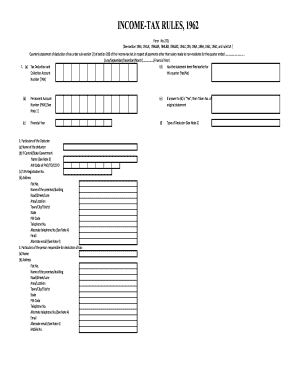

FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB 2003

What is the Form 27Q Statement Tax Income Sub Section

The Form 27Q is a tax statement required under specific sections of the Income Tax Act, particularly sections 194E, 194LB, 194LBA, and 194LBB. This form is utilized to report tax deductions made on payments to non-residents in the United States. It serves as a crucial document for both the payer and the payee, ensuring compliance with tax regulations. The form must be accurately filled out to reflect the correct amount of tax deducted, as well as the details of the recipient.

How to Use the Form 27Q Statement Tax Income Sub Section

Using the Form 27Q involves several key steps. First, ensure that you have the necessary details about the payment and the recipient. This includes the recipient's name, address, and taxpayer identification number. Once you have this information, you can fill out the form, ensuring that all fields are completed accurately. After filling out the form, it should be submitted to the appropriate tax authority, either electronically or by mail, depending on the regulations in your state.

Steps to Complete the Form 27Q Statement Tax Income Sub Section

Completing the Form 27Q involves a systematic approach:

- Gather all necessary information about the payment and the recipient.

- Access the official Form 27Q template, which can be downloaded online.

- Fill in the required fields, including the amount deducted and the recipient's details.

- Review the form for accuracy to avoid any compliance issues.

- Submit the completed form to the relevant tax authority by the deadline.

Legal Use of the Form 27Q Statement Tax Income Sub Section

The legal use of the Form 27Q is essential for compliance with U.S. tax laws. This form must be filed accurately to avoid penalties and ensure that all tax obligations are met. The information provided on the form must be truthful and complete, as it can be subject to audits by tax authorities. Proper use of this form helps maintain transparency in financial transactions involving non-residents.

Filing Deadlines for the Form 27Q Statement Tax Income Sub Section

Filing deadlines for the Form 27Q are critical to avoid penalties. Typically, the form must be submitted within a specified time frame after the payment has been made. It is advisable to check the current tax calendar for exact dates, as these can vary from year to year. Timely filing ensures compliance and helps avoid any unnecessary complications with tax authorities.

Required Documents for the Form 27Q Statement Tax Income Sub Section

To complete the Form 27Q, certain documents are required. These may include:

- The recipient's taxpayer identification number (TIN).

- Proof of payment made to the non-resident.

- Any relevant tax treaties or agreements that may affect the tax rate.

Having these documents ready will facilitate a smoother completion and submission process for the form.

Quick guide on how to complete form no 27q see section 194e 194lb 194lba 194lbb

Complete FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB easily on any device

Digital document management has become favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB on any device using airSlate SignNow’s Android or iOS applications and streamline any document-centered task today.

The simplest way to adjust and eSign FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB effortlessly

- Locate FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Select crucial sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document needs in just a few clicks from any device you prefer. Modify and eSign FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 27q see section 194e 194lb 194lba 194lbb

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the form 27q statement tax income sub section online?

The form 27q statement tax income sub section online is a tax document required for reporting all payments made to foreign applicants. It aims to ensure compliance with withholding tax provisions, allowing users to accurately file submitted income for tax purposes.

-

How can airSlate SignNow help with the form 27q statement tax income sub section online?

airSlate SignNow offers an efficient way to create, send, and eSign your form 27q statement tax income sub section online. Our platform streamlines the process and helps you maintain compliance with tax regulations, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for form 27q statement tax income sub section online?

airSlate SignNow provides flexible pricing plans to suit different business needs. Each plan includes features designed to simplify the eSigning process for documents like the form 27q statement tax income sub section online, ensuring you receive excellent value for your investment.

-

What features does airSlate SignNow offer for form 27q statement tax income sub section online?

AirSlate SignNow offers features like document templates, automated workflows, and secure cloud storage, specifically designed for documents like the form 27q statement tax income sub section online. These tools enhance efficiency and promote seamless collaboration.

-

Can I integrate airSlate SignNow with other software for managing form 27q statement tax income sub section online?

Yes, airSlate SignNow integrates with various software applications, including CRM and accounting systems. This integration allows you to manage your form 27q statement tax income sub section online conveniently and enhance your overall workflow.

-

How does signing the form 27q statement tax income sub section online protect my document?

When you sign your form 27q statement tax income sub section online using airSlate SignNow, it is embedded with advanced security features like encryption and secure audit trails. This ensures that your document remains tamper-proof and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for the form 27q statement tax income sub section online?

Using airSlate SignNow to process your form 27q statement tax income sub section online offers numerous benefits, including speed, efficiency, and cost-effectiveness. With automated workflows and easy eSigning, you can complete your tax documentation swiftly and with minimal hassle.

Get more for FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB

- Metlife change of beneficiary by policy owner form mail to

- Authorization for payoff form

- Home affordable modification program government monitoring data form

- Uniform residential loan application fillable 177159

- Vba 22 8691 arepdf form

- Form 7004 rev december

- Form 1120 nd rev december

- Form 8865 schedule k 2 and k 3 international tax

Find out other FORM NO 27Q See Section 194E, 194LB, 194LBA, 194LBB

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now