Tax Certification Statement 2013-2026

What is the Tax Certification Statement

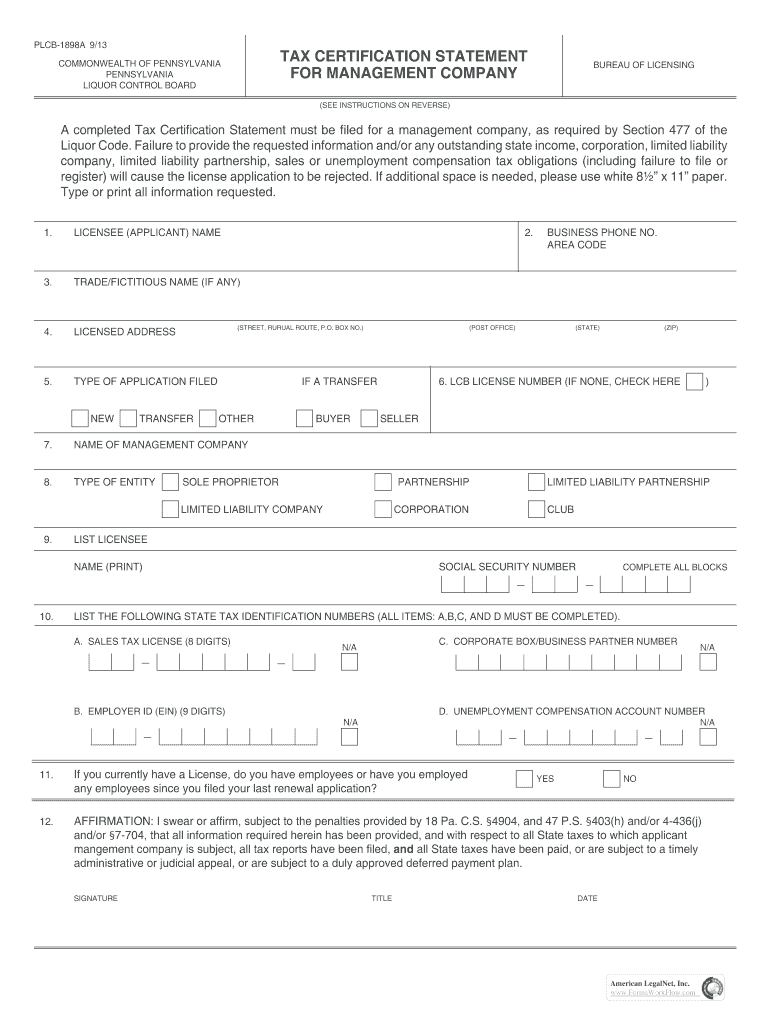

The tax certification statement is a formal document used by individuals and businesses to certify their tax status. This statement is often required by various governmental entities to confirm that the taxpayer is compliant with local, state, and federal tax regulations. It typically includes information such as the taxpayer’s identification details, tax identification number, and a declaration of the taxpayer's compliance with applicable tax laws. This form plays a crucial role in ensuring transparency and accountability in tax reporting.

How to use the Tax Certification Statement

Using the tax certification statement involves several key steps. First, the taxpayer must accurately fill out the required information, ensuring that all details match the records held by the IRS and other relevant authorities. Once completed, the statement can be submitted to the requesting entity, which may include financial institutions, government agencies, or other organizations that require proof of tax compliance. It is essential to retain a copy of the submitted statement for personal records, as it may be needed for future reference or audits.

Steps to complete the Tax Certification Statement

Completing the tax certification statement requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your tax identification number and personal details.

- Obtain the correct version of the tax certification statement form, ensuring it is the most current version.

- Fill out the form accurately, providing all requested information.

- Review the completed form for any errors or omissions.

- Sign and date the form, as required.

- Submit the form to the appropriate entity, either electronically or by mail.

Legal use of the Tax Certification Statement

The legal use of the tax certification statement is governed by various regulations that ensure its validity and acceptance. This document serves as a declaration of the taxpayer's compliance with tax obligations, and it may be used in legal contexts to prove tax status. To maintain its legal standing, the statement must be completed accurately and submitted to authorized entities. Non-compliance or inaccuracies can lead to penalties, making it crucial for taxpayers to understand the legal implications of the information provided.

Required Documents

When preparing to complete the tax certification statement, certain documents may be required to support the information provided. These documents typically include:

- Tax identification number (TIN) or Social Security number (SSN).

- Previous tax returns or documentation proving tax compliance.

- Any correspondence from tax authorities that may be relevant.

- Identification documents, such as a driver’s license or passport, for verification purposes.

Penalties for Non-Compliance

Failing to comply with the requirements of the tax certification statement can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is important for taxpayers to understand that inaccuracies or failure to submit the statement can lead to complications with tax authorities, which may affect their financial standing and ability to conduct business. Staying informed about compliance requirements is essential to avoid these potential issues.

Quick guide on how to complete tax certification statement

Effortlessly Prepare Tax Certification Statement on Any Device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without any holdups. Handle Tax Certification Statement on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Edit and Electronically Sign Tax Certification Statement with Ease

- Obtain Tax Certification Statement and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or cover confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Certification Statement and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax certification statement

Create this form in 5 minutes!

How to create an eSignature for the tax certification statement

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is a tax certification statement?

A tax certification statement is a document that verifies a person's or business's tax status, providing crucial information for various financial transactions. With airSlate SignNow, you can easily create, send, and eSign tax certification statements, ensuring compliance and accuracy in your financial documentation.

-

How does airSlate SignNow simplify the tax certification statement process?

airSlate SignNow streamlines the process of generating tax certification statements by providing templates and an intuitive interface. Users can easily fill out the necessary details, customize documents, and send them for eSignature, reducing the time spent on paperwork and increasing efficiency.

-

Are there any costs associated with creating a tax certification statement using airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available that provide access to features for creating and managing tax certification statements. Pricing varies based on your chosen plan, but it remains cost-effective compared to traditional methods of document handling.

-

What features does airSlate SignNow offer for managing tax certification statements?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for tax certification statements. These tools help ensure that your documents are not only compliant but also easily manageable throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow integrates with various applications and platforms that enhance your tax management process, allowing for seamless data transfer and document sharing. This integration capability provides a more comprehensive approach to managing your tax certification statements.

-

Is there support available for using airSlate SignNow to create tax certification statements?

Yes, airSlate SignNow provides robust customer support for all users. Whether you need help with creating tax certification statements or have questions about features, the support team is available via multiple channels to assist you promptly.

-

What are the benefits of using airSlate SignNow for tax certification statements?

Using airSlate SignNow for tax certification statements offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform ensures secure handling of your documents while providing a user-friendly experience, making tax management hassle-free.

Get more for Tax Certification Statement

- Raps manual institute for research and reform in education irre

- 1130 verf of rent ampamp liv4cdoc form

- Jdf1201 form

- Centaurus high school transcript request form

- My millionaire real estate agent business plan keller williams form

- Bfillableb naval postgraduate school nps form

- Work based learning employment student evaluation form

- Donor advised fund guidelines united way of tucson and bb unitedwaytucson form

Find out other Tax Certification Statement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will