial information, ensuring that all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via traditional mail to the IRS or state tax authority.

Key elements of the P14P60 End Of Year Returns 10 Sage

The P14P60 End Of Year Returns 10 Sage includes several key elements that are essential for accurate reporting. These elements typically include:

- Business identification information, such as name and address.

- Total income earned during the year.

- Deductible expenses that can reduce taxable income.

- Net profit or loss for the year.

- Any applicable tax credits or adjustments.

Filing Deadlines / Important Dates

Filing deadlines for the P14P60 End Of Year Returns 10 Sage are critical to avoid penalties. Typically, the form must be submitted by the end of March following the tax year. However, specific deadlines may vary depending on the business structure and state regulations. It is advisable to check the IRS guidelines for the most current deadlines to ensure timely submission.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the P14P60 End Of Year Returns 10 Sage. These guidelines cover aspects such as eligibility, required documentation, and filing methods. Adhering to these guidelines is essential for compliance and to avoid potential audits or penalties. It is recommended to consult the IRS website or a tax professional for detailed instructions related to this form.

Create this form in 5 minutes or less

Find and fill out the correct p14p60 end of year returns 10 sage

Create this form in 5 minutes!

How to create an eSignature for the p14p60 end of year returns 10 sage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are P14P60 End Of Year Returns 10 Sage?

P14P60 End Of Year Returns 10 Sage refers to the specific forms used for reporting employee earnings and tax deductions at the end of the financial year. These forms are essential for compliance with tax regulations and ensure accurate reporting to HMRC. Using airSlate SignNow, you can easily manage and eSign these documents, streamlining your end-of-year processes.

-

How does airSlate SignNow simplify the P14P60 End Of Year Returns 10 Sage process?

airSlate SignNow simplifies the P14P60 End Of Year Returns 10 Sage process by providing an intuitive platform for document management and eSigning. You can quickly upload, edit, and send your P14P60 forms for signatures, reducing the time spent on paperwork. This efficiency helps ensure that your returns are submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for P14P60 End Of Year Returns 10 Sage?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing P14P60 End Of Year Returns 10 Sage. This cost-effective solution allows you to optimize your document workflow without breaking the bank.

-

Can airSlate SignNow integrate with Sage for P14P60 End Of Year Returns?

Yes, airSlate SignNow can seamlessly integrate with Sage, allowing you to manage your P14P60 End Of Year Returns 10 Sage directly from your Sage account. This integration ensures that your data is synchronized, reducing the risk of errors and saving you time. You can easily access and eSign your documents without switching between platforms.

-

What benefits does airSlate SignNow provide for managing P14P60 End Of Year Returns 10 Sage?

Using airSlate SignNow for your P14P60 End Of Year Returns 10 Sage offers numerous benefits, including enhanced security, compliance, and efficiency. The platform ensures that your documents are securely stored and easily accessible, while also providing audit trails for compliance purposes. Additionally, the eSigning feature speeds up the approval process, allowing you to focus on other important tasks.

-

Is airSlate SignNow user-friendly for handling P14P60 End Of Year Returns 10 Sage?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to handle P14P60 End Of Year Returns 10 Sage. The platform features a straightforward interface that guides you through the document preparation and signing process, ensuring that even those with minimal technical skills can navigate it with ease.

-

What support options are available for airSlate SignNow users dealing with P14P60 End Of Year Returns 10 Sage?

airSlate SignNow provides comprehensive support options for users managing P14P60 End Of Year Returns 10 Sage. You can access a knowledge base, video tutorials, and customer support via chat or email. This ensures that you have the assistance you need to resolve any issues quickly and efficiently.

Get more for P14P60 End Of Year Returns 10 Sage

Find out other P14P60 End Of Year Returns 10 Sage

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF