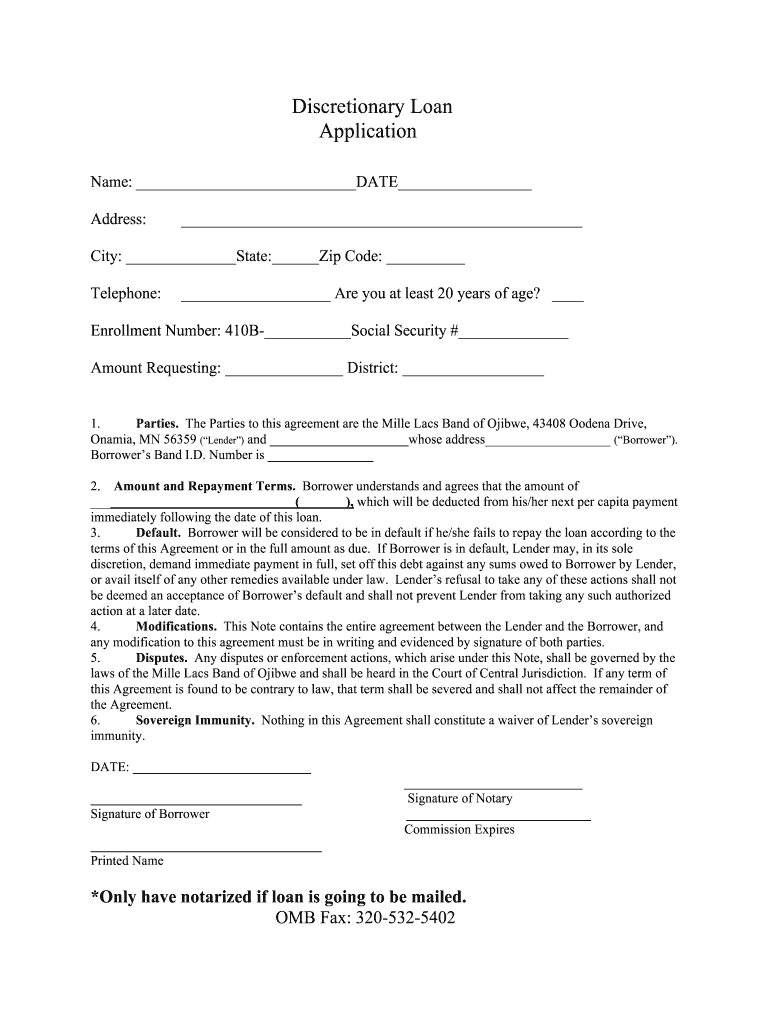

Discretionary Loan Form

What is the discretionary loan?

A discretionary loan is a type of financing that lenders offer at their discretion, often based on the borrower's financial situation and creditworthiness. Unlike conventional loans, which have strict guidelines and requirements, discretionary loans provide flexibility in terms of approval and terms. This can make them an appealing option for individuals or businesses needing quick access to funds for various purposes, such as emergencies, investments, or personal projects.

How to obtain the discretionary loan

Obtaining a discretionary loan typically involves several key steps:

- Research lenders: Identify financial institutions or lenders that offer discretionary loans. Look for those with favorable terms and a good reputation.

- Check eligibility: Review the lender's eligibility criteria, which may include credit score, income level, and existing debt.

- Prepare documentation: Gather necessary documents, such as proof of income, identification, and any other information the lender may require.

- Submit an application: Complete the loan application form, ensuring all information is accurate and complete.

- Await approval: After submission, the lender will review your application and determine whether to approve the loan.

Steps to complete the discretionary loan

Completing the discretionary loan process involves the following steps:

- Fill out the application: Provide all required information on the application form, including personal and financial details.

- Review terms: Carefully read the loan terms and conditions, including interest rates, repayment schedules, and any fees.

- Sign the agreement: Once you agree to the terms, sign the loan agreement electronically or in person, depending on the lender's process.

- Receive funds: After approval, the lender will disburse the funds to your designated account.

Legal use of the discretionary loan

The legal use of a discretionary loan includes adhering to the terms outlined in the loan agreement. Borrowers should use the funds for the intended purpose specified in the application. Misuse of the loan, such as using it for illegal activities or failing to repay as agreed, can lead to legal consequences, including penalties and damage to credit ratings.

Eligibility criteria

Eligibility criteria for a discretionary loan can vary by lender but generally include:

- Credit score: A minimum credit score may be required, although some lenders may offer loans to those with lower scores.

- Income verification: Proof of stable income is often necessary to demonstrate the ability to repay the loan.

- Debt-to-income ratio: Lenders may assess your existing debt compared to your income to evaluate your financial health.

Required documents

When applying for a discretionary loan, you may need to provide the following documents:

- Identification: A government-issued ID, such as a driver's license or passport.

- Proof of income: Recent pay stubs, tax returns, or bank statements to verify your income.

- Credit history: Some lenders may request your credit report to assess your creditworthiness.

Quick guide on how to complete discretionary loan

Complete Discretionary Loan effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute to conventional printed and signed materials, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly without delays. Handle Discretionary Loan on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and electronically sign Discretionary Loan with ease

- Locate Discretionary Loan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether via email, SMS, or a shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Discretionary Loan and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the discretionary loan

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is a discretionary loan?

A discretionary loan is a type of financing that provides flexibility in its usage. It allows borrowers to utilize funds for various purposes according to their needs, making it a popular choice for businesses seeking quick financial support. With airSlate SignNow, the process of applying for a discretionary loan can be streamlined through our easy-to-use platform.

-

How does a discretionary loan work?

A discretionary loan typically involves an agreed-upon amount of credit extended to the borrower, which can be used at their discretion. The terms and conditions, including interest rates and repayment schedules, are predefined in the application process. By using airSlate SignNow, businesses can manage loan documents efficiently and securely.

-

What are the benefits of a discretionary loan for businesses?

The main benefits of a discretionary loan for businesses include flexibility, quick access to funds, and the ability to cover unexpected expenses. This type of loan allows companies to seize growth opportunities without the need for extensive documentation or slow approval processes. airSlate SignNow further simplifies this by enabling electronic signatures and document management.

-

What features does airSlate SignNow offer for discretionary loans?

airSlate SignNow offers features such as secure document e-signature, customizable workflows, and easy document sharing, all of which enhance the discretionary loan process. Our platform is designed for quick turnaround times and user convenience, ensuring that your financing needs are met efficiently. Additionally, we provide templates and integrations to streamline loan documentation.

-

Are there any costs associated with obtaining a discretionary loan through airSlate SignNow?

Costs related to a discretionary loan can vary based on the lending terms, but airSlate SignNow offers a cost-effective solution for document management without hidden fees. While the loan itself may incur interest and repayment fees, using our platform to handle paperwork is affordable and simplifies the entire borrowing process. For specific pricing details, you can check our website.

-

How can I integrate discretionary loan services with my existing systems?

Integrating discretionary loan services with airSlate SignNow is straightforward, as we offer APIs and various integration options with popular business software. This ensures a seamless transition and streamlined workflows when handling documentation for discretionary loans. Our support team is available to assist with any integration needs, making it easy to adapt our services.

-

Can I track my discretionary loan documents using airSlate SignNow?

Yes, airSlate SignNow allows you to track your discretionary loan documents in real-time. You'll receive notifications regarding document status, such as when a file is opened, signed, or completed. This transparency ensures you stay informed throughout the loan process, making managing your discretionary loan easier.

Get more for Discretionary Loan

- Op 175 fillable form

- Irs payment plan form

- Nursing home volunteer application form

- Rose lafferty and flora foust scholarship application form

- Dmv form oa150i

- This form must be completed to pick up a ticket for a guest lcps

- Eya approval to operate from non domestic premises for childcare services ofsted form that childminders and providers of

- Crap checklist form

Find out other Discretionary Loan

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed