Form M 656 Offer in Settlement Mass Gov Mass 2009-2026

What is the Massachusetts Form M-656 Offer In Settlement?

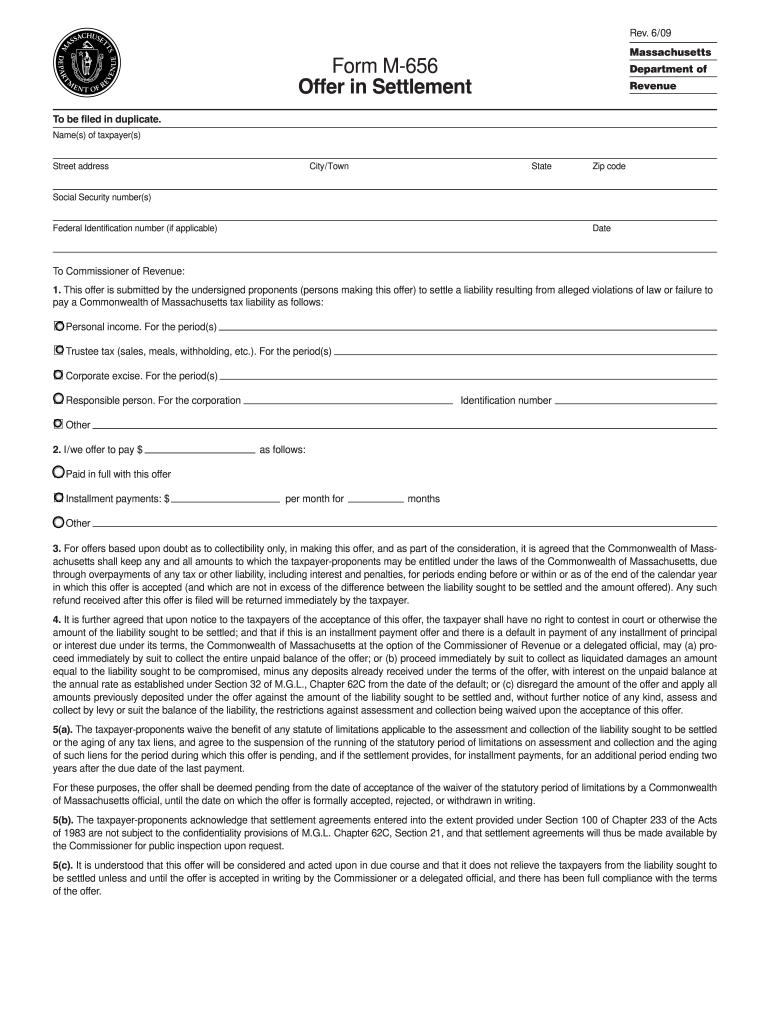

The Massachusetts Form M-656, known as the Offer in Settlement, is a legal document that allows taxpayers to propose a settlement for their tax liabilities. This form is particularly useful for individuals or businesses facing financial difficulties, as it provides an opportunity to negotiate a lower amount owed to the state. By submitting this form, taxpayers can potentially resolve their tax debts more affordably, thus avoiding more severe collection actions.

Steps to Complete the Massachusetts Form M-656 Offer In Settlement

Completing the Massachusetts Form M-656 involves several key steps to ensure accuracy and compliance with state regulations. Here is a straightforward guide:

- Gather Necessary Information: Collect all relevant financial documents, including income statements, expense reports, and any previous tax returns.

- Fill Out the Form: Enter your personal information, including your name, address, and taxpayer identification number. Provide detailed information about your financial situation, including assets and liabilities.

- Propose a Settlement Amount: Clearly state the amount you are willing to pay to settle your tax liability. This should be based on your financial assessment.

- Sign and Date the Form: Ensure that you sign and date the form to validate your offer. An unsigned form will not be considered.

Eligibility Criteria for the Massachusetts Form M-656 Offer In Settlement

To qualify for submitting the Massachusetts Form M-656, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate financial hardship or an inability to pay the full tax amount due. This includes providing evidence of income levels, expenses, and any other financial obligations. Additionally, taxpayers must be compliant with all other tax filing requirements to be considered for a settlement.

Legal Use of the Massachusetts Form M-656 Offer In Settlement

The Massachusetts Form M-656 serves a crucial legal function in tax resolution. By utilizing this form, taxpayers are formally requesting the state to accept a reduced payment as full satisfaction of their tax obligation. This legal process helps prevent further collection actions, such as wage garnishments or property liens, while the offer is being reviewed. It is essential to understand that submitting this form does not guarantee acceptance; the Massachusetts Department of Revenue will evaluate the offer based on financial documentation and compliance history.

Form Submission Methods for the Massachusetts Form M-656

Taxpayers have several options for submitting the Massachusetts Form M-656. The form can be filed electronically through the Massachusetts Department of Revenue's online portal, which is a convenient option for many. Alternatively, taxpayers can print the completed form and mail it directly to the appropriate department. In some cases, in-person submissions may also be accepted at local tax offices, depending on the current regulations and procedures in place.

Required Documents for the Massachusetts Form M-656 Offer In Settlement

When submitting the Massachusetts Form M-656, it is important to include supporting documentation to substantiate the offer. Required documents typically include:

- Recent tax returns

- Proof of income, such as pay stubs or bank statements

- Documentation of monthly expenses, including bills and loan statements

- Any additional financial records that demonstrate your current financial situation

Providing comprehensive and accurate documentation can significantly enhance the chances of your offer being accepted.

Quick guide on how to complete form m 656 offer in settlement massgov mass

Your assistance manual on how to prepare your Form M 656 Offer In Settlement Mass Gov Mass

If you are eager to learn how to finalize and submit your Form M 656 Offer In Settlement Mass Gov Mass, below are some concise instructions on how to simplify tax filing.

To start, all you need to do is create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that lets you edit, create, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to modify details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to complete your Form M 656 Offer In Settlement Mass Gov Mass in just a few minutes:

- Create your account and begin handling PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Form M 656 Offer In Settlement Mass Gov Mass in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally valid eSignature (if required).

- Review your document and make any necessary corrections.

- Save your changes, print your copy, send it to your intended recipient, and download it to your device.

Make the most of this guide to digitally file your taxes with airSlate SignNow. Please be aware that submitting on paper can lead to a higher rate of errors and delays in refunds. Be sure to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

-

How can I increase my muscle mass? I'm a 14 year old boy and I'm pretty scrawny and I don't have access to weights. Are there any exercises out there that will build muscle in my arms, chest, and abs?

There will be several ways to go about increasing your muscle mass, moreover, only a few proactive approaches that you can doa. without access to weightsb. sustainableFirst, you need to grasp the concept of intensity. When it comes to increasing lean mass your time will be better spent figuring out how to steadily increase your reps (volume) of bodyweight exercises such as pull-ups, rows, push-ups, etc.You can vary your mechanics (ex. two hands to to one), grip position, speed/tempo and range. I wouldn’t worry to much about how many sets until you stop seeing progress.Lastly, do some research on calisthenics and intense variations of them. Gymnasts rarely ever use weights yet their upper bodies are full of mass, most likely due to the number of varying repetitions done during hours of practice.Keep it simple!

-

I've gained 35 lbs in 10 months. I've worked out and I'm at weight but I would like my lower abs to show, I'm 205 lbs now. How long should I put on mass before I cut?

Don’t bulk up, its bad and it might be possible you won’t cut,just work out and gain muscle while being lean,you can also show off 365 days a year like that

-

How do I create forms for MySQL database? I have created a small database in Access and I’m planning to move to MySQL, but I am able to create only tables so far. How do I create forms for users to fill out the tables?

You can't directly. MySQL is the data engine, and has no user interface capabilities.To do this, you must write an application of some kind.You might write a desktop windows app using C# and its UI framework. Or maybe a Java desktop app using JavaFX for the UI and JDBC to connect to MySQLYou might write a web application, and then have a browser based interface.Whatever you do, what gets sent to MySQL will be SQL commands.It's more difficult than access for sure. And you have to consider the effects of multiple users editing the same data at the same time.

Create this form in 5 minutes!

How to create an eSignature for the form m 656 offer in settlement massgov mass

How to create an eSignature for the Form M 656 Offer In Settlement Massgov Mass in the online mode

How to make an eSignature for your Form M 656 Offer In Settlement Massgov Mass in Google Chrome

How to generate an electronic signature for putting it on the Form M 656 Offer In Settlement Massgov Mass in Gmail

How to make an electronic signature for the Form M 656 Offer In Settlement Massgov Mass from your smartphone

How to generate an electronic signature for the Form M 656 Offer In Settlement Massgov Mass on iOS devices

How to make an eSignature for the Form M 656 Offer In Settlement Massgov Mass on Android devices

People also ask

-

What is a Massachusetts form settlement?

A Massachusetts form settlement is a legal document that outlines the agreement between parties involved in a settlement process. airSlate SignNow simplifies this process by allowing users to create, send, and eSign Massachusetts form settlement documents securely and efficiently.

-

How does airSlate SignNow streamline the Massachusetts form settlement process?

airSlate SignNow offers an intuitive platform that enables users to quickly prepare and manage Massachusetts form settlements. The ease of use and integrated eSigning capabilities help reduce the turnaround time for executing these important legal documents.

-

What are the pricing options for using airSlate SignNow for Massachusetts form settlements?

airSlate SignNow provides affordable pricing plans tailored to various business needs, including those focused on Massachusetts form settlements. You can choose from several subscription models, ensuring that you find the solution that fits your budget while benefiting from extensive features.

-

Are there any features specifically designed for Massachusetts form settlement management?

Yes, airSlate SignNow includes features tailored for effective Massachusetts form settlement management, such as templates for common settlement documents, automated workflows, and secure cloud storage. These features enhance collaboration and ensure compliance throughout the settlement process.

-

What are the benefits of using airSlate SignNow for my Massachusetts form settlement?

Using airSlate SignNow for your Massachusetts form settlement offers several benefits, including streamlined document preparation, ease of signing, and improved tracking of agreements. Additionally, you can maintain a verified audit trail, ensuring the integrity of the settlement process.

-

Can airSlate SignNow integrate with other tools I use for Massachusetts form settlements?

Absolutely! airSlate SignNow integrates seamlessly with various business applications and tools commonly used for managing Massachusetts form settlements. This ensures a smooth workflow and enhances productivity by connecting your existing software solutions.

-

How secure is airSlate SignNow for handling Massachusetts form settlements?

airSlate SignNow prioritizes security for all documents, including Massachusetts form settlements. The platform uses advanced encryption methods, ensuring that your data remains protected and confidential throughout the signing process.

Get more for Form M 656 Offer In Settlement Mass Gov Mass

- Income subject to tax withholding estimated payments form

- 2022 michigan farmland preservation tax credit claim mi 1040cr 5 2022 michigan farmland preservation tax credit claim mi 1040cr form

- 1019 notice of assessment taxable valuation and property form

- Form it 2041 new york corporate partners schedule k tax year 2022

- Form it 217 fillable claim for farmers school tax credit

- Unrelated business income taxinternal revenue service irs tax forms

- City income tax ordinance pdf form

- Form it 249 claim for long term care insurance credit

Find out other Form M 656 Offer In Settlement Mass Gov Mass

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy