Vesp Vancouver Form

What is the Vancouver Employee Savings Plan?

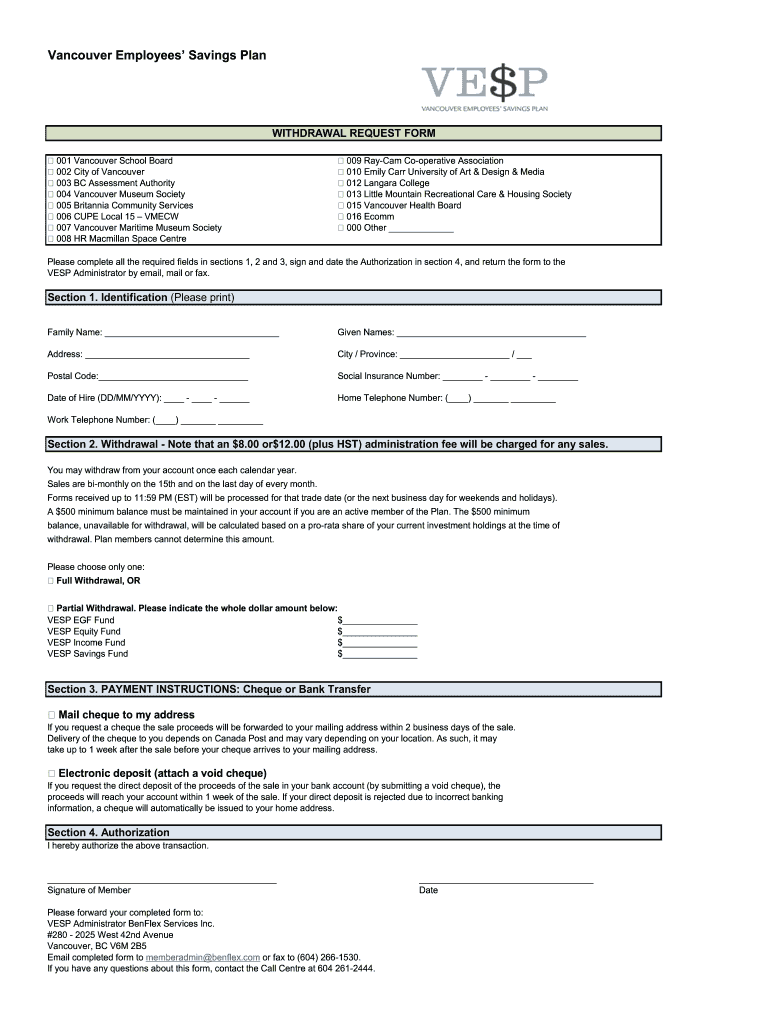

The Vancouver Employee Savings Plan is a structured program designed to help employees save for their future. This plan allows employees to contribute a portion of their earnings to a savings account, which can grow over time through interest or investment returns. The plan typically includes various investment options, allowing employees to choose how their savings are managed. It is an essential tool for financial planning, enabling individuals to prepare for retirement or other significant life events.

Key Elements of the Vancouver Employee Savings Plan

Understanding the key elements of the Vancouver Employee Savings Plan is crucial for effective participation. Key components include:

- Contribution Rates: Employees can select their contribution percentage, often with employer matching options.

- Investment Options: Plans usually offer a range of investment choices, such as stocks, bonds, or mutual funds.

- Withdrawal Rules: Guidelines on when and how employees can access their funds, including penalties for early withdrawal.

- Tax Advantages: Contributions may be tax-deductible, and earnings can grow tax-deferred until withdrawal.

Steps to Complete the Vancouver Employee Savings Plan

Completing the Vancouver Employee Savings Plan involves several straightforward steps:

- Review Plan Options: Familiarize yourself with the available investment choices and contribution rates.

- Fill Out Enrollment Forms: Provide necessary personal information and select your contribution percentage.

- Submit Documentation: Ensure all required documents are submitted to your HR department or plan administrator.

- Monitor Your Account: Regularly check your account balance and investment performance to make informed decisions.

Legal Use of the Vancouver Employee Savings Plan

The legal framework surrounding the Vancouver Employee Savings Plan ensures that it operates within established regulations. Compliance with federal and state laws is essential. This includes adherence to guidelines set forth by the Employee Retirement Income Security Act (ERISA) and other relevant legislation. Understanding these legalities helps protect both employees and employers, ensuring that the plan is managed transparently and fairly.

Eligibility Criteria for the Vancouver Employee Savings Plan

Eligibility for the Vancouver Employee Savings Plan typically depends on several factors, including:

- Employment Status: Generally, full-time employees are eligible, while part-time employees may have different criteria.

- Length of Service: Some plans may require a minimum period of employment before eligibility is granted.

- Age Requirements: Employees may need to be of a certain age to participate in specific investment options.

Who Issues the Vancouver Employee Savings Plan?

The Vancouver Employee Savings Plan is usually issued and managed by the employer or a designated financial institution. Employers often collaborate with financial service providers to administer the plan, ensuring that employees receive the necessary support and resources. This partnership helps facilitate the enrollment process and ongoing management of the savings plan, providing employees with access to professional guidance and investment options.

Quick guide on how to complete vesp vancouver

Complete Vesp Vancouver effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Vesp Vancouver on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Vesp Vancouver effortlessly

- Obtain Vesp Vancouver and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Edit and eSign Vesp Vancouver and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vesp vancouver

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is a Vancouver employee savings plan?

A Vancouver employee savings plan is a financial program designed to help employees save for retirement or other long-term goals. It offers various investment options and benefits specific to the Vancouver area, allowing participants to grow their savings while enjoying tax advantages.

-

How does the Vancouver employee savings plan work?

The Vancouver employee savings plan typically involves contributions from both the employer and the employee. These contributions are invested in a range of financial products, providing employees with a structured way to build their savings over time, often paired with matching contributions to enhance growth.

-

What are the benefits of a Vancouver employee savings plan?

The benefits of a Vancouver employee savings plan include tax-deferred growth, employer matching contributions, and enhanced employee retention. This plan not only helps employees save for their future but also incentivizes them to stay with the company through valuable financial benefits.

-

Are there any fees associated with the Vancouver employee savings plan?

Yes, there may be administrative fees associated with the Vancouver employee savings plan, which can vary depending on the plan provider. It's important for employees to review these fees to understand how they may impact their savings over time and to evaluate the overall value of the plan.

-

Can I customize my Vancouver employee savings plan options?

Many Vancouver employee savings plans offer customization options that allow employees to choose their investment allocations based on their risk tolerance and financial goals. This flexibility enables individuals to align their savings strategies with their personal preferences and retirement targets.

-

Is the Vancouver employee savings plan easy to integrate with existing payroll systems?

Yes, most Vancouver employee savings plans are designed to seamlessly integrate with existing payroll systems, ensuring that contributions are automatically deducted and allocated accordingly. This integration simplifies the process for employers and enhances the experience for employees.

-

What resources are available for employees to learn about the Vancouver employee savings plan?

Employees can access a variety of resources to learn about the Vancouver employee savings plan, including informational guides, webinars, and one-on-one consultative sessions with financial advisors. These resources help employees make informed decisions about their participation and optimize their savings potential.

Get more for Vesp Vancouver

- Vimsateneonet form

- Emory healthcare new patient form

- Letter of credit application form sbc bank

- Pan example of personal details filled section on psckgoke for an unemployed person form

- Longos online application form

- Spar application form pdf

- Airport jobs in cayman islands form

- Marble slab applicationpdffillercom form

Find out other Vesp Vancouver

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF