Ir633 2019-2026

What is the IR633?

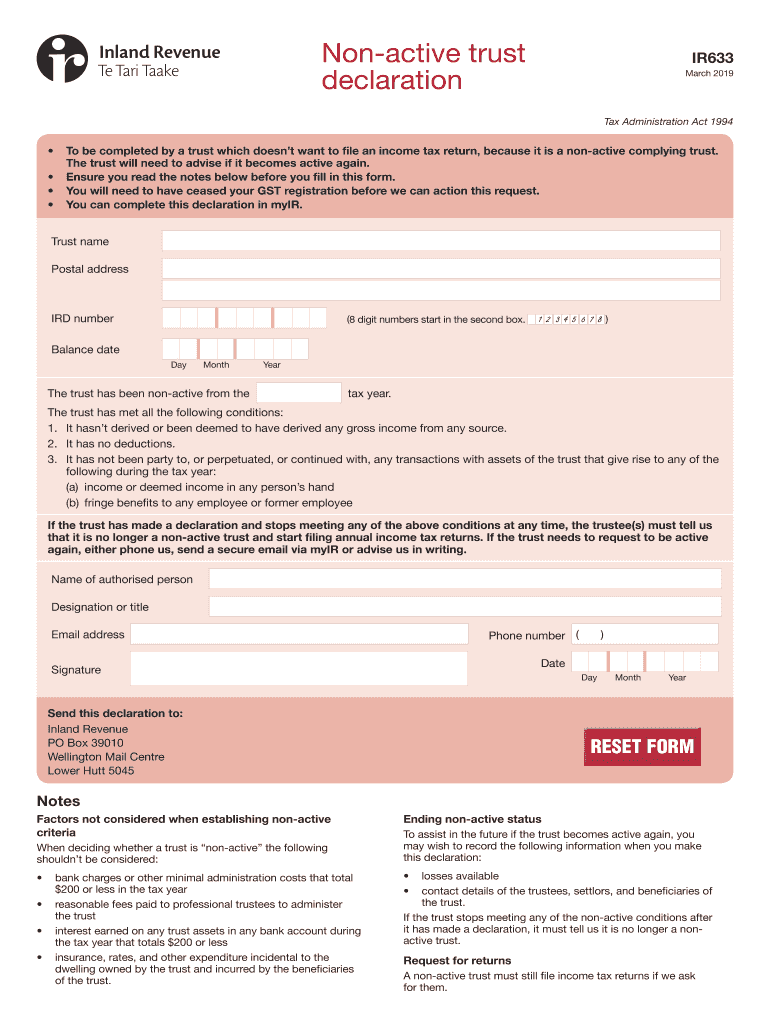

The IR633 form, also known as the non-active trust declaration, is a document used in the United States to declare the status of a non-active trust. This form is essential for individuals or entities that hold assets in a trust but are not actively managing it. The IR633 allows the trust's beneficiaries to clarify their tax obligations and ensures compliance with relevant tax regulations.

How to Use the IR633

Using the IR633 form involves several key steps. First, you need to gather all necessary information regarding the trust, including its name, the names of the trustees, and the beneficiaries. Next, complete the form by providing accurate details about the trust's status and any income generated. Once filled out, the form must be signed and submitted to the appropriate tax authority to ensure that the trust remains compliant with tax laws.

Steps to Complete the IR633

Completing the IR633 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation related to the trust.

- Fill in the trust's name and the details of the trustees and beneficiaries.

- Indicate the non-active status of the trust clearly.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the IR633

The legal use of the IR633 form is crucial for maintaining compliance with tax regulations. When properly completed and submitted, the IR633 serves as a formal declaration that the trust is non-active. This declaration can protect the trust and its beneficiaries from potential tax liabilities. It is important to keep records of the submission for future reference and to ensure that all parties involved understand their tax responsibilities.

Required Documents

To complete the IR633 form, you may need several documents, including:

- Trust agreement or declaration.

- Identification details of trustees and beneficiaries.

- Financial statements or records indicating the trust's status.

Having these documents ready will streamline the process of filling out the IR633 and ensure that all necessary information is accurately reported.

Form Submission Methods

The IR633 form can typically be submitted through various methods, including:

- Online submission via the relevant tax authority's website.

- Mailing a physical copy to the designated address.

- In-person submission at local tax offices.

Choosing the appropriate submission method can depend on personal preference or specific requirements set by the tax authority.

Quick guide on how to complete ir633 499877099

Prepare Ir633 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Ir633 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Ir633 with ease

- Find Ir633 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Ir633 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir633 499877099

Create this form in 5 minutes!

How to create an eSignature for the ir633 499877099

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the ir633 form and why is it important for my business?

The ir633 form is a crucial document used for tax purposes and ensuring compliance. It provides essential information needed by businesses to report taxable income correctly. By understanding and utilizing the ir633 form, you can avoid potential penalties and streamline your tax filing process.

-

How does airSlate SignNow help with the ir633 form?

airSlate SignNow simplifies the process of signing and sending the ir633 form electronically. With our user-friendly platform, you can easily gather signatures and manage documents without the hassle of physical paperwork. This not only saves time but also enhances the security and efficiency of handling your ir633 form.

-

Is there a cost associated with using airSlate SignNow for the ir633 form?

Yes, there are various pricing plans available for airSlate SignNow that cater to different business needs. Our pricing is designed to be cost-effective, ensuring you can manage documents like the ir633 form without breaking the bank. You can choose a plan that fits your budget while enjoying our exceptional eSigning features.

-

Can airSlate SignNow assist in tracking the status of the ir633 form?

Absolutely! AirSlate SignNow offers tracking capabilities that allow you to monitor the status of your ir633 form in real-time. You'll receive notifications when the document is opened, signed, and completed, ensuring you're always updated on the progress.

-

What features does airSlate SignNow offer for the ir633 form?

Some key features of airSlate SignNow when dealing with the ir633 form include customizable templates, reusable workflows, and secure storage options for all your documents. Additionally, our platform provides advanced security measures to protect sensitive information related to your ir633 form.

-

Can I integrate airSlate SignNow with my current software to manage the ir633 form?

Yes, airSlate SignNow supports various integrations with popular software applications, enhancing your ability to manage the ir633 form seamlessly. This allows you to connect with your existing systems, ensuring a smooth workflow for document handling.

-

What are the benefits of eSigning the ir633 form with airSlate SignNow?

Using airSlate SignNow to eSign the ir633 form offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced collaboration among stakeholders. It also eliminates the need for physical storage and simplifies record-keeping, making it a smart choice for businesses.

Get more for Ir633

- Horse lease agreement form

- Rental agreement vintage party props form

- Arai approved list speed governor form

- Cc affordable management application form

- Disputemgmt maybank service form

- Referee bstatementb education queensland education qld gov form

- Odometer statement for illinois form

- Form 19a printable

Find out other Ir633

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile