Genworth Term Life Insurancegenworth Life 2012

What is the Genworth Term Life Insurancegenworth Life

The Genworth Term Life Insurancegenworth Life is a financial product designed to provide a death benefit to beneficiaries in the event of the policyholder's passing during the term of the policy. This type of insurance is typically characterized by its fixed premium payments and a specified coverage period, which can range from ten to thirty years. It is particularly appealing for individuals seeking affordable life insurance options that offer substantial coverage without the complexities of permanent life insurance policies.

How to use the Genworth Term Life Insurancegenworth Life

Using the Genworth Term Life Insurancegenworth Life involves several key steps. First, individuals must assess their insurance needs, considering factors such as dependents, debts, and future financial obligations. Next, they can obtain a quote from Genworth, which may involve providing personal information and health details. After selecting a suitable policy, applicants will fill out the necessary forms, which can be completed digitally for convenience. Once the application is submitted, it undergoes underwriting, after which the policyholder will receive their policy documents if approved.

Steps to complete the Genworth Term Life Insurancegenworth Life

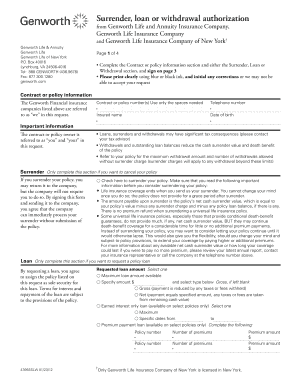

Completing the Genworth Term Life Insurancegenworth Life form requires careful attention to detail. The following steps outline the process:

- Gather necessary personal information, including Social Security number, income details, and health history.

- Choose the desired coverage amount and term length based on your financial needs.

- Fill out the application form accurately, ensuring all information is complete and truthful.

- Submit the application online or through other accepted methods, such as mail or in-person.

- Await the underwriting decision, which may involve additional health assessments or interviews.

Legal use of the Genworth Term Life Insurancegenworth Life

The legal use of the Genworth Term Life Insurancegenworth Life is governed by state and federal regulations regarding life insurance policies. These laws ensure that the terms of the policy are clear and that the rights of the policyholder and beneficiaries are protected. It is important for policyholders to understand their rights, including the right to cancel the policy within a specified period and the obligation to disclose relevant health information during the application process.

Eligibility Criteria

Eligibility for the Genworth Term Life Insurancegenworth Life typically depends on several factors, including age, health status, and lifestyle choices. Most insurers require applicants to be within a certain age range, often between eighteen and seventy-five years old. Additionally, individuals may need to undergo a medical examination or provide health records to assess their risk level. Lifestyle factors, such as smoking or engaging in hazardous activities, can also impact eligibility and premium rates.

Required Documents

To apply for the Genworth Term Life Insurancegenworth Life, applicants must prepare several key documents. These often include:

- Proof of identity, such as a driver’s license or passport.

- Social Security number for verification purposes.

- Medical history documentation, which may include recent medical exams or health questionnaires.

- Financial information to determine coverage needs and premium affordability.

Quick guide on how to complete genworth term life insurancegenworth life

Effortlessly prepare Genworth Term Life Insurancegenworth Life on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents promptly without delays. Manage Genworth Term Life Insurancegenworth Life on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Genworth Term Life Insurancegenworth Life with ease

- Locate Genworth Term Life Insurancegenworth Life and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Genworth Term Life Insurancegenworth Life and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct genworth term life insurancegenworth life

Create this form in 5 minutes!

How to create an eSignature for the genworth term life insurancegenworth life

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Genworth term life insurancegenworth life?

Genworth term life insurancegenworth life is a type of life insurance policy that provides coverage for a specified period of time, typically ranging from 10 to 30 years. It is designed to offer financial protection for your loved ones in the event of your untimely passing during the policy term. This option is often more affordable than permanent life insurance, making it a popular choice for families.

-

How does Genworth term life insurancegenworth life pricing work?

The pricing for Genworth term life insurancegenworth life varies based on several factors, including the applicant's age, health, and the coverage amount desired. Generally, younger individuals with good health receive lower premiums. You can easily get a quote online to understand how much coverage you might need and what you can expect to pay.

-

What benefits do Genworth term life insurancegenworth life policies offer?

Genworth term life insurancegenworth life policies provide several benefits, including high coverage amounts at lower premiums. They also offer flexibility, allowing policyholders to choose the term length that best suits their needs. Another key benefit is the peace of mind knowing that your beneficiaries will receive a financial payout for their future expenses.

-

Can I convert my Genworth term life insurancegenworth life policy to a permanent policy?

Yes, many Genworth term life insurancegenworth life policies come with a conversion option. This allows you to convert your term policy into a permanent life policy without undergoing additional medical examinations. It's an excellent choice for those who wish to maintain coverage beyond the initial term.

-

How do I file a claim under my Genworth term life insurancegenworth life policy?

To file a claim under your Genworth term life insurancegenworth life policy, you will need to provide necessary documentation, including the death certificate of the insured. You can initiate the claim process by contacting Genworth customer service or visiting their official website. Their team will guide you through the necessary steps to ensure a smooth claim experience.

-

Are there any exclusions in Genworth term life insurancegenworth life policies?

Like many life insurance policies, Genworth term life insurancegenworth life may include certain exclusions. Common exclusions involve deaths resulting from self-inflicted injuries or illegal activities within the first two years of the policy. It’s important to read the specific policy terms and conditions to understand these exclusions fully.

-

What additional features can I add to my Genworth term life insurancegenworth life policy?

You may have the option to add riders to your Genworth term life insurancegenworth life policy, such as accelerated death benefits or waiver of premium benefits. These riders can provide additional protection and flexibility tailored to your unique needs. Always consult with a licensed insurance agent to explore the best options for you.

Get more for Genworth Term Life Insurancegenworth Life

- Us usda form usda rd 3560 11 fmi us federal forms

- Af form 942

- Us air force form aetc708 free download

- Air force form 77

- Dma 5200 iapdf application for health coverage amp help paying costs info dhhs state nc form

- Us navy form opnav 5520 20 us federal forms

- Dd2896 1 form

- Aof cv assessment of occupational functioning collaborative form

Find out other Genworth Term Life Insurancegenworth Life

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free