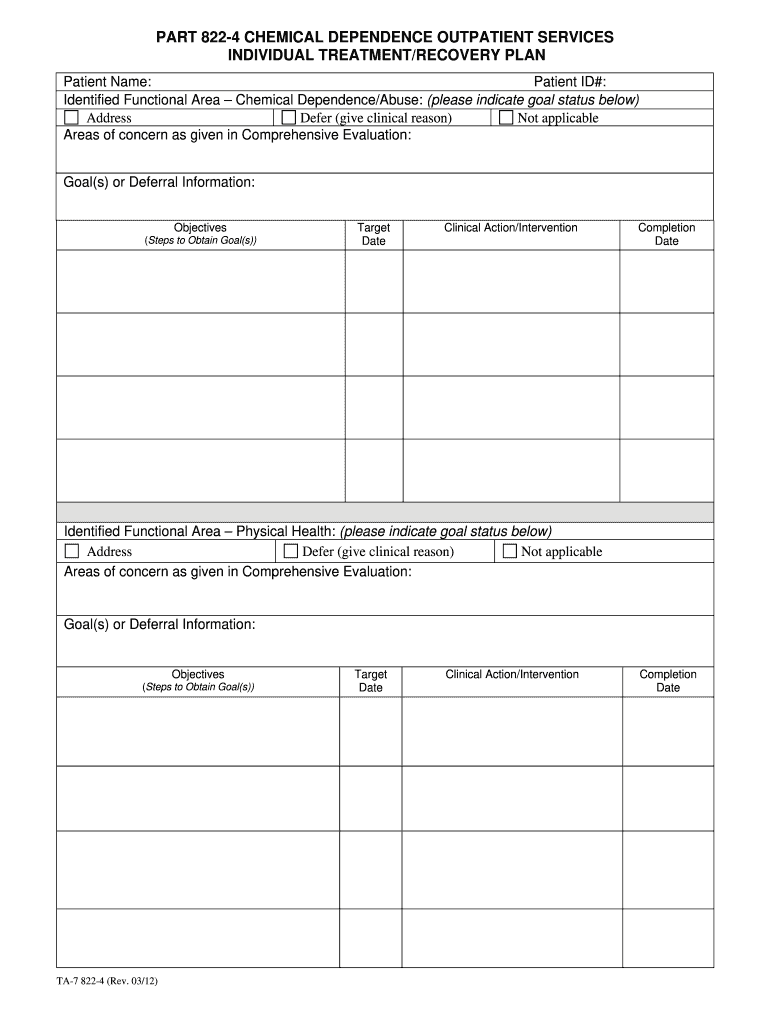

Ta 7 822 4 Form

What is the Ta 7 822 4

The Ta 7 822 4 is a specific form used primarily in tax-related processes within the United States. It serves as a declaration for certain tax exemptions and is essential for individuals and businesses seeking to navigate their tax obligations effectively. Understanding the purpose of this form is crucial for ensuring compliance with state and federal regulations.

How to use the Ta 7 822 4

Using the Ta 7 822 4 involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant financial documents and personal identification needed to complete the form. Next, fill out the required sections, ensuring that all entries are clear and legible. Once completed, review the form for accuracy before submission to avoid any potential delays or issues with processing.

Steps to complete the Ta 7 822 4

Completing the Ta 7 822 4 can be broken down into a series of straightforward steps:

- Gather necessary documents, including income statements and identification.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form to validate your submission.

- Submit the form via the chosen method, whether online, by mail, or in person.

Legal use of the Ta 7 822 4

The legal use of the Ta 7 822 4 is governed by specific regulations that ensure its validity in tax matters. To be considered legally binding, the form must be completed in accordance with the guidelines set forth by the IRS and relevant state authorities. This includes providing accurate information and adhering to submission deadlines to avoid penalties.

Required Documents

To complete the Ta 7 822 4, certain documents are required to support the information provided on the form. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including a driver's license or Social Security card.

- Any additional forms or documents that may be specified by state regulations.

Form Submission Methods

The Ta 7 822 4 can be submitted through various methods, providing flexibility for users. The options include:

- Online submission via authorized platforms that support e-filing.

- Mailing a physical copy to the designated tax authority.

- In-person submission at local tax offices or designated locations.

Filing Deadlines / Important Dates

Filing deadlines for the Ta 7 822 4 are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by specific dates set by the IRS or state tax authorities. It is essential to stay informed about these deadlines, as they can vary based on individual circumstances and changes in tax law.

Quick guide on how to complete ta 7 822 4

Effortlessly Prepare Ta 7 822 4 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources to create, edit, and electronically sign your documents quickly without hassles. Handle Ta 7 822 4 on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Ta 7 822 4 without any effort

- Find Ta 7 822 4 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or hide sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Ta 7 822 4 and ensure great communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ta 7 822 4

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the airSlate SignNow pricing structure for the 822 4 service?

The airSlate SignNow pricing structure for the 822 4 service is designed to be budget-friendly, catering to businesses of all sizes. We offer flexible plans that include both monthly and yearly subscriptions, making it easy to choose an option that fits your needs. By leveraging our cost-effective solution, you can access top-tier eSigning capabilities without breaking the bank.

-

What features does airSlate SignNow provide for the 822 4 solution?

The airSlate SignNow solution for 822 4 provides a comprehensive suite of features designed to streamline document signing. Users can enjoy capabilities like customizable templates, automated workflows, and real-time tracking of document status. These features help businesses increase efficiency while ensuring their signing processes are secure and compliant.

-

How does airSlate SignNow improve the signing experience with 822 4?

With 822 4 powered by airSlate SignNow, the signing experience is revolutionized through its user-friendly interface. The platform facilitates quick and easy eSigning, which minimizes delays and enhances overall productivity. This intuitive design allows users to complete transactions faster while keeping the signing process seamless and efficient.

-

Is airSlate SignNow compatible with other software for 822 4 integrations?

Yes, airSlate SignNow offers a variety of integrations with popular software tools for the 822 4 service. We support applications like Salesforce, Google Workspace, and Dropbox, enabling businesses to incorporate eSigning into their existing workflows. This connectivity allows for a more cohesive and streamlined operational process.

-

What benefits can businesses expect from using 822 4 with airSlate SignNow?

Businesses can expect signNow benefits from using the 822 4 service with airSlate SignNow, such as increased efficiency and reduced turnaround times for document signing. Additionally, our platform enhances compliance with industry regulations, ensuring that all signed documents are secure and legally binding. These advantages make airSlate SignNow an invaluable tool for modern businesses.

-

What types of documents can be signed using the airSlate SignNow 822 4 method?

The airSlate SignNow 822 4 method supports a wide array of document types for electronic signing. From contracts and agreements to invoices and consent forms, the platform adapts to meet diverse business needs. This versatility ensures that any document requiring a signature can be handled quickly and efficiently through our service.

-

How secure is the airSlate SignNow 822 4 signing process?

The airSlate SignNow 822 4 signing process prioritizes security and confidentiality. We utilize advanced encryption and authentication measures to protect sensitive data during the signing process. This level of security helps businesses maintain trust and compliance while navigating the complexities of digital signing.

Get more for Ta 7 822 4

Find out other Ta 7 822 4

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer