Dc Power Attorney Form

What is the DC Power Attorney?

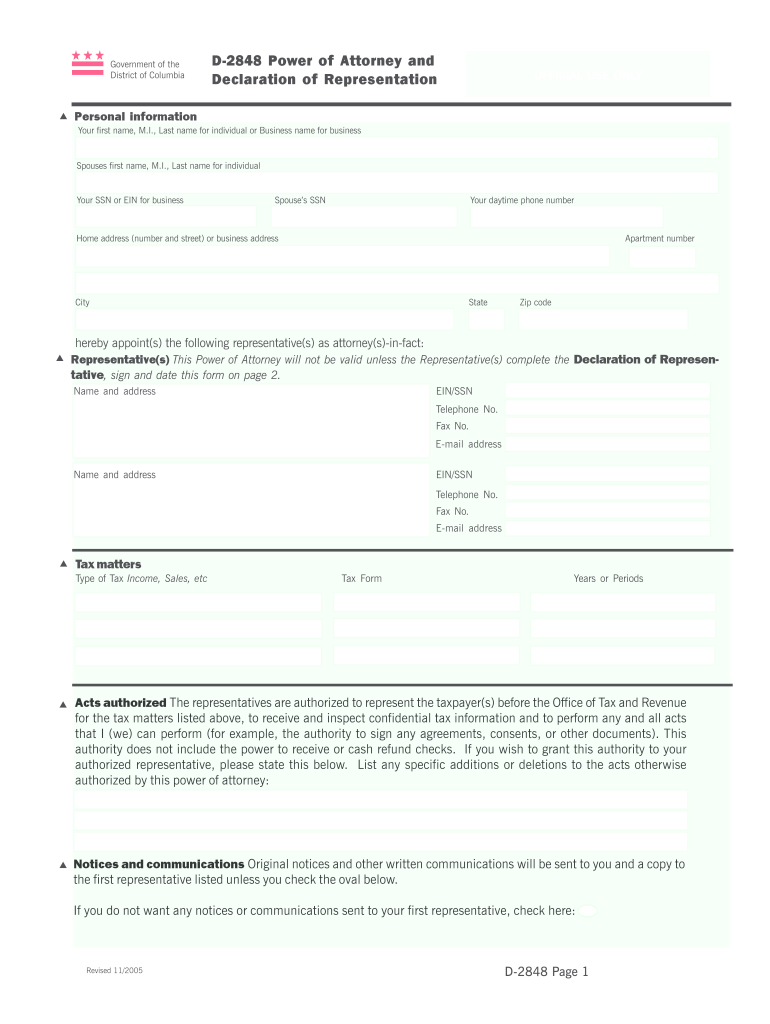

The DC Power Attorney, formally known as Form D 2848, is a legal document that grants an individual the authority to act on behalf of another person in specific matters. This form is particularly useful for tax-related issues, allowing the appointed representative to communicate with the IRS regarding the taxpayer's affairs. It is essential for individuals who may not be able to manage their tax responsibilities directly, such as those who are incapacitated or otherwise unavailable.

How to Use the DC Power Attorney

Using the DC Power Attorney involves a straightforward process. First, the individual granting authority must complete Form D 2848, providing details about the representative and the specific powers being granted. Once the form is signed and dated, it should be submitted to the relevant authority, such as the IRS. The representative can then act on behalf of the individual, handling matters like filing tax returns, communicating with tax officials, and receiving confidential tax information.

Steps to Complete the DC Power Attorney

Completing the DC Power Attorney requires careful attention to detail. Here are the key steps:

- Obtain a copy of Form D 2848 from a reliable source.

- Fill out the form with accurate information, including the name, address, and taxpayer identification number of both the taxpayer and the representative.

- Specify the tax matters for which the authority is granted, including the years or periods involved.

- Sign and date the form to validate it.

- Submit the completed form to the IRS or relevant tax authority.

Legal Use of the DC Power Attorney

The DC Power Attorney is legally binding when completed correctly. It must comply with federal and state regulations to ensure that the authority granted is recognized by the IRS and other authorities. The form must be signed by the taxpayer, and the representative must act within the scope of the authority granted. Misuse of the power granted can lead to legal repercussions for both parties.

Required Documents

To effectively use the DC Power Attorney, certain documents may be required. The primary document is Form D 2848 itself. Additionally, the taxpayer may need to provide identification, such as a driver's license or Social Security card, to verify their identity. If the representative is a tax professional, they may also need to provide proof of their credentials or professional designation.

Filing Deadlines / Important Dates

When using the DC Power Attorney, it is crucial to be aware of any filing deadlines that may apply. For tax-related matters, the deadlines for submitting Form D 2848 can vary depending on the specific tax year and the type of tax involved. Generally, it is advisable to submit the form well in advance of any critical tax dates to ensure that the representative can act on behalf of the taxpayer without delay.

Examples of Using the DC Power Attorney

There are several scenarios in which the DC Power Attorney can be beneficial. For instance, a taxpayer who is overseas may use Form D 2848 to authorize a family member or tax professional to handle their tax filings. Similarly, an individual who is unable to attend to their tax matters due to health issues can designate someone they trust to manage these responsibilities. This flexibility ensures that important tax obligations are met even when the taxpayer is unavailable.

Quick guide on how to complete dc power attorney

Complete Dc Power Attorney effortlessly on any gadget

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow offers all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Dc Power Attorney on any device with airSlate SignNow's Android or iOS applications and improve any document-related task today.

How to modify and electronically sign Dc Power Attorney with ease

- Locate Dc Power Attorney and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Dc Power Attorney and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc power attorney

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the d 2848 form and why is it important?

The d 2848 form, also known as the Power of Attorney and Declaration of Representative, is crucial for giving someone authority to act on your behalf in tax matters. By using the d 2848 form, you can ensure that your designated representative can access your tax information and represent you during proceedings with the IRS.

-

How does airSlate SignNow facilitate the d 2848 form process?

airSlate SignNow streamlines the d 2848 form process by allowing users to easily create, send, and eSign the document online. This digital solution eliminates the need for paper forms, enhances security, and speeds up the submission process, making it convenient for both you and your representative.

-

Is there a cost associated with using airSlate SignNow for the d 2848 form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different needs. Utilizing airSlate SignNow for managing the d 2848 form can be a cost-effective solution considering the time saved and the increased efficiency in handling important tax documents.

-

Can I customize the d 2848 form within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the d 2848 form to fit your specific requirements. You can add fields, change the layout, and incorporate your branding, ensuring that the form meets your professional standards and is suited to your needs.

-

What integrations does airSlate SignNow offer for processing the d 2848 form?

airSlate SignNow seamlessly integrates with a variety of tools, including cloud storage services and project management applications. These integrations enhance your workflow, making it easier to manage the d 2848 form alongside other essential documents in your business environment.

-

How secure is the d 2848 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the d 2848 form, all documents are encrypted, and access is strictly controlled, ensuring that your sensitive tax information remains protected throughout the eSigning process.

-

Can multiple parties eSign the d 2848 form using airSlate SignNow?

Yes, airSlate SignNow supports multi-party eSigning for the d 2848 form. This functionality makes it easy for all required parties to review and sign the document quickly and efficiently, reducing delays and improving the overall process.

Get more for Dc Power Attorney

Find out other Dc Power Attorney

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy