Form 8885 Internal Revenue Service Irs 2013

What is the Form 8885 Internal Revenue Service IRS

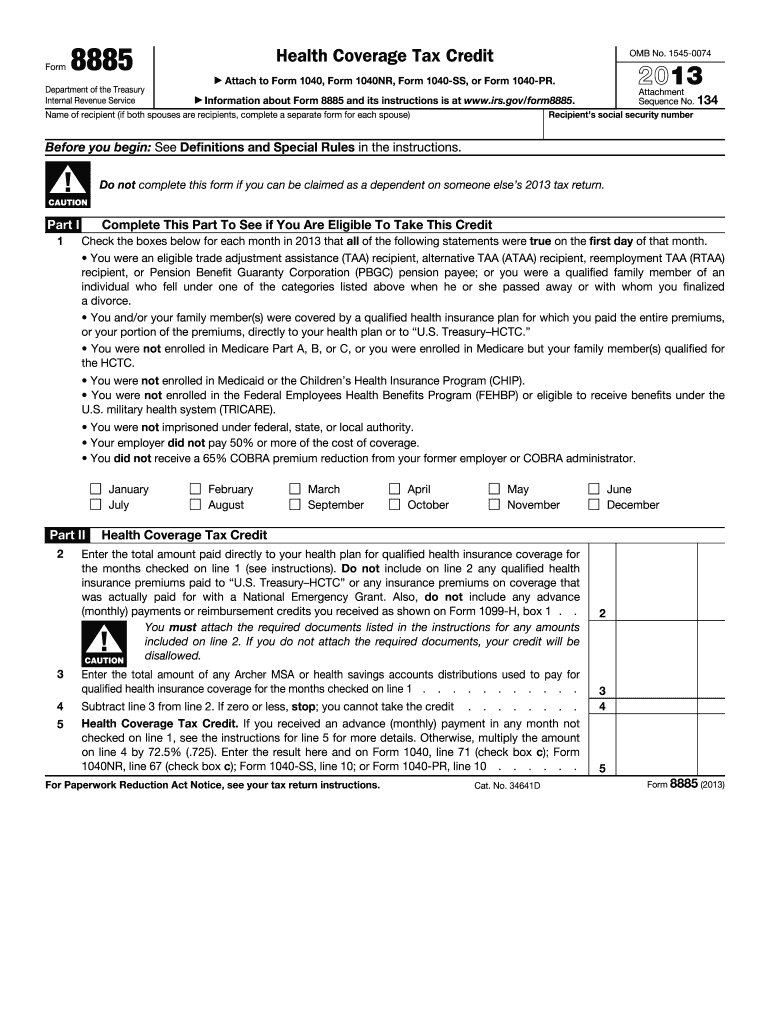

The Form 8885 is a tax form used by the Internal Revenue Service (IRS) to determine the eligibility for the Health Coverage Tax Credit (HCTC). This credit is designed to assist individuals who are receiving certain types of unemployment benefits or who are eligible for pension benefits from the Pension Benefit Guaranty Corporation (PBGC). The form helps taxpayers claim a refundable tax credit for a percentage of their health insurance premiums, which can significantly reduce their overall tax liability.

How to use the Form 8885 Internal Revenue Service IRS

To effectively use Form 8885, taxpayers must first ensure they meet the eligibility requirements for the Health Coverage Tax Credit. After confirming eligibility, individuals can download the form from the IRS website or obtain it through tax preparation software. The form must be filled out accurately, detailing the health insurance premiums paid and the qualifying coverage period. Once completed, it should be submitted along with the taxpayer's federal income tax return to claim the credit.

Steps to complete the Form 8885 Internal Revenue Service IRS

Completing Form 8885 involves several key steps:

- Gather necessary documentation, including proof of health insurance premiums and eligibility for HCTC.

- Download the form from the IRS website or access it through tax preparation software.

- Fill in personal information, including your name, Social Security number, and details about your health insurance coverage.

- Calculate the amount of the credit based on the premiums paid and the applicable percentage.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 8885 Internal Revenue Service IRS

The legal use of Form 8885 is governed by IRS regulations, which stipulate that the form must be accurately completed and submitted in accordance with federal tax laws. The information provided on the form must be truthful and verifiable, as submitting false information can lead to penalties or legal repercussions. It is crucial for taxpayers to retain copies of their submitted forms and supporting documents for their records and potential audits.

Eligibility Criteria

To qualify for the Health Coverage Tax Credit and use Form 8885, individuals must meet specific eligibility criteria. These include:

- Being eligible for Trade Adjustment Assistance (TAA) or receiving pension benefits from the PBGC.

- Having health insurance coverage for themselves and their qualifying family members.

- Paying premiums for qualified health insurance during the specified coverage period.

Filing Deadlines / Important Dates

Filing deadlines for Form 8885 align with the general tax return deadlines set by the IRS. Typically, individual taxpayers must submit their federal income tax returns, including Form 8885, by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential for taxpayers to be aware of these deadlines to ensure timely submission and avoid penalties.

Quick guide on how to complete form 8885 internal revenue service irs

Complete Form 8885 Internal Revenue Service Irs effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Form 8885 Internal Revenue Service Irs on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Form 8885 Internal Revenue Service Irs with minimal effort

- Locate Form 8885 Internal Revenue Service Irs and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, monotonous form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8885 Internal Revenue Service Irs and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8885 internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the form 8885 internal revenue service irs

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 8885 from the Internal Revenue Service (IRS)?

Form 8885 is a tax form used by the Internal Revenue Service (IRS) to determine the health coverage tax credit (HCTC) for certain individuals. This form is essential for taxpayers looking to receive a tax credit for health insurance premiums. By filling out Form 8885 correctly, you can maximize your potential credits effectively.

-

How does airSlate SignNow facilitate the signing of Form 8885 Internal Revenue Service (IRS) documents?

airSlate SignNow provides an intuitive platform that allows users to digitally sign and send Form 8885 Internal Revenue Service (IRS) documents with ease. With a few clicks, businesses can streamline their document workflows, ensuring that Form 8885 is signed and submitted quickly and securely. This helps reduce processing times and enhances business efficiencies.

-

What pricing options are available for using airSlate SignNow with Form 8885 Internal Revenue Service (IRS)?

airSlate SignNow offers a range of pricing plans tailored to meet various business needs when dealing with Form 8885 Internal Revenue Service (IRS). Plans typically vary based on features such as the number of documents, templates, and storage options. By choosing a plan that fits your budget, you can efficiently manage the signing of Form 8885 and other documents.

-

What features does airSlate SignNow offer for managing Form 8885 Internal Revenue Service (IRS) signatures?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking for Form 8885 Internal Revenue Service (IRS) documents. These tools enhance usability and help ensure that all necessary signatures are obtained swiftly. With advanced security measures in place, you can rest assured that your sensitive IRS documents are protected.

-

Can I integrate airSlate SignNow with other tools when managing Form 8885 Internal Revenue Service (IRS)?

Yes, airSlate SignNow offers seamless integrations with various productivity and business tools, making it easy to manage Form 8885 Internal Revenue Service (IRS) alongside your existing workflows. These integrations help streamline your operations and make it simple to share, sign, and submit documents quickly. Enhance your efficiency by connecting your favorite apps with SignNow.

-

What benefits does airSlate SignNow provide for handling Form 8885 Internal Revenue Service (IRS)?

Using airSlate SignNow to handle Form 8885 Internal Revenue Service (IRS) can save time and reduce errors in the signing process. The digital platform allows for quick document turnaround, enabling faster tax filing and compliance. Additionally, the user-friendly interface ensures that anyone can easily navigate the process without extensive training.

-

Is there customer support available for questions related to Form 8885 Internal Revenue Service (IRS) on airSlate SignNow?

Absolutely! airSlate SignNow provides excellent customer support to assist you with any questions about Form 8885 Internal Revenue Service (IRS). Whether you need help with the signing process or have inquiries about features, our dedicated support team is available to guide you through any challenges you may encounter.

Get more for Form 8885 Internal Revenue Service Irs

Find out other Form 8885 Internal Revenue Service Irs

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word