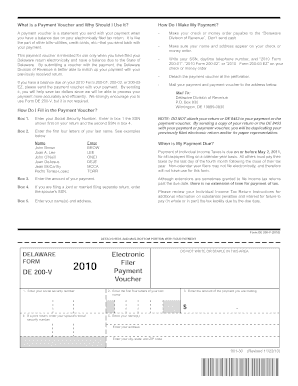

De 200 V Online Payment Form 2020

What is the De 200 V Online Payment Form

The De 200 V Online Payment Form is a specific document used in the United States for processing electronic payments related to various tax obligations. This form serves as a means for taxpayers to make payments directly to the IRS, ensuring that their tax liabilities are settled efficiently and securely. It is particularly useful for individuals and businesses who prefer to handle their payments digitally, aligning with modern practices of financial management.

How to use the De 200 V Online Payment Form

Using the De 200 V Online Payment Form involves a few straightforward steps. First, access the form through a reliable digital platform that supports electronic signatures and submissions. Fill in the required fields, which typically include personal identification information and payment details. After completing the form, review all entries for accuracy. Finally, submit the form electronically, ensuring that you receive a confirmation of your payment for your records.

Steps to complete the De 200 V Online Payment Form

Completing the De 200 V Online Payment Form can be broken down into several key steps:

- Gather necessary information, including your Social Security number or Employer Identification Number.

- Access the form on a secure digital platform.

- Fill in your personal and payment information accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save the confirmation for future reference.

Legal use of the De 200 V Online Payment Form

The De 200 V Online Payment Form is legally binding when completed in accordance with federal regulations. To ensure its legality, users must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and documents, provided that they meet specific criteria, such as the intention to sign and consent to use electronic records.

Required Documents

When filling out the De 200 V Online Payment Form, certain documents may be required to support your submission. These typically include:

- Your Social Security number or Employer Identification Number.

- Details of the tax obligation you are paying.

- Bank account information for payment processing.

Having these documents ready will streamline the completion process and help ensure accuracy.

Form Submission Methods

The De 200 V Online Payment Form can be submitted through various methods, primarily focusing on electronic submission. Users can complete the form online and submit it directly through a secure portal. Alternatively, if necessary, the form may also be printed and mailed to the appropriate IRS address. In-person submissions are generally not common for this type of payment, as electronic methods provide greater efficiency and tracking capabilities.

Quick guide on how to complete de 200 v online payment form

Prepare De 200 V Online Payment Form effortlessly on any gadget

Online document management has gained traction among enterprises and individuals. It presents a perfect environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage De 200 V Online Payment Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign De 200 V Online Payment Form without hassle

- Find De 200 V Online Payment Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choosing. Modify and eSign De 200 V Online Payment Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de 200 v online payment form

Create this form in 5 minutes!

How to create an eSignature for the de 200 v online payment form

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the De 200 V Online Payment Form?

The De 200 V Online Payment Form is a customizable document that allows businesses to collect online payments efficiently. By using airSlate SignNow, you can create and manage this form to streamline your payment process, ensuring a professional and user-friendly experience for your customers.

-

How much does the De 200 V Online Payment Form cost?

The De 200 V Online Payment Form is part of the airSlate SignNow suite, which offers flexible pricing plans. These plans are designed to fit various business sizes and budgets, making it a cost-effective solution for creating and managing online payment forms.

-

What features does the De 200 V Online Payment Form offer?

The De 200 V Online Payment Form offers features such as customizable templates, electronic signature capabilities, and secure payment processing. These features are designed to enhance the user experience and provide businesses with the tools needed to efficiently collect payments online.

-

How can the De 200 V Online Payment Form benefit my business?

Using the De 200 V Online Payment Form can signNowly reduce the time and effort spent on manual payment processing. It enhances customer satisfaction by providing a seamless and secure payment experience, which can lead to increased sales and improved cash flow for your business.

-

Is the De 200 V Online Payment Form easy to integrate with existing systems?

Yes, the De 200 V Online Payment Form is designed to integrate seamlessly with various payment gateways and business applications. This flexibility allows businesses to incorporate the form into their existing workflows without disruption, making it a practical choice for diverse operations.

-

Can I customize the De 200 V Online Payment Form to match my brand?

Absolutely! The De 200 V Online Payment Form can be fully customized to reflect your brand's identity. You can change colors, logos, and layout to create a consistent and professional look that aligns with your brand's image.

-

What security measures are in place for the De 200 V Online Payment Form?

The De 200 V Online Payment Form prioritizes security by using industry-standard encryption and secure payment processing protocols. This ensures that both your business and customer data remain safe and protected during transactions.

Get more for De 200 V Online Payment Form

- Discovery ex gratia application form

- Accident report form columbia chiropractic columbiachiropractic

- Board of zoning appeals appeal application form

- Planning amp zoningfront royal va form

- Go 19n form fire

- Incident report form

- Maryland healthy kids program date padderhealth com form

- Dss 2435i spanish form

Find out other De 200 V Online Payment Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document