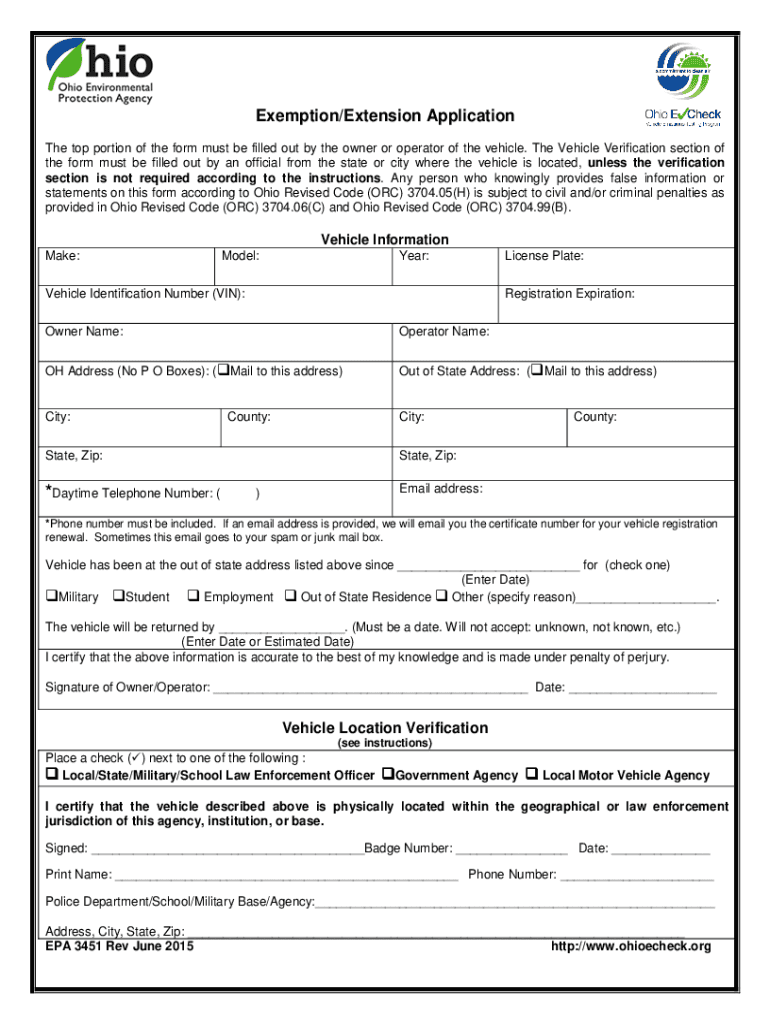

Ohio Exemption Application 2015

What is the Ohio Exemption Application

The Ohio Exemption Application is a formal request that allows eligible individuals and organizations to apply for tax-exempt status within the state of Ohio. This application is essential for those seeking to avoid certain taxes, such as sales tax or property tax, based on specific criteria set by state law. The exemption can apply to various entities, including nonprofit organizations, educational institutions, and government agencies, depending on their compliance with Ohio's tax exemption regulations.

Eligibility Criteria

To qualify for the Ohio Exemption Application, applicants must meet specific eligibility requirements. Generally, these criteria include:

- Being a nonprofit organization, educational institution, or government entity.

- Operating exclusively for charitable, educational, or governmental purposes.

- Providing documentation that supports the claim for exemption, such as articles of incorporation or bylaws.

It is crucial for applicants to review the detailed eligibility guidelines provided by the Ohio Department of Taxation to ensure compliance.

Steps to complete the Ohio Exemption Application

Completing the Ohio Exemption Application involves several key steps:

- Gather necessary documentation, including proof of nonprofit status and financial statements.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application through the appropriate channels, either online or via mail, as specified by the Ohio Department of Taxation.

Following these steps carefully can help streamline the application process and improve the chances of approval.

Required Documents

When applying for the Ohio Exemption Application, several documents are typically required to substantiate the request. These may include:

- Proof of nonprofit status, such as a 501(c)(3) determination letter from the IRS.

- Articles of incorporation and bylaws that outline the organization's purpose and structure.

- Financial statements or budgets demonstrating the organization's operational status.

- Any additional documentation that may support the claim for tax exemption.

Ensuring that all required documents are included can help facilitate a smoother review process.

Legal use of the Ohio Exemption Application

The legal use of the Ohio Exemption Application is governed by state tax laws and regulations. It is essential for applicants to understand that misuse of the application or providing false information can lead to penalties, including the revocation of tax-exempt status. Compliance with all legal requirements is vital to maintain the benefits associated with tax exemption. Organizations should consult legal counsel if they have questions regarding the application’s legal implications.

Form Submission Methods

Applicants can submit the Ohio Exemption Application through various methods, including:

- Online Submission: Many applicants prefer to submit their forms electronically via the Ohio Department of Taxation's website.

- Mail: Completed applications can also be sent via postal mail to the designated address provided on the form.

- In-Person: Some applicants may choose to deliver their applications in person at local tax offices.

Choosing the appropriate submission method can depend on the applicant's preference and the urgency of the request.

Quick guide on how to complete ohio exemption application

Accomplish Ohio Exemption Application effortlessly on any gadget

Digital document administration has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can readily access the appropriate form and securely archive it online. airSlate SignNow provides all the resources necessary to produce, modify, and electronically sign your documents rapidly without interruptions. Manage Ohio Exemption Application on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to alter and electronically sign Ohio Exemption Application with ease

- Find Ohio Exemption Application and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ohio Exemption Application and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio exemption application

Create this form in 5 minutes!

How to create an eSignature for the ohio exemption application

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the process for filling out the form for the tax exempt in Ohio?

To fill out the form for the tax exempt in Ohio, you'll need to gather the necessary information regarding your organization, such as its tax status and purpose. Using airSlate SignNow, you can easily input this information into the provided templates and eSign it efficiently. This simplifies the submission process and ensures accuracy.

-

How does airSlate SignNow help with the form for the tax exempt in Ohio?

airSlate SignNow offers a streamlined platform to create, send, and eSign the form for the tax exempt in Ohio. Our user-friendly interface allows you to customize forms as needed while ensuring they meet Ohio's specific requirements. This enhances compliance and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the form for the tax exempt in Ohio?

Yes, there is a cost for utilizing the airSlate SignNow platform, but it is designed to be cost-effective for businesses of all sizes. Pricing varies based on the features you need, but the investment is typically outweighed by the time and resources saved in processing the form for the tax exempt in Ohio.

-

Can I integrate airSlate SignNow with other software for handling the form for the tax exempt in Ohio?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM and accounting software. This allows you to manage the form for the tax exempt in Ohio alongside your other business processes, enhancing overall efficiency and organization.

-

What features does airSlate SignNow offer for the form for the tax exempt in Ohio?

airSlate SignNow provides a range of features tailored for the form for the tax exempt in Ohio, including customizable templates, automated workflows, and secure eSignatures. These tools help streamline the documentation process, ensuring your form is correctly filled out and submitted without hassle.

-

Are there templates available for the form for the tax exempt in Ohio?

Yes, airSlate SignNow offers pre-designed templates specifically for the form for the tax exempt in Ohio. These templates are helpful in ensuring that all necessary fields are included and compliant with state regulations, reducing errors during the completion process.

-

How secure is airSlate SignNow when submitting the form for the tax exempt in Ohio?

Security is a top priority for airSlate SignNow. When submitting the form for the tax exempt in Ohio, all data is encrypted, and we comply with industry standards to ensure that your information remains confidential and secure throughout the process.

Get more for Ohio Exemption Application

- Waiver form

- Printable t shirt form

- Hexcel 8552 as4 plain weave statistical analysis report national form

- Kansas retailersamp39 event sales tax form wichita state university webs wichita

- Lesson plan format ncate widener university

- Power of attorney etrade form

- Frost bank mobile deposit form

- Deposit form habib bank ag zurich

Find out other Ohio Exemption Application

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document