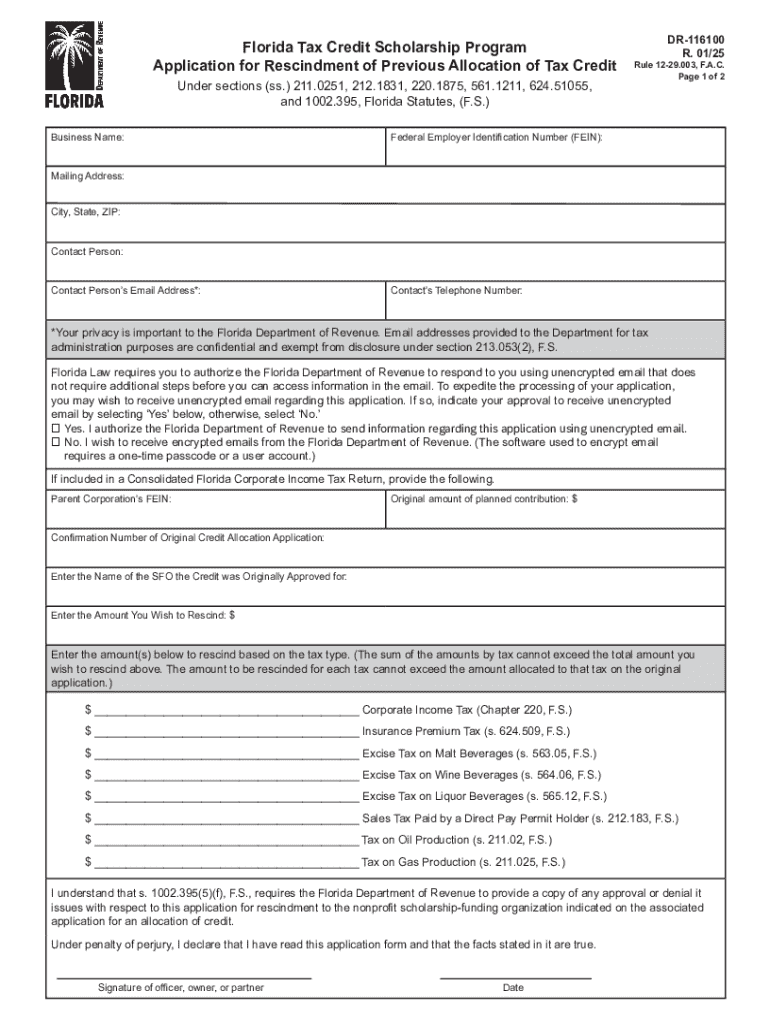

Florida Tax Credit Scholarship Program Application 2025-2026

Understanding the Rescindment Process

Rescindment refers to the formal cancellation or revocation of a previously issued document or agreement. This process is essential in various contexts, including legal, financial, and administrative situations. Understanding the rescindment process helps individuals and organizations ensure compliance with relevant laws and regulations, while also safeguarding their rights and interests.

Steps to Complete the Rescindment

To effectively execute a rescindment, follow these steps:

- Review the original document or agreement to identify the terms and conditions related to rescindment.

- Prepare a written notice of rescindment, clearly stating the intent to cancel the agreement.

- Include any necessary details, such as the date of the original agreement, parties involved, and reasons for rescindment.

- Deliver the notice to all parties involved, ensuring that it is received in a timely manner.

- Maintain a copy of the rescindment notice for your records.

Legal Use of Rescindment

The legal use of rescindment is crucial in various scenarios, such as contract disputes or changes in circumstances. It is important to ensure that the rescindment complies with applicable laws and regulations. Legal grounds for rescindment may include misrepresentation, fraud, or mutual agreement between parties. Consulting with a legal professional can provide clarity on the implications and requirements of rescindment in specific cases.

Required Documents for Rescindment

When initiating a rescindment, certain documents may be required to support the process. These may include:

- The original agreement or contract.

- Written notice of rescindment.

- Any correspondence related to the agreement.

- Documentation supporting the reasons for rescindment.

Having these documents organized and accessible can facilitate a smoother rescindment process.

Eligibility Criteria for Rescindment

Eligibility for rescindment may vary depending on the nature of the agreement and the specific circumstances. Generally, parties seeking rescindment must demonstrate that:

- The original agreement contained terms that allow for rescindment.

- There are valid reasons for rescinding the agreement, such as misrepresentation or changed circumstances.

- All parties involved are notified and agree to the rescindment.

Understanding these criteria is essential for ensuring that the rescindment is valid and enforceable.

Penalties for Non-Compliance

Failure to properly execute a rescindment can lead to various penalties, including legal disputes or financial liabilities. Non-compliance with the terms of the original agreement or applicable laws may result in claims for damages or enforcement of the original contract. It is advisable to follow all necessary procedures and consult legal counsel to mitigate potential risks associated with rescindment.

Create this form in 5 minutes or less

Find and fill out the correct florida tax credit scholarship program application

Create this form in 5 minutes!

How to create an eSignature for the florida tax credit scholarship program application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rescindment in the context of eSigning documents?

Rescindment refers to the process of withdrawing or canceling a previously signed document. With airSlate SignNow, users can easily manage rescindments, ensuring that any changes to agreements are handled efficiently and legally.

-

How does airSlate SignNow facilitate rescindment of documents?

airSlate SignNow provides a user-friendly interface that allows users to rescind documents with just a few clicks. This feature ensures that all parties are notified of the rescindment, maintaining transparency and compliance throughout the process.

-

Are there any costs associated with rescindment using airSlate SignNow?

There are no additional costs specifically for rescindment when using airSlate SignNow. The platform offers a cost-effective solution that includes rescindment features as part of its standard pricing plans, making it accessible for all users.

-

Can I integrate rescindment features with other applications?

Yes, airSlate SignNow offers integrations with various applications, allowing users to streamline their workflows. This means that rescindment processes can be easily incorporated into existing systems, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for rescindment?

Using airSlate SignNow for rescindment provides several benefits, including ease of use, legal compliance, and quick processing times. The platform ensures that rescindments are handled professionally, reducing the risk of disputes and enhancing trust among parties.

-

Is there a limit to the number of rescindments I can perform?

No, airSlate SignNow does not impose limits on the number of rescindments you can perform. Users can manage as many rescindments as needed, making it a flexible solution for businesses of all sizes.

-

How does rescindment affect the validity of signed documents?

When a rescindment is processed through airSlate SignNow, the original signed document is effectively canceled, and all parties are notified. This ensures that the validity of agreements is maintained, as rescindments are documented and legally recognized.

Get more for Florida Tax Credit Scholarship Program Application

Find out other Florida Tax Credit Scholarship Program Application

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship