Income Tax Act Ird Govt 2017

What is the Income Tax Act Ird Govt

The Income Tax Act Ird Govt is a crucial piece of legislation that governs the taxation of individuals and businesses within the United States. It outlines the rules and regulations for income tax collection, including the rates applicable to different income brackets and the types of income that are taxable. This act is essential for ensuring compliance with federal tax obligations and provides a framework for the Internal Revenue Service (IRS) to enforce tax laws. Understanding this act is vital for taxpayers to navigate their responsibilities and rights effectively.

How to use the Income Tax Act Ird Govt

Utilizing the Income Tax Act Ird Govt involves understanding its provisions and applying them to your financial situation. Taxpayers should familiarize themselves with the various sections of the act that pertain to their income types, deductions, and credits. It is advisable to consult with tax professionals or utilize tax preparation software to ensure accurate compliance. Keeping abreast of any amendments or updates to the act is also essential for proper tax filing and planning.

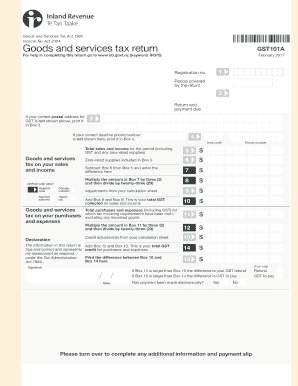

Steps to complete the Income Tax Act Ird Govt

Completing the requirements of the Income Tax Act Ird Govt involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Determine your filing status and applicable deductions based on your circumstances.

- Fill out the appropriate tax forms, ensuring accuracy in reporting income and expenses.

- Review the completed forms for any errors or omissions before submission.

- Submit your tax return electronically or via mail by the designated deadline.

Legal use of the Income Tax Act Ird Govt

The legal use of the Income Tax Act Ird Govt is defined by compliance with its provisions. Taxpayers must adhere to the guidelines set forth in the act to avoid penalties. This includes accurately reporting income, claiming eligible deductions, and paying taxes owed by the deadlines. The act also provides mechanisms for taxpayers to appeal decisions made by the IRS, ensuring that individuals have recourse in case of disputes regarding their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines are critical for compliance with the Income Tax Act Ird Govt. Generally, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of deadlines for estimated tax payments, which are typically due quarterly. Staying informed about these dates helps avoid penalties and interest on unpaid taxes.

Required Documents

To comply with the Income Tax Act Ird Govt, taxpayers must prepare specific documents, including:

- W-2 forms from employers for reporting wages and taxes withheld.

- 1099 forms for reporting various types of income, such as freelance work or interest.

- Receipts and records for deductible expenses, such as medical costs or charitable contributions.

- Previous tax returns for reference and consistency in reporting.

Penalties for Non-Compliance

Failure to comply with the Income Tax Act Ird Govt can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential criminal charges for tax evasion. The IRS has the authority to levy additional penalties for inaccuracies in reporting income or claiming deductions. Understanding these risks emphasizes the importance of accurate and timely tax filing to avoid adverse consequences.

Quick guide on how to complete income tax act 2004 ird govt

Effortlessly Prepare Income Tax Act Ird Govt on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly, without delays. Manage Income Tax Act Ird Govt on any platform using airSlate SignNow's Android or iOS applications and optimize any document-related task today.

The easiest way to modify and eSign Income Tax Act Ird Govt without hassle

- Find Income Tax Act Ird Govt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Income Tax Act Ird Govt and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax act 2004 ird govt

Create this form in 5 minutes!

How to create an eSignature for the income tax act 2004 ird govt

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the Income Tax Act Ird Govt. and how does it impact businesses?

The Income Tax Act Ird Govt. is legislation governing the taxation framework for income earned by individuals and businesses. Understanding this act is crucial for businesses to ensure compliance and optimize their tax liabilities. airSlate SignNow can help streamline your document management processes in relation to tax documentation.

-

How can airSlate SignNow assist with compliance to the Income Tax Act Ird Govt.?

airSlate SignNow provides a platform to easily manage and eSign documents that are necessary for compliance with the Income Tax Act Ird Govt. This ensures that your tax-related documents are processed accurately and efficiently, minimizing risks associated with non-compliance.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow includes features such as secure electronic signatures, templates for tax-related documents, and automated workflows. These tools are designed to simplify the completion and compliance of documents required under the Income Tax Act Ird Govt., enhancing your productivity.

-

Is airSlate SignNow cost-effective for handling Income Tax Act Ird Govt. compliance?

Yes, airSlate SignNow offers a cost-effective solution that allows businesses to manage their tax documentation needs without unnecessary overhead. The pricing plans are designed to fit various budgets while ensuring that you meet the requirements of the Income Tax Act Ird Govt. efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software for tax purposes?

Absolutely! airSlate SignNow can integrate seamlessly with many popular accounting and tax software solutions. This integration allows for smooth data transfer and ensures that your documentation is in line with the Income Tax Act Ird Govt. without additional manual effort.

-

How does using airSlate SignNow benefit my business in terms of tax filing?

Using airSlate SignNow can signNowly reduce the time spent on preparing and filing tax documents while ensuring they comply with the Income Tax Act Ird Govt. This means your team can focus more on strategic tasks rather than administrative burdens.

-

What types of documents can I manage related to the Income Tax Act Ird Govt. using airSlate SignNow?

With airSlate SignNow, you can manage a variety of documents related to the Income Tax Act Ird Govt., including tax returns, W-2 forms, and other necessary filings. Our platform supports all types of documents that require signatures and approvals, providing you a comprehensive solution.

Get more for Income Tax Act Ird Govt

Find out other Income Tax Act Ird Govt

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF