Vat Return Form

What is the VAT Return Form?

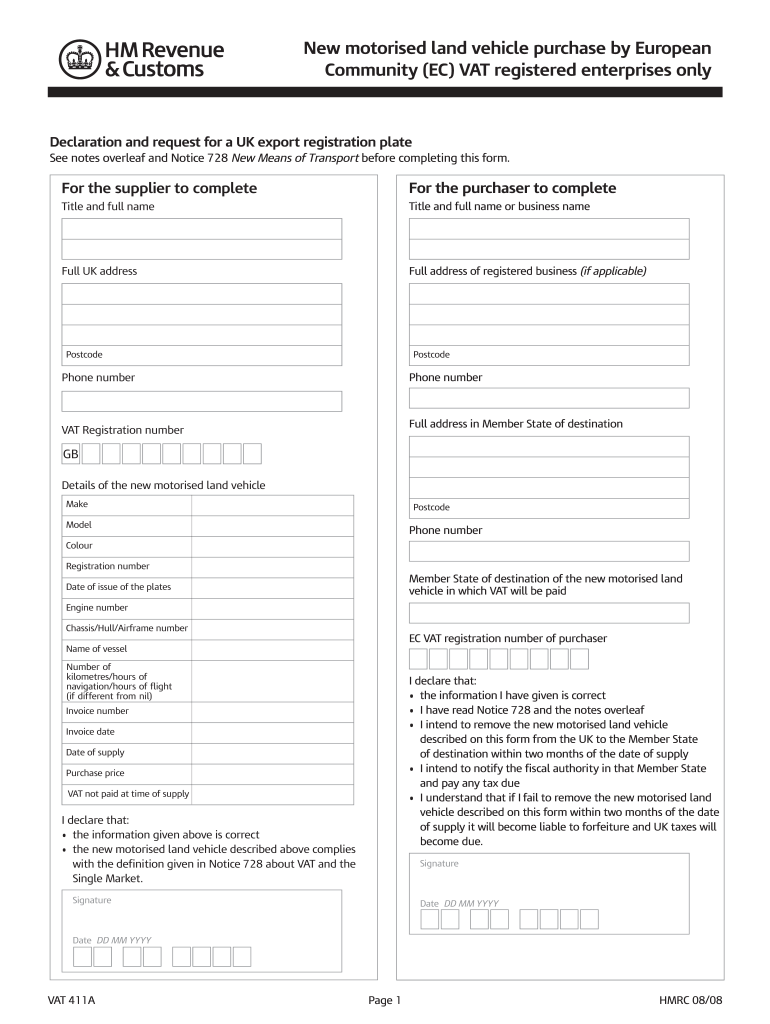

The VAT Return Form, commonly referred to as the VAT 411A form, is a crucial document used in the United States for reporting value-added tax (VAT) obligations. This form is primarily utilized by businesses that are registered for VAT and need to report their sales, purchases, and the amount of VAT they owe to the government. The form helps ensure compliance with tax regulations and provides a clear record of a business's tax liabilities.

Steps to Complete the VAT Return Form

Completing the VAT 411A form involves several essential steps to ensure accuracy and compliance. First, gather all necessary financial records, including invoices and receipts, as these will provide the data needed to fill out the form. Next, calculate the total sales and purchases for the reporting period, ensuring to include the VAT amounts. After that, accurately fill in the form by entering the calculated figures in the appropriate fields. Finally, review the completed form for any errors before submission.

Legal Use of the VAT Return Form

The VAT 411A form is legally binding when completed and submitted correctly. To ensure its legal standing, businesses must comply with the relevant regulations governing VAT reporting. This includes maintaining accurate records, submitting the form by the deadline, and ensuring that all calculations are precise. Utilizing a reliable electronic signature solution can further enhance the legal validity of the form, as it provides a secure method for signing and submitting documents electronically.

Form Submission Methods

The VAT 411A form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient, allowing for quicker processing times. When submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing option. In-person submissions may be required in certain circumstances, such as when additional documentation is needed or if there are questions regarding the form.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 411A form are critical to avoid penalties. Typically, businesses must submit their VAT returns on a quarterly or annual basis, depending on their revenue and tax obligations. It is essential to keep track of these deadlines to ensure timely submission. Mark your calendar with the specific dates to help maintain compliance and avoid any late fees or interest charges that may arise from missed deadlines.

Required Documents

To complete the VAT 411A form accurately, certain documents are necessary. These typically include sales invoices, purchase receipts, and any previous VAT returns. Additionally, businesses should have records of VAT payments made during the reporting period. Having these documents readily available will streamline the process of filling out the form and help ensure that all information reported is accurate and complete.

Quick guide on how to complete vat return form

Complete Vat Return Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and smoothly. Manage Vat Return Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign Vat Return Form with ease

- Find Vat Return Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Vat Return Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat return form

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the VAT 411A form and why do I need it?

The VAT 411A form is a crucial document for businesses seeking to manage their value-added tax obligations effectively. It helps ensure compliance with VAT regulations and streamline the process of tax reporting. Using airSlate SignNow to eSign this form can simplify the digital document workflow for your business.

-

How can I complete the VAT 411A form using airSlate SignNow?

Completing the VAT 411A form with airSlate SignNow is straightforward. Simply upload your document to our platform, fill out the necessary fields, and then use our eSignature feature for a legal, digital signature. This ensures that your form is completed efficiently and securely.

-

Is airSlate SignNow compliant with VAT regulations for the VAT 411A form?

Yes, airSlate SignNow is fully compliant with VAT regulations, ensuring that processes related to the VAT 411A form meet all legal requirements. Our platform adheres to the necessary security and compliance standards to protect your data. This gives you peace of mind when managing VAT-related documentation.

-

What are the pricing options for using airSlate SignNow for VAT 411A forms?

airSlate SignNow offers flexible pricing options tailored to different business needs, starting with a free trial that allows you to test its functionalities. Our affordable plans include features specifically designed for managing VAT 411A forms and other important documents. You can choose a plan that best fits your business size and requirements.

-

What features does airSlate SignNow provide for the VAT 411A form?

airSlate SignNow provides features like eSigning, custom templates, and easy document sharing for the VAT 411A form. These tools allow you to streamline your workflow and save time in processing VAT-related paperwork. Additionally, you can track the status of your forms to ensure timely submissions.

-

Can I integrate airSlate SignNow with my existing software for VAT 411A forms?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, making it easy to incorporate the VAT 411A form into your existing workflow. Whether you use accounting software or document management systems, our platform enhances your productivity and efficiency.

-

What benefits does airSlate SignNow offer for signing the VAT 411A form?

Using airSlate SignNow to sign your VAT 411A form provides multiple benefits, including a faster turnaround time, enhanced security, and easy document management. You can quickly gather signatures from multiple parties, ensuring that your forms are submitted without unnecessary delays. This helps your business stay compliant and operational.

Get more for Vat Return Form

Find out other Vat Return Form

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy