Ir997 2017

What is the Ir997

The Ir997 form is a tax-related document used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). It is essential for taxpayers who need to disclose specific income, deductions, or credits. Understanding the purpose of the Ir997 is crucial for compliance with federal tax regulations.

How to use the Ir997

Using the Ir997 involves several steps to ensure accurate reporting. Taxpayers must first gather all relevant financial documents, including income statements and receipts for deductions. Once the necessary information is compiled, the form can be filled out accurately. It is important to follow the IRS guidelines closely to avoid errors that could lead to penalties.

Steps to complete the Ir997

Completing the Ir997 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Legal use of the Ir997

The legal use of the Ir997 is defined by IRS regulations. To ensure the form is legally binding, it must be completed accurately and submitted on time. Failure to comply with the legal requirements can result in penalties or audits. Understanding the legal implications of the Ir997 is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Ir997 are crucial to avoid late penalties. Typically, the form must be submitted by April fifteenth of each year, unless an extension is granted. Taxpayers should keep track of any changes to deadlines announced by the IRS, especially during tax season.

Required Documents

To complete the Ir997, taxpayers need several documents, including:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

Having these documents ready will facilitate a smoother completion process.

Penalties for Non-Compliance

Non-compliance with the Ir997 can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits by the IRS. Understanding the consequences of failing to file or inaccurately reporting information is vital for all taxpayers.

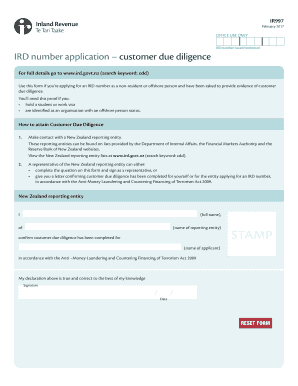

Quick guide on how to complete ir997

Effortlessly Prepare Ir997 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow supplies you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Ir997 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and eSign Ir997

- Locate Ir997 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ir997 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir997

Create this form in 5 minutes!

How to create an eSignature for the ir997

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the ir997 feature in airSlate SignNow?

The ir997 feature in airSlate SignNow allows users to securely electronically sign documents while ensuring compliance with industry regulations. It provides a seamless way to manage document workflows, making it easier for businesses to streamline their processes.

-

How can I get started with the ir997 feature?

Getting started with the ir997 feature is simple. Sign up for an airSlate SignNow account, and once logged in, you can access the ir997 feature directly from your dashboard. There are also helpful tutorials available to guide you through the signing process.

-

Is there a cost associated with using ir997 in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the ir997 feature. Pricing is designed to be cost-effective for businesses of all sizes, ensuring that you get the best value without compromising on quality.

-

What benefits does the ir997 feature provide for businesses?

The ir997 feature enhances business efficiency by reducing the time spent on document management. It simplifies the electronic signing process, allowing for quicker approvals and improved collaboration, which ultimately boosts productivity.

-

Can I integrate the ir997 feature with other software?

Yes, airSlate SignNow's ir997 feature can be easily integrated with various third-party applications, enhancing your workflow. Whether you need to connect with CRM systems or document storage solutions, integrations ensure a smooth experience.

-

How secure is the ir997 feature in airSlate SignNow?

The ir997 feature is designed with top-notch security protocols to protect sensitive documents. airSlate SignNow utilizes encryption and compliance with industry standards, ensuring that your documents are safe throughout the signing process.

-

What types of documents can I sign using the ir997 feature?

The ir997 feature in airSlate SignNow supports a wide variety of document types, including contracts, agreements, and forms. This versatility allows businesses to handle multiple use cases, making it a valuable tool for maintaining comprehensive document management.

Get more for Ir997

Find out other Ir997

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer