Application for Rescindment of Tax Credit Allocation for Contributions 2019

What is the Application For Rescindment Of Tax Credit Allocation For Contributions

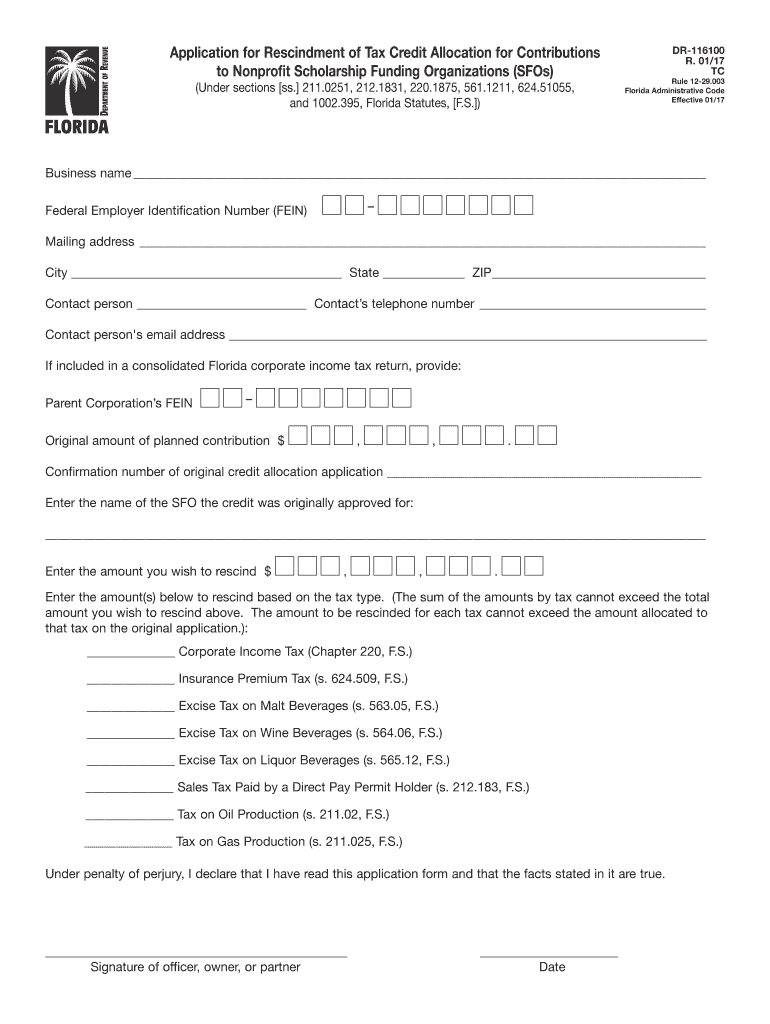

The Application For Rescindment Of Tax Credit Allocation For Contributions is a formal document used by individuals or organizations to request the cancellation of previously allocated tax credits related to contributions. This application is essential for ensuring that any tax credits that are no longer applicable or desired can be officially revoked. It is particularly relevant in situations where contributions have changed or the eligibility criteria have not been met, allowing taxpayers to maintain compliance with tax regulations.

Steps to Complete the Application For Rescindment Of Tax Credit Allocation For Contributions

Completing the Application For Rescindment Of Tax Credit Allocation For Contributions involves several key steps:

- Gather necessary information: Collect all relevant details regarding the original tax credit allocation, including the amount and purpose of the contributions.

- Fill out the application: Accurately complete all sections of the application form, ensuring that all required fields are addressed.

- Review for accuracy: Double-check the information provided to avoid errors that could delay processing.

- Sign the application: Ensure that the application is signed electronically or manually, depending on the submission method.

- Submit the application: Choose the appropriate submission method, whether online, by mail, or in person.

Legal Use of the Application For Rescindment Of Tax Credit Allocation For Contributions

The legal use of the Application For Rescindment Of Tax Credit Allocation For Contributions is governed by specific regulations that ensure its validity. To be legally binding, the application must be completed in accordance with federal and state tax laws. Utilizing a reliable eSignature platform can enhance the legal standing of the document, as it provides an electronic certificate and maintains compliance with the ESIGN and UETA acts. This ensures that the application is recognized as a legitimate request for rescindment.

Required Documents

To successfully submit the Application For Rescindment Of Tax Credit Allocation For Contributions, certain documents may be required. These typically include:

- The original allocation notice or documentation of the tax credit.

- Proof of contributions made, such as receipts or bank statements.

- Identification information, which may include a Social Security number or taxpayer identification number.

- Any correspondence related to the tax credit allocation.

Form Submission Methods

The Application For Rescindment Of Tax Credit Allocation For Contributions can be submitted through various methods, depending on the preferences of the applicant and the requirements of the tax authority. Common submission methods include:

- Online: Many tax authorities offer online submission options through secure portals.

- By mail: Applicants can print the completed form and send it to the designated tax office.

- In-person: Some may choose to submit the application directly at a local tax office for immediate processing.

Eligibility Criteria

To be eligible to submit the Application For Rescindment Of Tax Credit Allocation For Contributions, applicants must meet certain criteria. Generally, these include:

- Having previously received a tax credit allocation for contributions.

- Demonstrating a legitimate reason for requesting the rescindment, such as changes in contribution status or eligibility.

- Completing the application accurately and providing all required documentation.

Quick guide on how to complete application for rescindment of tax credit allocation for contributions

Easily Prepare Application For Rescindment Of Tax Credit Allocation For Contributions on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Application For Rescindment Of Tax Credit Allocation For Contributions on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Application For Rescindment Of Tax Credit Allocation For Contributions Effortlessly

- Find Application For Rescindment Of Tax Credit Allocation For Contributions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Update and eSign Application For Rescindment Of Tax Credit Allocation For Contributions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for rescindment of tax credit allocation for contributions

Create this form in 5 minutes!

How to create an eSignature for the application for rescindment of tax credit allocation for contributions

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Application For Rescindment Of Tax Credit Allocation For Contributions?

The Application For Rescindment Of Tax Credit Allocation For Contributions is a formal request to reverse previous tax credit allocations for contributions. This application is essential for organizations seeking to adjust their tax obligations in light of changing circumstances. Understanding this process can help businesses manage their finances more effectively.

-

How can airSlate SignNow assist with the Application For Rescindment Of Tax Credit Allocation For Contributions?

airSlate SignNow provides a streamlined platform to create, send, and eSign documents related to the Application For Rescindment Of Tax Credit Allocation For Contributions. Our user-friendly interface ensures that the entire process is efficient and compliant with legal standards. This can signNowly reduce the time and effort involved in submitting your application.

-

What features does airSlate SignNow offer for managing tax-related documents?

With airSlate SignNow, users can create templates, automate workflows, and securely store documents, including the Application For Rescindment Of Tax Credit Allocation For Contributions. These features enhance organization and ensure that all necessary information is easily accessible. Additionally, real-time tracking lets you monitor the status of your documents.

-

Is there a cost associated with using airSlate SignNow for my tax credit rescindment applications?

Yes, airSlate SignNow offers different pricing plans tailored to various business needs. The cost will depend on the specific features and number of users required for processing documents like the Application For Rescindment Of Tax Credit Allocation For Contributions. We recommend visiting our pricing page to find a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for my tax credit documentation?

Absolutely! airSlate SignNow integrates seamlessly with various platforms and applications, enhancing your workflow for the Application For Rescindment Of Tax Credit Allocation For Contributions. This integration ensures that data is consistent across your systems, improving efficiency and reducing errors.

-

How secure is the information I share when using airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents, including the Application For Rescindment Of Tax Credit Allocation For Contributions, are encrypted and stored securely to protect sensitive information. Additionally, our platform complies with industry standards to ensure the confidentiality and integrity of your data.

-

What benefits does eSigning provide for my tax applications?

eSigning simplifies the process of submitting your Application For Rescindment Of Tax Credit Allocation For Contributions by allowing immediate signature collection from relevant parties. This speed reduces turnaround time and allows for faster processing of your application. Plus, it eliminates the need for physical document handling, which can be cumbersome and inefficient.

Get more for Application For Rescindment Of Tax Credit Allocation For Contributions

- Patient history update form dr covell

- In service documentation form

- Form 1317 pharmacy eligibility verification portal access form

- Chow form docx

- Certificate of immunity form covid 4 6

- Medical nutrition therapy referral form

- By signing this form you acknowledge receipt of the notice of privacy practices the notice of forefront dermatology s

- Adult hiv confidential case report form illinois perinatal hiv hivpregnancyhotline

Find out other Application For Rescindment Of Tax Credit Allocation For Contributions

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad