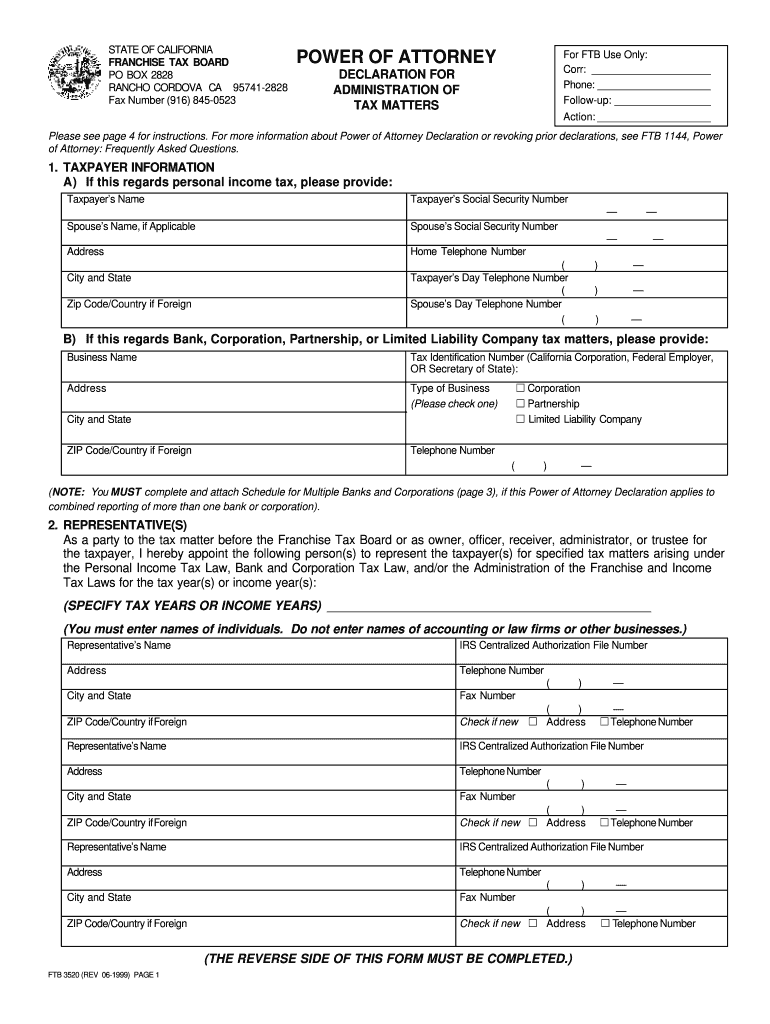

Franchise Tax Board Form

What is the Franchise Tax Board

The Franchise Tax Board (FTB) is the agency responsible for administering California's personal income tax and corporate income tax laws. It plays a crucial role in ensuring compliance with state tax regulations and collecting taxes owed to the state. The FTB also oversees tax refunds and provides assistance to taxpayers in understanding their tax obligations. Its operations are governed by California tax laws, making it a key entity for residents and businesses alike.

How to use the Franchise Tax Board

Utilizing the Franchise Tax Board involves several steps to ensure compliance with tax regulations. Taxpayers can access a variety of resources online, including forms, instructions, and guidelines for filing taxes. The FTB website provides tools for checking the status of tax returns, making payments, and accessing tax-related information. Additionally, taxpayers can contact the FTB directly via phone for assistance, including the franchise tax board phone number, which is, for inquiries about their accounts or specific tax issues.

Steps to complete the Franchise Tax Board

Completing your obligations with the Franchise Tax Board involves a series of steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Select the appropriate tax forms based on your filing status and income type.

- Complete the forms accurately, ensuring all information is correct to avoid delays.

- Submit your forms electronically through the FTB website or by mail, depending on your preference.

- Monitor your tax return status online or by calling the FTB for updates.

Legal use of the Franchise Tax Board

The legal use of the Franchise Tax Board is essential for compliance with California tax laws. Taxpayers must adhere to deadlines for filing and paying taxes to avoid penalties. The FTB operates under the authority of California law, ensuring that all processes related to tax collection and enforcement are legally binding. Understanding your rights and responsibilities when interacting with the FTB helps ensure that you remain compliant and informed.

Required Documents

When dealing with the Franchise Tax Board, certain documents are necessary to facilitate the tax filing process. Commonly required documents include:

- Income statements such as W-2s and 1099s.

- Proof of deductions, including receipts for business expenses or charitable contributions.

- Previous year’s tax return for reference.

- Any relevant forms specific to your tax situation, such as the OSGI reinstatement form.

Form Submission Methods

Taxpayers can submit their forms to the Franchise Tax Board using various methods. The available options include:

- Online submission through the FTB website, which offers a streamlined process for e-filing.

- Mailing paper forms to the designated FTB address, ensuring they are sent well before the deadline.

- In-person submissions at FTB offices, providing an option for those who prefer face-to-face assistance.

Quick guide on how to complete franchise tax board fax number form

Easily prepare Franchise Tax Board on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as users can access the required forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Franchise Tax Board on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to edit and eSign Franchise Tax Board effortlessly

- Find Franchise Tax Board and click Get Form to initiate.

- Use the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and eSign Franchise Tax Board and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the fax number for the California Franchise Tax Board?

You can find the current contact information at the California Franchise Tax Board web site.There is no single FAX number for general communication. Relevant departments that accept FAXes each have their own listed FAX number. For general correspondence, they use email.In 1989, a colleague of mine quipped, "FAX is for people who don't understand how to use email." It's true more so today than in the past. Except for some narrow use cases, FAX is almost always the wrong tool for the job.

-

I want to create a web app that enables users to sign up/in, fill out a form, and then fax it to a fax machine. How to difficult is this to develop?

Are you sending yourself the fax or are they able to send the fax anywhere? The latter has already been done numerous times. There are email to fax and fax to email applications that have been available for decades. I'm pretty certain that converting email to fax into app or form submission to fax is pretty trivial. They convert faxes to PDF's in many of these apps IIRC so anywhere you could view a PDF you could get a fax.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the franchise tax board fax number form

How to make an eSignature for your Franchise Tax Board Fax Number Form online

How to generate an eSignature for your Franchise Tax Board Fax Number Form in Google Chrome

How to generate an electronic signature for putting it on the Franchise Tax Board Fax Number Form in Gmail

How to create an eSignature for the Franchise Tax Board Fax Number Form straight from your smart phone

How to make an electronic signature for the Franchise Tax Board Fax Number Form on iOS

How to generate an eSignature for the Franchise Tax Board Fax Number Form on Android OS

People also ask

-

What is the Franchise Tax Board and how does it relate to airSlate SignNow?

The Franchise Tax Board (FTB) is the agency responsible for collecting income taxes for the state of California. With airSlate SignNow, businesses can streamline the process of submitting necessary documents to the Franchise Tax Board, ensuring compliance and efficiency in tax-related submissions.

-

How can airSlate SignNow help with documents required by the Franchise Tax Board?

airSlate SignNow simplifies the process of creating, sending, and eSigning documents that may be required by the Franchise Tax Board. By using our solution, you can ensure that all tax documents are completed accurately and submitted on time, reducing the risk of penalties.

-

What features of airSlate SignNow make it suitable for filing with the Franchise Tax Board?

AirSlate SignNow offers features such as customizable templates, secure cloud storage, and audit trails that are essential for filing documents with the Franchise Tax Board. These tools ensure you have everything you need to complete and track your submissions efficiently.

-

Is airSlate SignNow cost-effective for small businesses dealing with the Franchise Tax Board?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses facing obligations to the Franchise Tax Board. Our pricing plans are flexible, allowing you to choose the right option that fits your budget while ensuring compliance with tax requirements.

-

What integrations does airSlate SignNow offer that can assist with Franchise Tax Board submissions?

AirSlate SignNow integrates with various accounting and tax software that can aid in preparing documents for the Franchise Tax Board. By connecting our platform with these tools, you can streamline your workflow and ensure that all necessary documents are efficiently prepared and submitted.

-

Can airSlate SignNow help me keep track of my submissions to the Franchise Tax Board?

Absolutely! With airSlate SignNow, you can easily track the status of your documents submitted to the Franchise Tax Board. Our platform provides notifications and audit trails that keep you informed about when documents are viewed, signed, and submitted.

-

What are the key benefits of using airSlate SignNow for Franchise Tax Board document management?

Using airSlate SignNow for your Franchise Tax Board document management offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. This allows you to focus more on your business while ensuring that all tax-related documents are handled properly and securely.

Get more for Franchise Tax Board

- Derm surgery associates general dermatology dermatologic dermsurgery form

- Levy dermatology p form

- Update history form2 foothill family clinic draper

- Metlife hospital clinic profilepdf form

- Wsu referral form

- Dr james edgar allen urologist clairton pa medicinenet form

- Dermatology fellowship application and selection form

- Informed surgery form

Find out other Franchise Tax Board

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe