Bir 1702 2018-2026

What is the Bir 1702?

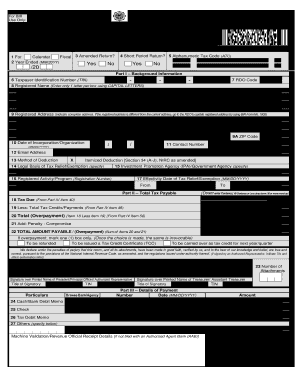

The Bir 1702 is a tax form used in the Philippines, specifically for the annual income tax return of corporations and partnerships. This form is essential for businesses as it reports their income, deductions, and tax liability for the preceding year. The 2013 Bir form 1702 is a specific version that adheres to the tax regulations in place during that year. Understanding this form is crucial for compliance with tax laws and for accurate reporting of financial activities.

How to use the Bir 1702

Using the Bir 1702 involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax deductions. Next, fill out the form by entering the required information accurately. This includes total income, allowable deductions, and the resulting taxable income. After completing the form, review it for any errors before submitting it to the Bureau of Internal Revenue (BIR) either electronically or by mail.

Steps to complete the Bir 1702

Completing the Bir 1702 requires careful attention to detail. Here are the essential steps:

- Gather all financial documents needed for the reporting period.

- Fill in the basic information, including the taxpayer's name, address, and Tax Identification Number (TIN).

- Report total income earned during the year in the designated section.

- List all allowable deductions to arrive at the taxable income.

- Calculate the tax due based on the taxable income.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the BIR by the specified deadline.

Legal use of the Bir 1702

The legal use of the Bir 1702 is governed by tax regulations set forth by the Bureau of Internal Revenue. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with the deadlines established by the BIR. Compliance with these regulations is essential to avoid penalties and legal issues. Additionally, using a reliable electronic signature tool can enhance the legal validity of the document when submitting it online.

Filing Deadlines / Important Dates

Filing deadlines for the Bir 1702 are crucial for compliance. Typically, the annual income tax return must be filed on or before the fifteenth day of the fourth month following the close of the taxable year. For corporations with a fiscal year ending December 31, the deadline is usually April 15 of the following year. It is important to stay informed about any changes in deadlines or extensions that may be announced by the BIR.

Required Documents

To complete the Bir 1702, several documents are required to support the information reported on the form. These include:

- Financial statements for the year, including balance sheets and income statements.

- Receipts and records of all business expenses.

- Documentation for any tax credits or deductions claimed.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Bir 1702 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the BIR. Options include:

- Online submission through the BIR's e-filing system, which allows for immediate processing.

- Mailing a printed copy of the completed form to the appropriate BIR office.

- In-person submission at designated BIR offices, which may provide immediate confirmation of receipt.

Choosing the right submission method can enhance efficiency and ensure timely compliance with tax obligations.

Quick guide on how to complete bir 1702

Effortlessly prepare Bir 1702 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents quickly and without complications. Manage Bir 1702 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Bir 1702 effortlessly

- Obtain Bir 1702 and click on Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of missing or lost files, tedious searches for forms, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Bir 1702 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir 1702

Create this form in 5 minutes!

How to create an eSignature for the bir 1702

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 2013 BIR Form 1702 and why is it important?

The 2013 BIR Form 1702 is an essential tax document used in the Philippines for corporations and partnerships to report their income. Filing this form is crucial for compliance, ensuring that businesses satisfy tax obligations and avoid penalties. Utilizing airSlate SignNow can streamline the e-signing process for this essential form.

-

How can airSlate SignNow help with the 2013 BIR Form 1702?

airSlate SignNow allows businesses to easily send and eSign the 2013 BIR Form 1702 digitally. This eliminates the hassles of paper-based processes, reducing errors and speeding up document turnaround times. Its user-friendly interface makes it accessible even for those less familiar with digital tools.

-

Is there a cost associated with using airSlate SignNow for the 2013 BIR Form 1702?

Yes, airSlate SignNow offers different pricing plans tailored to business needs. The cost-effective solutions provide flexibility for companies looking to efficiently manage forms like the 2013 BIR Form 1702 without breaking the bank. You can explore various plans to find one that suits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2013 BIR Form 1702?

airSlate SignNow offers features like customizable templates, secure eSignature options, and document tracking specifically for forms like the 2013 BIR Form 1702. These features enhance efficiency by facilitating quick edits and easy review processes. Additionally, automatic reminders ensure timely completion and submission.

-

Can I integrate airSlate SignNow with other tools for better management of the 2013 BIR Form 1702?

Yes, airSlate SignNow supports integrations with various business tools such as Google Drive, Dropbox, and CRMs. This enhances document management for forms like the 2013 BIR Form 1702, allowing seamless access and organization of necessary files. It enables businesses to maintain a smooth workflow by connecting all necessary applications.

-

Is airSlate SignNow compliant with regulatory standards for the 2013 BIR Form 1702?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring that all electronic signatures and document transactions meet legal standards. When handling sensitive forms like the 2013 BIR Form 1702, businesses can trust airSlate SignNow’s adherence to security protocols. This compliance helps mitigate risks during tax filing and financial reporting.

-

How can I start using airSlate SignNow for the 2013 BIR Form 1702?

Getting started with airSlate SignNow for the 2013 BIR Form 1702 is simple. You can sign up on their website and choose a plan that fits your needs. Once registered, you can create, send, and eSign your documents with ease, streamlining your tax reporting processes effectively.

Get more for Bir 1702

Find out other Bir 1702

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document