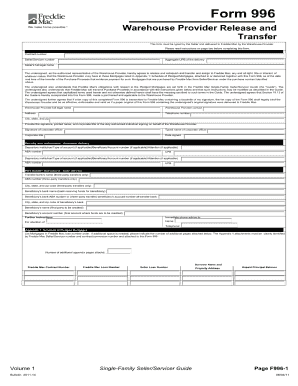

Form 996 Instructions 2011

What is the Form 996 Instructions

The Form 996 Instructions provide guidance for completing Form 996, which is used for reporting specific information to the Internal Revenue Service (IRS). This form is essential for taxpayers who need to disclose certain financial details accurately. Understanding the instructions is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to complete the Form 996 Instructions

Completing the Form 996 Instructions involves several key steps:

- Review the eligibility criteria to confirm that you need to file this form.

- Gather all necessary documents, including financial statements and previous tax returns.

- Fill out the form accurately, following the guidelines provided in the instructions.

- Double-check all entries for accuracy and completeness to prevent errors.

- Submit the form by the specified deadline to ensure compliance with IRS regulations.

Legal use of the Form 996 Instructions

The legal use of the Form 996 Instructions is vital for taxpayers. The form must be filled out in accordance with IRS guidelines to be considered valid. This includes providing accurate information and adhering to submission timelines. Failure to comply with these legal requirements can result in penalties or audits.

Key elements of the Form 996 Instructions

Several key elements are essential when working with the Form 996 Instructions:

- Identification Information: Ensure that your name, address, and taxpayer identification number are correctly entered.

- Financial Data: Accurately report all required financial information, including income and deductions.

- Signature: The form must be signed to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 996 Instructions are critical to avoid penalties. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth. However, it is important to check for any specific extensions or changes in deadlines that may apply for the current tax year.

Form Submission Methods (Online / Mail / In-Person)

The Form 996 can be submitted through various methods:

- Online: Many taxpayers opt to file electronically through the IRS website or approved software.

- Mail: The completed form can be mailed to the designated IRS address.

- In-Person: Taxpayers may also choose to submit the form in person at local IRS offices.

Quick guide on how to complete form 996 instructions

Prepare Form 996 Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Handle Form 996 Instructions on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 996 Instructions with ease

- Find Form 996 Instructions and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 996 Instructions and ensure outstanding communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 996 instructions

Create this form in 5 minutes!

How to create an eSignature for the form 996 instructions

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What are Form 996 Instructions and why are they important?

Form 996 Instructions provide detailed guidelines on how to properly complete and submit the form. Understanding these instructions is crucial as accurate submission can affect the processing of your documents. Thus, having access to clear Form 996 Instructions helps ensure compliance and efficiency in business operations.

-

How can airSlate SignNow assist with Form 996 Instructions?

airSlate SignNow simplifies the process by providing features that guide you through the completion of Form 996. Our platform ensures that you have access to all necessary templates and instructions, streamlining your document workflow. This efficiency saves time and reduces errors during submission.

-

Is there a cost associated with using airSlate SignNow for Form 996 Instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for accessing Form 996 Instructions. Our competitive pricing ensures that you receive an effective e-signature solution while managing your budget. You can choose the plan that fits your requirements best.

-

What features does airSlate SignNow offer for completing Form 996 Instructions?

The airSlate SignNow platform features user-friendly templates, automated workflows, and collaboration tools that facilitate the completion of Form 996 Instructions. You can easily customize forms, track document status, and securely store completed files. These features enhance productivity and accuracy in document management.

-

Can I integrate airSlate SignNow with other applications for Form 996 Instructions?

Absolutely! airSlate SignNow offers extensive integration capabilities with various applications that can support your workflow for Form 996 Instructions. Whether you're using CRM tools, cloud storage, or project management software, our integrations help create a seamless experience across platforms.

-

What are the benefits of using airSlate SignNow for Form 996 Instructions?

Using airSlate SignNow for Form 996 Instructions enhances efficiency and accuracy in document handling. The platform minimizes the risk of errors while ensuring compliance with submission guidelines. Additionally, the ease of use and cost-effectiveness makes it accessible for businesses of all sizes.

-

Is technical support available for issues related to Form 996 Instructions?

Yes, airSlate SignNow provides comprehensive technical support to assist users with any issues related to Form 996 Instructions. Our support team is available to answer questions, troubleshoot problems, and guide you through the platform's features. We aim to ensure that you have a smooth and effective experience.

Get more for Form 996 Instructions

- Mchp application form

- Madap application form

- Apm 025 university of california office of the president ucop form

- Wayne county human relations first tier form

- Wisconsin waterways commission dnr form

- Rehabilitation unit criteria worksheet form

- Map 347 form

- Filled form of international student certificate of finances

Find out other Form 996 Instructions

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe