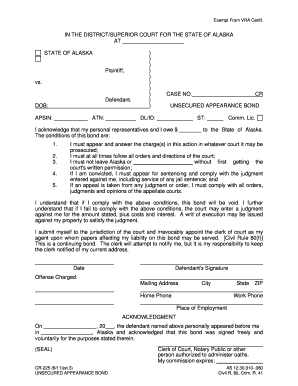

Cr 225 Unsecured Bond Form

What is the Cr 225 Unsecured Bond

The Cr 225 unsecured bond is a legal document used primarily in the United States as a financial guarantee. Unlike secured bonds, which require collateral, an unsecured bond relies solely on the issuer's creditworthiness. This type of bond is often used in various legal and financial contexts, such as court proceedings or business transactions, where a party needs to assure another party of their financial commitment without providing physical assets as security.

How to use the Cr 225 Unsecured Bond

Using the Cr 225 unsecured bond involves several steps to ensure its effectiveness and legal standing. First, the bond must be properly filled out, including all required information such as the names of the parties involved and the bond amount. After completing the form, it should be signed by the relevant parties, often requiring notarization. Once executed, the bond can be submitted to the appropriate authority, such as a court or regulatory body, as part of a legal or financial obligation.

Steps to complete the Cr 225 Unsecured Bond

Completing the Cr 225 unsecured bond requires careful attention to detail. Here are the key steps:

- Gather necessary information, including names, addresses, and the bond amount.

- Fill out the form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Sign the form in the presence of a notary, if required.

- Submit the bond to the relevant authority or keep it for your records.

Legal use of the Cr 225 Unsecured Bond

The Cr 225 unsecured bond serves a critical legal function. It acts as a promise to pay a specified amount if the terms of the bond are violated. This bond is often required in legal proceedings, such as appeals or as a condition for certain licenses. Understanding the legal implications of the bond is essential, as it binds the issuer to the obligations outlined within the document, making it enforceable in a court of law.

Key elements of the Cr 225 Unsecured Bond

Several key elements define the Cr 225 unsecured bond, ensuring its validity and enforceability:

- Principal Amount: The total sum that the bond guarantees.

- Obligor: The party responsible for fulfilling the bond's terms.

- Obligee: The party entitled to receive payment under the bond.

- Conditions: Specific terms that must be met for the bond to be valid.

- Signatures: Required signatures from all parties involved, often necessitating notarization.

Eligibility Criteria

Eligibility for obtaining a Cr 225 unsecured bond typically includes several factors. The applicant must demonstrate sufficient creditworthiness, as the bond is unsecured. This often involves a credit check or financial assessment. Additionally, the applicant may need to provide documentation supporting their financial status, such as income statements or tax returns. Understanding these criteria is essential for a smooth application process.

Quick guide on how to complete cr 225 unsecured bond

Complete Cr 225 Unsecured Bond effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Cr 225 Unsecured Bond on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Cr 225 Unsecured Bond with ease

- Obtain Cr 225 Unsecured Bond and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Cr 225 Unsecured Bond and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cr 225 unsecured bond

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is an unsecured bond and how does it work?

An unsecured bond is a type of bond that is not backed by any collateral. Instead, the issuer promises to pay the bondholder a specified amount at maturity. This means that in the event of default, bondholders have no claim on specific assets, making it important to assess the creditworthiness of the issuer.

-

What advantages does using airSlate SignNow offer for managing unsecured bonds?

Using airSlate SignNow for managing unsecured bonds provides an efficient, streamlined way to eSign and manage bond-related documents. Its user-friendly interface allows for quick processing without the need for physical paperwork, reducing errors and enhancing security. Additionally, it facilitates compliance with relevant regulations through secure document management.

-

Are there any fees associated with eSigning unsecured bonds using airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for eSigning unsecured bonds, with transparent pricing plans. Users can explore various subscription levels that fit their needs, allowing for flexible budgeting. This makes it easier for businesses to incorporate eSigning into their operations without unexpected costs.

-

Can airSlate SignNow integrate with other financial services related to unsecured bonds?

Yes, airSlate SignNow seamlessly integrates with various financial platforms and services. This allows users to manage their unsecured bonds alongside other financial documents and processes, enhancing operational efficiency. Integrations support a wide variety of apps, making it easier to synchronize workflows.

-

What features does airSlate SignNow offer for tracking unsecured bond transactions?

AirSlate SignNow provides robust tracking features for all documents, including those related to unsecured bonds. Users can monitor who viewed or signed documents and access an audit trail for compliance. These features enhance accountability and transparency in bond management processes.

-

How can airSlate SignNow ensure the security of unsecured bond documents?

AirSlate SignNow prioritizes the security of all documents, including those involving unsecured bonds. With advanced encryption, multi-factor authentication, and secure cloud storage, users can trust that their sensitive information is protected. This robust security infrastructure helps mitigate risks associated with document management.

-

Is the airSlate SignNow platform user-friendly for those unfamiliar with unsecured bond regulations?

Absolutely! AirSlate SignNow is designed to be user-friendly, even for those who may not be familiar with the regulations surrounding unsecured bonds. The platform offers intuitive navigation and helpful resources, ensuring that all users can efficiently manage their eSigning needs without extensive training.

Get more for Cr 225 Unsecured Bond

- Dog show entry form

- Personal injury accident medical history intake form

- Form 355q

- Formular quotansuchen um zulassung zum studiumquot jku

- Quit claim deed from corporation to individual form

- Income tax refund request form city of springfield ohio

- Psychiatric evaluation form mass gov

- Right of entry form 384938716

Find out other Cr 225 Unsecured Bond

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF