Tax Alaska 2019

What is the Tax Alaska

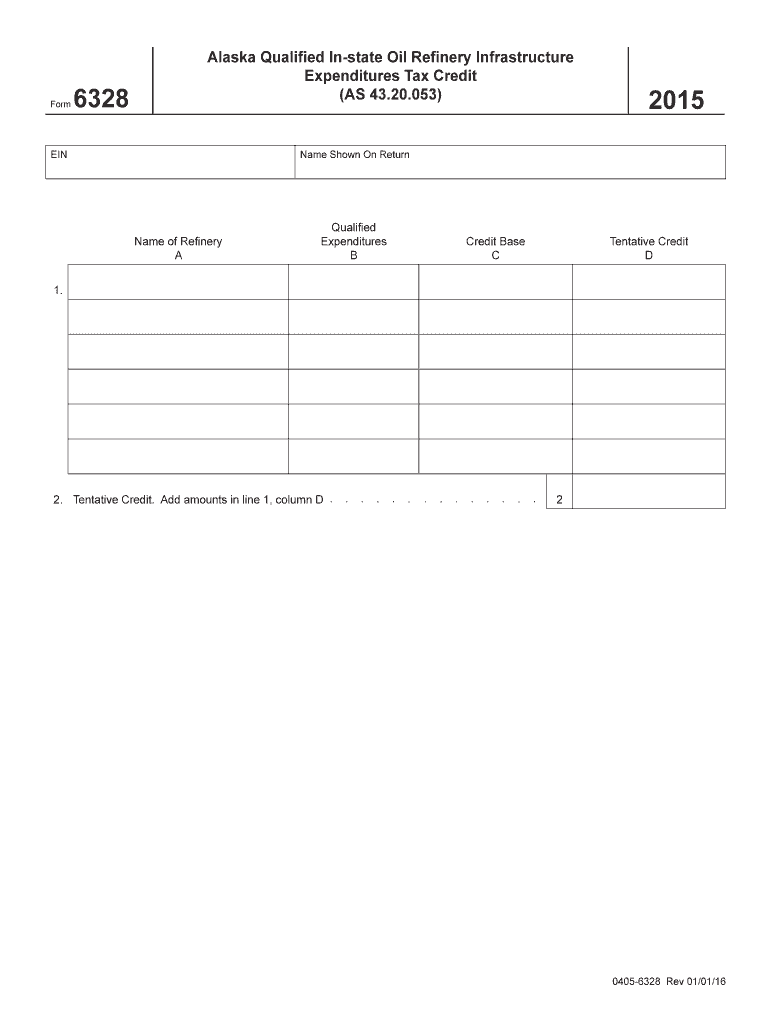

The Tax Alaska form is a specific document used for tax-related purposes within the state of Alaska. It is essential for individuals and businesses to report their income, expenses, and other financial information to the state tax authorities. This form ensures compliance with state tax laws and regulations, allowing for accurate assessment and collection of taxes owed. Understanding the purpose and requirements of the Tax Alaska form is crucial for effective tax management.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and previous tax returns. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form with accurate information, ensuring that all figures are correctly calculated. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the specified deadline to avoid penalties.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. It is important for taxpayers to use this form in accordance with these laws to avoid any legal repercussions. The form must be completed truthfully and accurately, as providing false information can lead to penalties, fines, or even criminal charges. Additionally, understanding the legal implications of submitting the form can help taxpayers navigate potential audits or disputes with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical for compliance. Generally, the form must be submitted by April fifteenth of each year for individual taxpayers. However, businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes. Keeping a calendar of important tax dates can help ensure timely filing.

Required Documents

To complete the Tax Alaska form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant financial statements or documents

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws, collecting taxes, and ensuring compliance among taxpayers. The department provides resources and guidance for individuals and businesses to help them understand their tax obligations and complete the necessary forms accurately.

Penalties for Non-Compliance

Failure to comply with the requirements of the Tax Alaska form can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the importance of timely and accurate submission of the form to avoid these consequences. Regularly reviewing tax obligations and seeking assistance when needed can help mitigate the risk of non-compliance.

Quick guide on how to complete tax alaska 6967225

Easily prepare Tax Alaska on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and eSign your documents promptly without delays. Manage Tax Alaska on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

Steps to modify and eSign Tax Alaska effortlessly

- Obtain Tax Alaska and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Tax Alaska and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967225

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967225

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a powerful eSignature and document management solution that helps businesses streamline their processes, including those related to Tax Alaska. By automating document workflows and secure eSigning, businesses can simplify their tax filing and compliance efforts in Alaska.

-

How does airSlate SignNow handle Tax Alaska document requirements?

With airSlate SignNow, you can easily create, send, and sign documents required for Tax Alaska compliance. The platform offers customizable templates and secure electronic signatures, ensuring that your tax-related documents meet legal standards in Alaska.

-

Is airSlate SignNow cost-effective for managing Tax Alaska documents?

Yes, airSlate SignNow is a cost-effective solution designed for small to large businesses managing Tax Alaska documents. Its competitive pricing plans enable users to choose the features they need without overspending, making it ideal for budget-conscious businesses.

-

What are the key features of airSlate SignNow for Tax Alaska?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage, all geared towards simplifying Tax Alaska document processes. These features help ensure that users can efficiently handle their tax filings and related paperwork.

-

Can airSlate SignNow integrate with accounting software to assist with Tax Alaska?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software that support Tax Alaska processes. This allows businesses to sync data and manage documents efficiently, reducing manual entry and enhancing overall productivity.

-

What benefits does airSlate SignNow provide for Tax Alaska-focused businesses?

Businesses focused on Tax Alaska can benefit from enhanced compliance and security features of airSlate SignNow. The platform not only ensures faster document turnaround times but also facilitates better tracking and management of tax-related workflows.

-

How secure is airSlate SignNow for managing sensitive Tax Alaska documents?

airSlate SignNow prioritizes security with advanced encryption and authentication measures to protect sensitive Tax Alaska documents. Users can confidently manage their tax-related documents, knowing their information is secure and compliant with regulations.

Get more for Tax Alaska

- Diplomatic clause sample form

- Form w 4 employees withholding certificate 625900111

- Ia801308 us archive org form

- Agent link notification form fill online printable fillable

- Navy hums package form

- Bco 10 renewal application pa department of state form

- Defendant has lived in the state of wyoming for at least 60 days form

- Is obtained from the landlord form

Find out other Tax Alaska

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF