8885 2018-2026

What is IRS Form 8885?

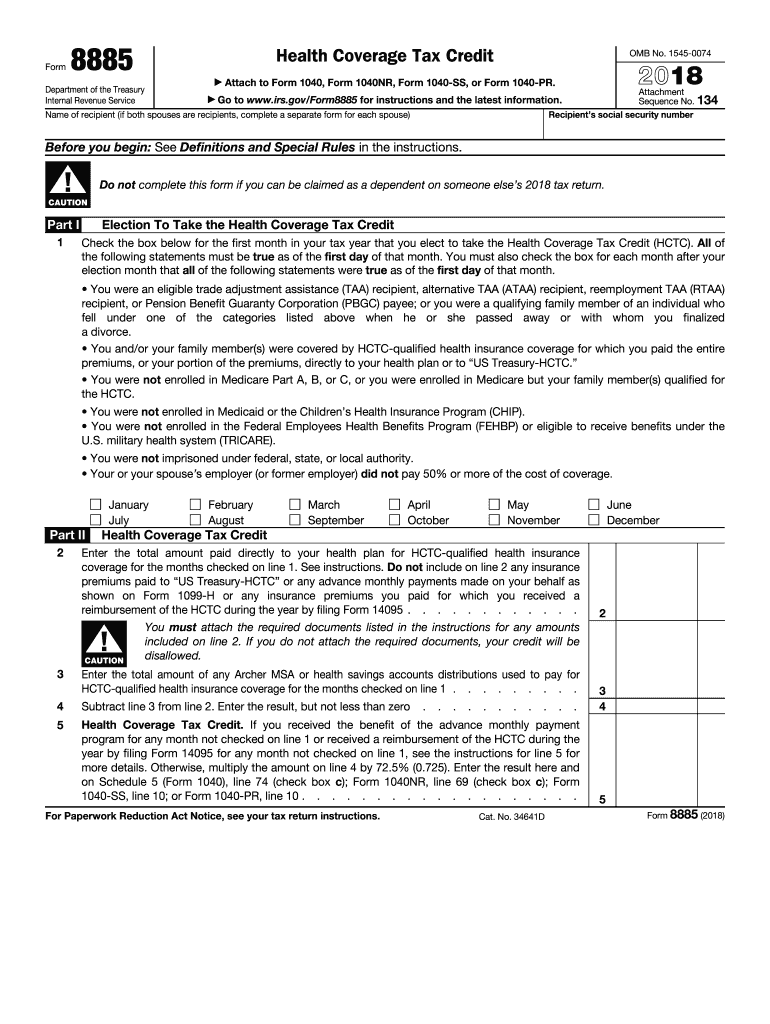

IRS Form 8885 is a tax form used to claim the Health Coverage Tax Credit (HCTC). This credit is designed to help individuals and families afford health insurance premiums. It is primarily available to those who are receiving Trade Adjustment Assistance, Pension Benefit Guaranty Corporation benefits, or are eligible for certain other programs. By completing this form, taxpayers can receive a significant reduction in their health insurance costs, making healthcare more accessible.

How to Use IRS Form 8885

To effectively use IRS Form 8885, taxpayers must first determine their eligibility for the Health Coverage Tax Credit. Once eligibility is confirmed, the form should be filled out with accurate personal information, including details about the health insurance coverage. It is essential to follow the instructions carefully to ensure all necessary information is provided. The completed form can then be submitted with the taxpayer's annual income tax return to claim the credit.

Steps to Complete IRS Form 8885

Completing IRS Form 8885 involves several key steps:

- Gather necessary documents, including proof of health insurance coverage and eligibility documentation.

- Fill out the form with personal information, including your name, address, and Social Security number.

- Indicate the months you had qualified health coverage during the tax year.

- Calculate the amount of the tax credit based on your premiums and eligible months.

- Review the completed form for accuracy before submission.

Legal Use of IRS Form 8885

IRS Form 8885 is legally binding when completed accurately and submitted according to IRS guidelines. To ensure compliance, taxpayers must adhere to the requirements set forth by the IRS regarding eligibility and documentation. Electronic signatures are accepted, provided they meet the criteria established by the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Using a reliable eSignature solution can enhance the legal standing of the completed form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with IRS Form 8885 to avoid penalties. Typically, the form should be submitted along with the annual tax return, which is due on April fifteenth. However, if the taxpayer files for an extension, they must still ensure that Form 8885 is included in the extended filing. Keeping track of these dates is crucial for maintaining compliance and securing the health coverage tax credit.

Eligibility Criteria

To qualify for the Health Coverage Tax Credit using IRS Form 8885, individuals must meet specific eligibility criteria. This includes being a recipient of Trade Adjustment Assistance or Pension Benefit Guaranty Corporation benefits, or being eligible for other qualifying programs. Additionally, the taxpayer must have paid health insurance premiums for qualified coverage. It is important to review the eligibility requirements thoroughly to ensure compliance before completing the form.

Quick guide on how to complete 8885

Complete 8885 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 8885 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign 8885 with ease

- Locate 8885 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 8885 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8885

Create this form in 5 minutes!

How to create an eSignature for the 8885

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is IRS Form 8885 and why do I need it?

IRS Form 8885 is used to claim the amount you paid for your health coverage under the Affordable Care Act. Completing this form is essential for accurately reporting your health coverage to the IRS and ensuring compliance with tax regulations. Using airSlate SignNow, you can eSign this form easily and securely.

-

How can airSlate SignNow help with IRS Form 8885?

airSlate SignNow provides a user-friendly platform for businesses to eSign IRS Form 8885 quickly and efficiently. With our solution, you can prepare, send, and manage your forms electronically, ensuring a seamless and organized workflow. Our secure platform ensures your sensitive information remains protected throughout the process.

-

What are the pricing options for using airSlate SignNow for IRS Form 8885?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from a free trial or various paid plans based on the volume of forms you need to process, including IRS Form 8885. Our cost-effective solutions help you manage expenses while ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other tools for IRS Form 8885?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to streamline your processes for completing IRS Form 8885. Integration with tools like Google Drive, Dropbox, and CRM systems helps you manage documents more efficiently. This ensures that you can access your important forms from wherever you work.

-

Is airSlate SignNow secure for sending IRS Form 8885?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure servers, to protect your IRS Form 8885 and any sensitive data. Our platform is compliant with industry standards to ensure your information is safe during the entire document signing process.

-

What benefits can I expect from using airSlate SignNow for IRS Form 8885?

Using airSlate SignNow for IRS Form 8885 offers numerous benefits, such as improved efficiency, reduced processing times, and enhanced organization. You can easily track the status of your forms and receive reminders for important deadlines, ensuring that you meet all necessary tax obligations. This ultimately helps save your business time and money.

-

Can I access IRS Form 8885 on mobile devices using airSlate SignNow?

Yes, with airSlate SignNow, you can access IRS Form 8885 on mobile devices, allowing you to eSign documents anytime and anywhere. Our mobile-friendly platform makes it convenient for users to manage their forms, stay compliant, and complete tasks on the go. This flexibility supports better work-life balance and efficiency.

Get more for 8885

Find out other 8885

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template