Deceased Before July 2 Illinois State Treasurer Treasurer Il Form

Understanding Illinois Unclaimed Money for Deceased Individuals

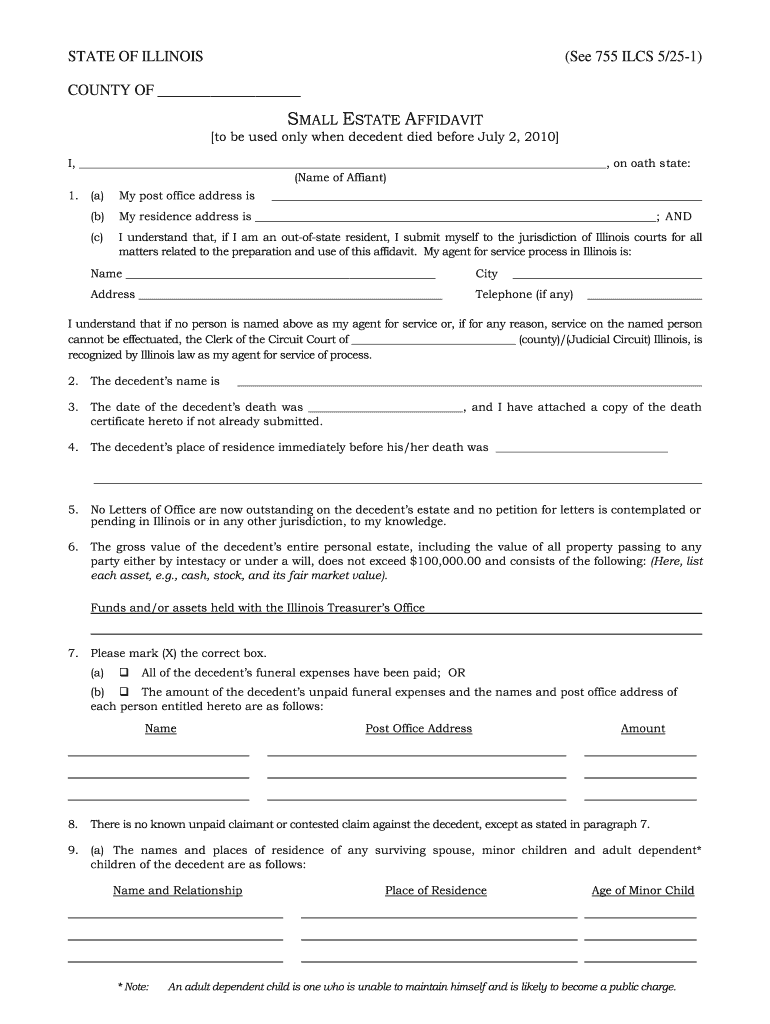

Illinois unclaimed money refers to funds or assets that have been abandoned or unclaimed by their rightful owners. When an individual passes away, any unclaimed money belonging to them may be transferred to the state. This can include bank accounts, insurance policies, or other financial assets. The Illinois State Treasurer holds these funds until they can be claimed by heirs or beneficiaries. Understanding the process for accessing these funds is crucial for those managing the estate of a deceased person.

Steps to Claim Illinois Unclaimed Money for Deceased Persons

Claiming unclaimed money in Illinois for a deceased individual involves several steps:

- Gather necessary documentation, including the death certificate, proof of relationship to the deceased, and any relevant financial documents.

- Visit the Illinois State Treasurer's website to search for unclaimed funds using the deceased's name.

- Complete the required unclaimed property form, which may include the 2001 Illinois 755 state form, ensuring all information is accurate.

- Submit the completed form along with the required documentation either online, by mail, or in person at designated locations.

- Monitor the status of your claim through the state’s online portal or by contacting the Treasurer’s office directly.

Required Documents for Filing a Claim

To successfully file a claim for unclaimed money in Illinois for a deceased person, you will need to provide specific documents:

- Death Certificate: An official copy of the death certificate is essential to prove the individual has passed away.

- Proof of Relationship: Documentation such as a birth certificate, marriage certificate, or legal will that establishes your relationship to the deceased.

- Identification: A government-issued ID to verify your identity when submitting the claim.

- Financial Documents: Any documents related to the unclaimed funds, such as bank statements or insurance policy details.

Legal Considerations for Claiming Unclaimed Property

When dealing with Illinois unclaimed money for deceased individuals, it is vital to understand the legal aspects involved:

- The claim must be filed by an authorized individual, typically an heir or executor of the estate.

- There may be a statute of limitations on claiming unclaimed funds, so timely action is advisable.

- Failure to provide accurate information or required documents could result in delays or denial of the claim.

Submission Methods for the Unclaimed Property Form

Illinois offers several methods for submitting the unclaimed property form:

- Online Submission: The most efficient method, allowing you to complete and submit the form directly through the Illinois State Treasurer’s website.

- Mail: You can print the completed form and send it along with the required documentation to the appropriate address provided by the state.

- In-Person: Visit designated state offices to submit your claim in person, which may allow for immediate assistance and clarification of any questions.

Quick guide on how to complete deceased before july 2 2010 illinois state treasurer treasurer il

Complete and submit your Deceased Before July 2 Illinois State Treasurer Treasurer Il swiftly

Advanced tools for digital document exchange and validation are now crucial for process enhancement and the continuous evolution of your forms. When managing legal documents and executing a Deceased Before July 2 Illinois State Treasurer Treasurer Il, the appropriate signature solution can save you signNow time and resources with each submission.

Locate, fill, modify, sign, and distribute your legal documents with airSlate SignNow. This service offers everything you need to create seamless paper submission workflows. Its extensive library of legal forms and user-friendly interface can assist you in obtaining your Deceased Before July 2 Illinois State Treasurer Treasurer Il quickly, and the editor equipped with our signature feature will enable you to complete and approve it instantly.

Sign your Deceased Before July 2 Illinois State Treasurer Treasurer Il in a few straightforward steps

- Obtain the Deceased Before July 2 Illinois State Treasurer Treasurer Il you need from our library by utilizing search or catalog pages.

- Examine the form details and view it to confirm it meets your needs and state standards.

- Click Acquire form to access it for editing.

- Complete the form using the all-inclusive toolbar.

- Double-check the information you've entered and click the Sign tool to validate your document.

- Select one of three options to append your signature.

- Conclude your modifications and save the document in your storage, then download it to your device or share it right away.

Optimize every stage of your document preparation and validation with airSlate SignNow. Explore a more effective online solution that has all aspects of managing your paperwork carefully arranged.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deceased before july 2 2010 illinois state treasurer treasurer il

How to generate an electronic signature for the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il online

How to make an eSignature for the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il in Google Chrome

How to generate an electronic signature for putting it on the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il in Gmail

How to generate an electronic signature for the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il right from your smart phone

How to generate an electronic signature for the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il on iOS devices

How to make an electronic signature for the Deceased Before July 2 2010 Illinois State Treasurer Treasurer Il on Android devices

People also ask

-

What is Illinois unclaimed money for deceased individuals?

Illinois unclaimed money for deceased individuals refers to assets or funds that are abandoned or unclaimed after someone's passing. These can include bank accounts, insurance proceeds, and other financial assets. It's essential for heirs or beneficiaries to search for such assets to ensure they receive what is rightfully theirs.

-

How can I find Illinois unclaimed money for deceased relatives?

To find Illinois unclaimed money for deceased relatives, you can visit the Illinois State Treasurer's website and use their online search tool. By entering the deceased's name and other relevant information, you can check for any unclaimed money that may be owed to their estate. It's a straightforward process that can help recover signNow funds.

-

What are the requirements to claim Illinois unclaimed money for deceased?

To claim Illinois unclaimed money for deceased individuals, you typically need to provide legal documentation verifying your relationship to the deceased. This can include a death certificate, proof of identity, and possibly a will or letters of administration. Ensuring you have the correct paperwork simplifies the process of claiming the funds.

-

Is there a fee to claim Illinois unclaimed money for deceased individuals?

No, there is typically no fee to claim Illinois unclaimed money for deceased individuals. The state's process is designed to help individuals recover their funds without incurring costs. However, it's advisable to be wary of any third-party services that may charge fees to assist in claiming these assets.

-

How long does it take to receive Illinois unclaimed money for deceased claims?

The time it takes to receive Illinois unclaimed money for deceased claims can vary, but the process often takes several weeks to a few months. Once all required documents are submitted and verified, the state will process the claim and issue payment. It's important to be patient and ensure your application is complete to avoid delays.

-

Can I file for Illinois unclaimed money for deceased online?

Yes, you can file for Illinois unclaimed money for deceased individuals online. The Illinois State Treasurer's website provides a user-friendly portal for submitting claims. This digital solution offers convenience and accelerates the process of claiming funds that belong to your deceased relatives.

-

What types of assets are included in Illinois unclaimed money for deceased?

Illinois unclaimed money for deceased individuals can include a variety of assets, such as bank accounts, stocks, insurance policies, and utility deposits. Various financial institutions are required to report unclaimed assets to the state after a specific period of inactivity. This means a wide range of potentially recoverable assets for claimants.

Get more for Deceased Before July 2 Illinois State Treasurer Treasurer Il

- Printable personal information sheet

- Etrade direct deposit form

- Corrective deed california pdf form

- 424402 form

- Work permit alabama 88931 form

- Covalent bonding webquest answer key pdf form

- Form of application by the contractor for seeking lakshadweep lakshadweep nic

- Artist gallery consignment agreement template form

Find out other Deceased Before July 2 Illinois State Treasurer Treasurer Il

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online