Gsu Loan Form

What is the GSU Loan Form

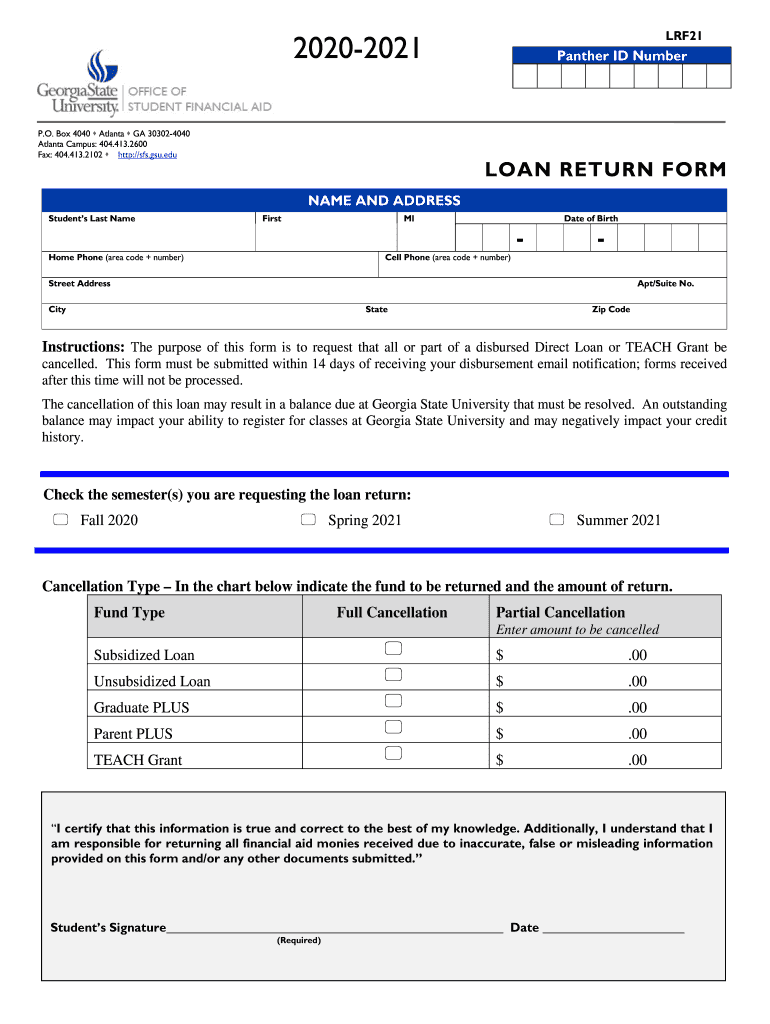

The GSU loan form is a crucial document used by students at Georgia State University to apply for financial assistance. This form allows students to request loans that can help cover tuition and other educational expenses. It is designed to gather essential information about the applicant's financial situation, academic status, and personal details, which are necessary for the loan approval process. Understanding the specific requirements and components of the GSU loan form is vital for students seeking financial support.

How to use the GSU Loan Form

Using the GSU loan form involves several steps to ensure that the application is completed accurately. First, students should obtain the form, which is typically available online through the university's financial aid office. After downloading the GSU loan form, applicants need to fill it out with precise information, including their personal details, financial information, and the amount of loan requested. Once completed, the form should be reviewed for accuracy before submission. It is essential to follow any specific instructions provided by the university regarding submission methods and deadlines.

Steps to complete the GSU Loan Form

Completing the GSU loan form requires careful attention to detail. Here are the steps to follow:

- Download the GSU loan form from the university's official website.

- Fill in your personal information, including your name, student ID, and contact details.

- Provide financial information, such as income, expenses, and any other financial aid received.

- Specify the loan amount you are requesting and the purpose of the loan.

- Review the form to ensure all information is accurate and complete.

- Submit the form according to the university's guidelines, whether online or in person.

Legal use of the GSU Loan Form

The legal use of the GSU loan form is governed by various regulations that ensure the protection of both the borrower and the lender. When filling out the form, it is important to provide truthful and accurate information, as any discrepancies may lead to legal consequences. Additionally, the completed form must comply with federal and state laws regarding financial aid and student loans. Understanding these legal requirements helps ensure that the loan process is transparent and fair for all parties involved.

Required Documents

To successfully complete the GSU loan form, several supporting documents may be required. These typically include:

- Proof of enrollment at Georgia State University.

- Financial documentation, such as tax returns or income statements.

- Identification documents, like a driver's license or social security card.

- Any additional forms specified by the financial aid office.

Gathering these documents in advance can streamline the application process and help ensure that the GSU loan form is processed efficiently.

Form Submission Methods

The GSU loan form can be submitted through various methods, depending on the university's guidelines. Common submission methods include:

- Online submission via the university's financial aid portal.

- Mailing the completed form to the financial aid office.

- In-person submission at the financial aid office during business hours.

It is essential to check the specific submission requirements and deadlines to ensure that the application is processed in a timely manner.

Quick guide on how to complete gsu loan form

Complete Gsu Loan Form with ease on any device

Digital document management has gained immense traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the suitable form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without hold-ups. Handle Gsu Loan Form on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign Gsu Loan Form effortlessly

- Find Gsu Loan Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a standard wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Gsu Loan Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsu loan form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the GSU loan form and why is it important?

The GSU loan form is a crucial document for students seeking financial assistance through Georgia State University. It provides detailed information about the loan request and ensures that all necessary data is collected for processing. Completing the GSU loan form accurately is essential for securing the funds needed for your education.

-

How can airSlate SignNow help me with the GSU loan form?

airSlate SignNow can streamline the process of completing the GSU loan form by allowing you to eSign documents securely and efficiently. With its user-friendly interface, you can easily fill out the form and send it directly to the appropriate department for faster processing. This eliminates the hassle of printing and mailing forms.

-

Is there a cost associated with using airSlate SignNow for the GSU loan form?

Yes, while there may be fees associated with using airSlate SignNow, the platform offers various pricing plans that can suit different budgets. By using airSlate SignNow to manage your GSU loan form, you can save time and potentially get your loan processed more quickly, making the cost worthwhile for many users.

-

What features does airSlate SignNow offer for managing the GSU loan form?

airSlate SignNow provides a range of features for document management, including eSignatures, document templates, and real-time status tracking. These features ensure that your GSU loan form is completed accurately and efficiently. Additionally, you can easily store and retrieve your documents at any time.

-

Can I use airSlate SignNow on my mobile device to fill out the GSU loan form?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing you to fill out and sign the GSU loan form on the go. Whether you're using a smartphone or tablet, you can access all the necessary features to complete your loan form whenever and wherever you need.

-

Does airSlate SignNow integrate with other applications for my GSU loan form?

Yes, airSlate SignNow offers integrations with various applications and platforms, making it easier to manage your GSU loan form. Whether you use document storage services or CRM platforms, SignNow can connect and streamline your workflow for added convenience.

-

What are the benefits of using airSlate SignNow for the GSU loan form?

Using airSlate SignNow for your GSU loan form provides multiple benefits, including increased efficiency, enhanced security, and reduced paperwork. The ability to sign documents electronically accelerates the loan process, allowing you to focus on your studies without the stress of administrative delays.

Get more for Gsu Loan Form

Find out other Gsu Loan Form

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template