FORM 720 VI Virgin Islands Bureau of Internal Revenue 2012

What is the FORM 720 VI Virgin Islands Bureau Of Internal Revenue

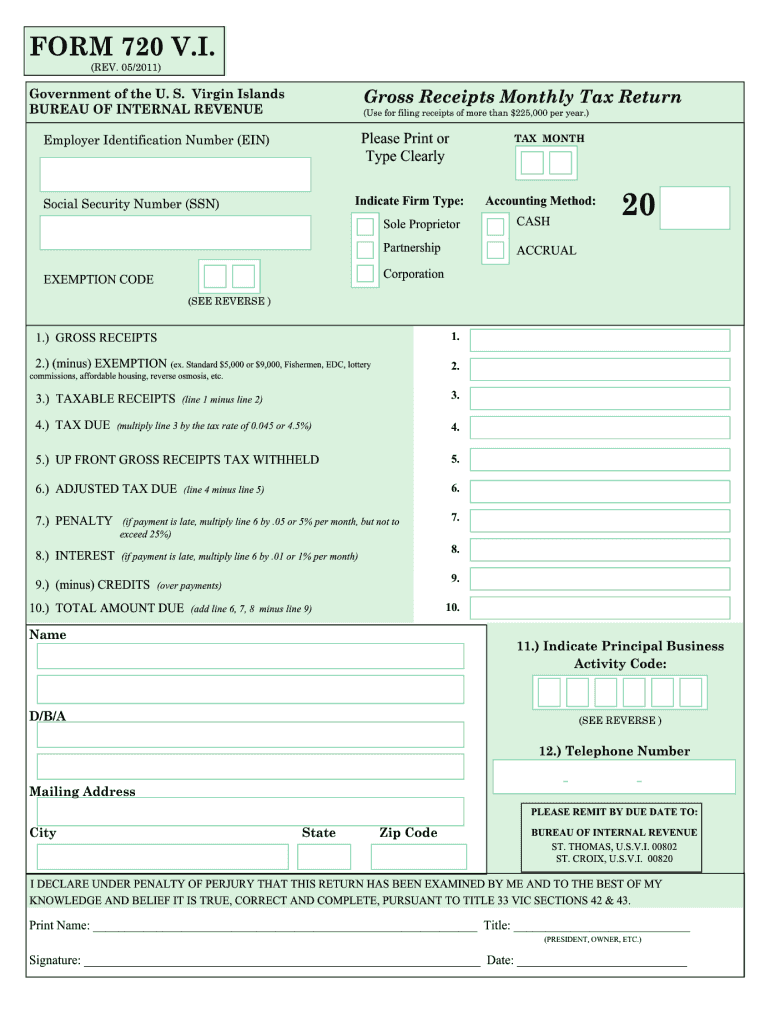

The FORM 720 VI is a tax form issued by the Virgin Islands Bureau of Internal Revenue. It is primarily used for reporting various tax obligations for individuals and businesses operating within the Virgin Islands. This form plays a crucial role in ensuring compliance with local tax laws and regulations. Understanding its purpose and requirements is essential for taxpayers to fulfill their legal obligations accurately.

How to use the FORM 720 VI Virgin Islands Bureau Of Internal Revenue

Using the FORM 720 VI involves several steps, beginning with gathering the necessary information related to your income, deductions, and credits. Taxpayers must accurately complete each section of the form, ensuring that all figures are correct and supported by appropriate documentation. After filling out the form, it can be submitted either electronically or via traditional mail, depending on the preferences of the taxpayer and the regulations in place.

Steps to complete the FORM 720 VI Virgin Islands Bureau Of Internal Revenue

Completing the FORM 720 VI requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill out the personal information section, ensuring accuracy in names, addresses, and identification numbers.

- Report your income in the designated sections, including wages, interest, and other earnings.

- Detail any deductions or credits you are eligible for, supporting them with appropriate documentation.

- Review the completed form for errors or omissions before submission.

Legal use of the FORM 720 VI Virgin Islands Bureau Of Internal Revenue

The FORM 720 VI is legally binding when filled out and submitted in accordance with the Virgin Islands tax laws. To ensure its legal standing, taxpayers must comply with all relevant regulations, including accurate reporting of income and adherence to deadlines. It is important to retain copies of submitted forms and any supporting documents for future reference, as they may be required for audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 720 VI are crucial for compliance. Typically, the form must be submitted by the designated tax deadline, which aligns with the federal tax filing dates. It is advisable to check for any changes in deadlines annually, as they may vary based on specific circumstances or legislative updates. Taxpayers should mark their calendars to ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The FORM 720 VI can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: The form can be printed and mailed to the appropriate tax office, ensuring it is sent well before the deadline.

- In-Person: Some individuals may choose to submit the form in person at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 720 vi virgin islands bureau of internal revenue

Effortlessly prepare FORM 720 VI Virgin Islands Bureau Of Internal Revenue on any gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the needed form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage FORM 720 VI Virgin Islands Bureau Of Internal Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign FORM 720 VI Virgin Islands Bureau Of Internal Revenue with ease

- Find FORM 720 VI Virgin Islands Bureau Of Internal Revenue and click on Get Form to begin.

- Use the provided tools to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign FORM 720 VI Virgin Islands Bureau Of Internal Revenue to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 vi virgin islands bureau of internal revenue

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

FORM 720 VI Virgin Islands Bureau Of Internal Revenue is a tax form used by businesses in the Virgin Islands to report certain types of income and collect the appropriate taxes. It is essential for compliance with local tax regulations. Completing this form accurately ensures that businesses meet their financial obligations effectively.

-

How does airSlate SignNow simplify the process of filling out FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

airSlate SignNow offers an intuitive platform that allows users to easily fill out and eSign FORM 720 VI Virgin Islands Bureau Of Internal Revenue. The user-friendly interface streamlines document preparation, helping businesses save time and reduce errors. With our platform, you can manage your tax documents efficiently and securely.

-

Is airSlate SignNow a cost-effective solution for handling FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various budgets while providing valuable features specifically for managing documents like FORM 720 VI Virgin Islands Bureau Of Internal Revenue. This ensures you can stay compliant without overspending.

-

What features does airSlate SignNow offer for FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

airSlate SignNow provides a range of features to facilitate the completion of FORM 720 VI Virgin Islands Bureau Of Internal Revenue, including customizable templates, cloud storage, and eSignature capabilities. These features help streamline the document management process, making it easier to organize and access your tax forms at any time.

-

Can I integrate airSlate SignNow with other software for FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business software systems, making it easy to manage FORM 720 VI Virgin Islands Bureau Of Internal Revenue alongside other financial documents. Integrating our platform enhances productivity and ensures that all your data remains synchronized.

-

What are the benefits of using airSlate SignNow for tax forms like FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

Using airSlate SignNow for tax forms such as FORM 720 VI Virgin Islands Bureau Of Internal Revenue provides numerous benefits, including improved accuracy, reduced processing time, and enhanced security. Our electronic signature solution ensures that all documents are legally compliant, helping businesses avoid potential penalties.

-

Is there customer support available for questions about FORM 720 VI Virgin Islands Bureau Of Internal Revenue?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions regarding FORM 720 VI Virgin Islands Bureau Of Internal Revenue. Our dedicated support team is available to help you resolve issues promptly and ensure you can navigate the tax form process smoothly.

Get more for FORM 720 VI Virgin Islands Bureau Of Internal Revenue

- Facility worksheet for oregon fetal death certificate word version 407568391 form

- Oregon death certificate form

- Formula authorization form pennsylvania wic

- Security company contract template form

- Security consultant contract template form

- Security contract template form

- Security deposit contract template form

- Security guard contract template form

Find out other FORM 720 VI Virgin Islands Bureau Of Internal Revenue

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter