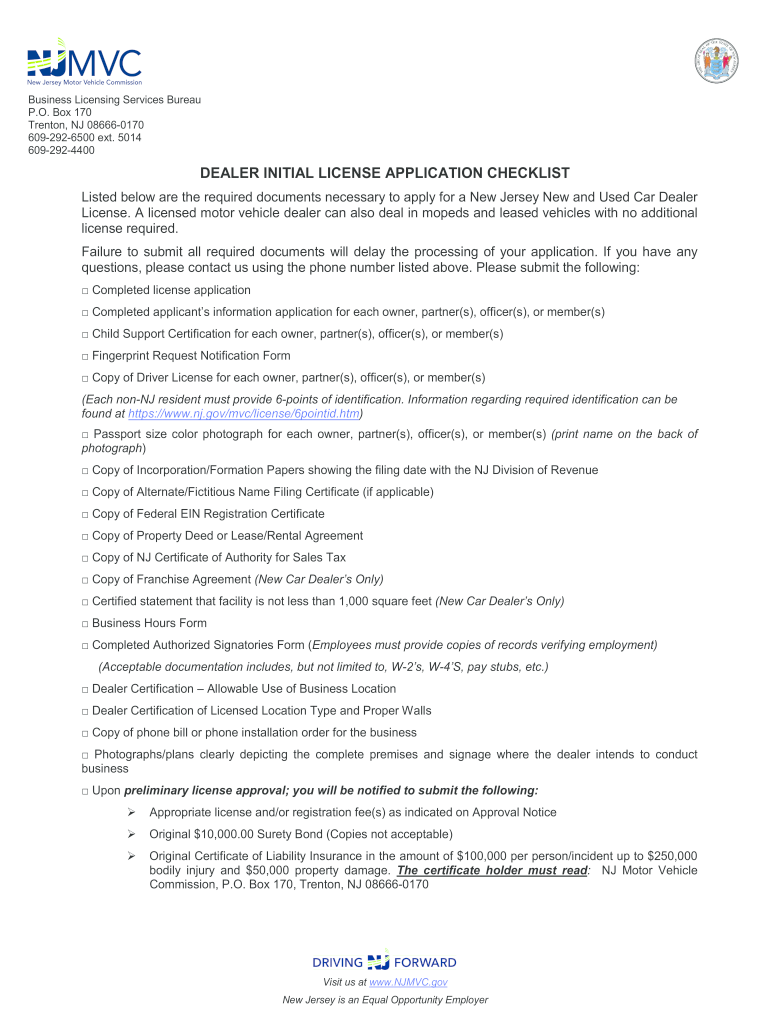

Announcement All Initial Business License Applicants NJ Gov 2019-2026

Understanding the New Jersey Auto Dealer Bond

The New Jersey auto dealer bond is a crucial requirement for individuals and businesses looking to operate as auto dealers in the state. This bond serves as a financial guarantee that the dealer will comply with state regulations and laws governing the sale of vehicles. It protects consumers by ensuring that dealers adhere to ethical business practices and fulfill their obligations, such as paying taxes and fees. The bond amount varies based on the type of dealership and can range from $10,000 to $100,000, depending on the specific license type.

Steps to Obtain a New Jersey Auto Dealer Bond

Obtaining a New Jersey auto dealer bond involves several steps. First, you must determine the appropriate bond amount based on your dealership type. Next, you will need to contact a surety bond provider to get a quote. The provider will assess your financial stability and creditworthiness, which may affect the bond premium you will pay. Once approved, you will sign the bond agreement and pay the premium, after which the bond will be issued. It is essential to keep the bond active and renew it as required to maintain compliance with state regulations.

Legal Use of the New Jersey Auto Dealer Bond

The legal use of the New Jersey auto dealer bond is primarily to protect consumers and ensure compliance with state laws. In the event that a dealer fails to meet their obligations, such as failing to deliver a vehicle or not paying taxes, consumers can file a claim against the bond. This claim allows consumers to seek financial compensation for their losses. It is important for auto dealers to understand their responsibilities under the bond agreement to avoid potential claims and maintain their business reputation.

Key Elements of the New Jersey Auto Dealer Bond

Several key elements define the New Jersey auto dealer bond. These include the bond amount, the parties involved (the principal, obligee, and surety), and the duration of the bond. The bond amount reflects the financial guarantee provided to the state and consumers. The principal is the auto dealer, the obligee is the state of New Jersey, and the surety is the bonding company that issues the bond. Additionally, the bond must be renewed periodically, and any claims against it can affect the dealer's ability to obtain future bonds.

Eligibility Criteria for the New Jersey Auto Dealer Bond

To be eligible for a New Jersey auto dealer bond, applicants must meet specific criteria set by the state. These typically include being of legal age, having a clean criminal record, and demonstrating financial stability. Applicants may also need to provide business documentation, such as a business plan and proof of a physical location for the dealership. Meeting these eligibility requirements is essential for securing the bond and obtaining the necessary dealership license.

Penalties for Non-Compliance with the New Jersey Auto Dealer Bond

Non-compliance with the New Jersey auto dealer bond can lead to significant penalties. If a dealer fails to maintain an active bond or does not comply with state regulations, they may face fines, suspension of their dealer license, or even legal action. Additionally, claims made against the bond can result in financial liability for the dealer, as they may be required to reimburse the surety for any payouts made to claimants. Understanding these penalties emphasizes the importance of adhering to the bond's requirements.

Quick guide on how to complete announcement all initial business license applicants njgov

Complete Announcement All Initial Business License Applicants NJ gov effortlessly on any device

Digital document management has become popular with organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Announcement All Initial Business License Applicants NJ gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Announcement All Initial Business License Applicants NJ gov without hassle

- Obtain Announcement All Initial Business License Applicants NJ gov and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Announcement All Initial Business License Applicants NJ gov and ensure superb communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct announcement all initial business license applicants njgov

Create this form in 5 minutes!

How to create an eSignature for the announcement all initial business license applicants njgov

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a New Jersey auto dealer bond?

A New Jersey auto dealer bond is a surety bond required for individuals or businesses to obtain a license to operate as an auto dealer in New Jersey. This bond serves as a financial guarantee that you will comply with state laws and regulations. If you fail to meet these obligations, the bond can provide compensation to affected parties.

-

How much does a New Jersey auto dealer bond cost?

The cost of a New Jersey auto dealer bond varies based on factors such as your credit score, financial history, and the bond amount required by the state. Generally, you can expect to pay a percentage of the total bond amount as a premium. Working with a reliable surety bond provider can help you find the best rates.

-

What are the benefits of purchasing a New Jersey auto dealer bond?

Purchasing a New Jersey auto dealer bond protects consumers by ensuring that auto dealers adhere to state regulations. It enhances your credibility as a dealer and fosters trust with your customers. Additionally, having this bond in place is a legal requirement that allows you to operate within the state.

-

How long does it take to get a New Jersey auto dealer bond?

The time it takes to obtain a New Jersey auto dealer bond can vary, but many applicants can get bonded within a few days. After submitting your application and any required documentation, a surety provider will evaluate your qualifications. Once approved, your bond will be issued promptly.

-

Are there any specific requirements for a New Jersey auto dealer bond?

Yes, to obtain a New Jersey auto dealer bond, you must meet certain requirements set by the state. This includes submitting a completed application, providing financial disclosures, and sometimes a credit check. Your bond provider can help guide you through the requirements for your specific situation.

-

Can I renew my New Jersey auto dealer bond online?

Yes, many surety bond providers offer online services that allow you to easily renew your New Jersey auto dealer bond. Renewals typically require you to pay the annual premium again and may involve updated financial information. Check with your provider for specific renewal instructions.

-

What happens if I need to file a claim against my New Jersey auto dealer bond?

If you need to file a claim against your New Jersey auto dealer bond, it typically involves demonstrating how the dealer violated the terms of the bond. Claims can be filed by customers or other affected parties. It's essential to contact your surety provider immediately to understand the claim process.

Get more for Announcement All Initial Business License Applicants NJ gov

- Fsa 2001 2015 2019 form

- Certificate of training form 5000 23 msha

- International student immunization record indian springs school indiansprings form

- Iv immune globulin ivig order form infusion

- Mmr1015 coloradogov colorado form

- Proof of ohio residency certified statement ohio department of publicsafety ohio form

- 2009 oregon income tax full year resident form 40 and instructions 150 101 043 oregon

- Pers oss 138 2013 form

Find out other Announcement All Initial Business License Applicants NJ gov

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement