PAYROLL CORRECTION FORM

What is the payroll correction form

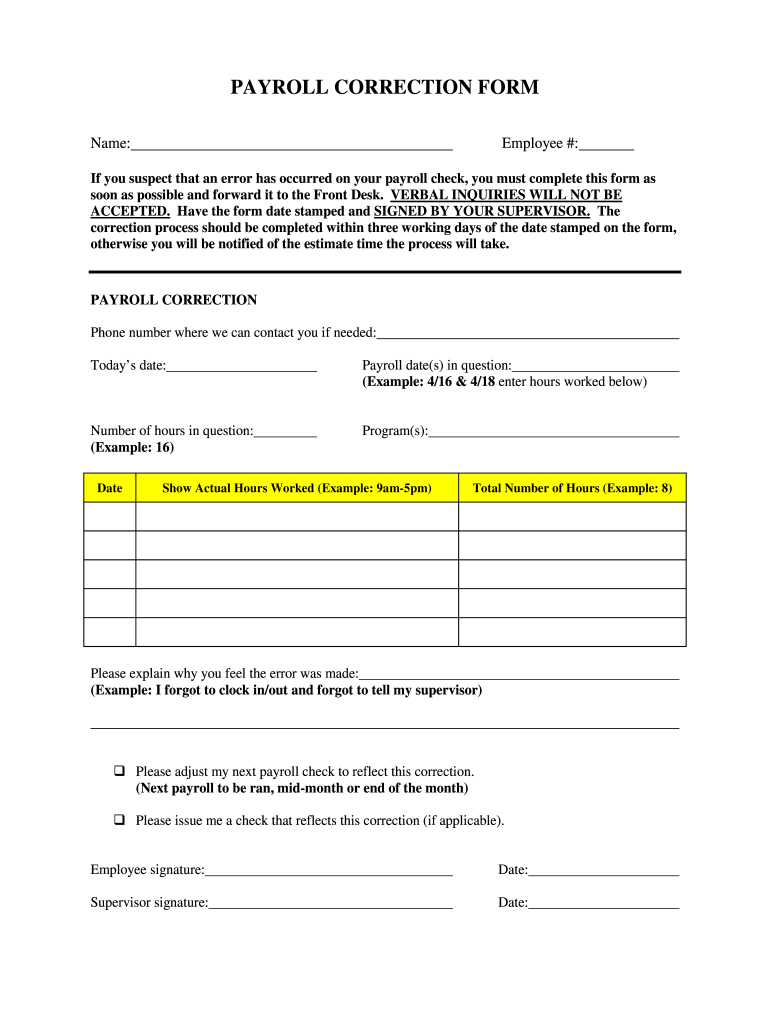

The payroll correction form is a crucial document used to rectify errors in payroll processing. This form allows employers to amend inaccuracies related to employee wages, tax withholdings, or other payroll-related discrepancies. By submitting a payroll correction, businesses can ensure compliance with tax regulations and maintain accurate employee records. It is essential for both employers and employees to understand the significance of this form in addressing payroll issues promptly.

How to use the payroll correction form

Using the payroll correction form involves several straightforward steps. First, identify the specific error that needs correction, such as incorrect hours worked or miscalculated deductions. Next, fill out the form with accurate information, including the employee's name, identification number, and the nature of the correction. Ensure that all relevant details are clearly stated to avoid further discrepancies. Once completed, submit the form to the appropriate department within your organization for processing.

Steps to complete the payroll correction form

Completing the payroll correction form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including the employee's details and the specific payroll error.

- Clearly indicate the corrections needed on the form.

- Provide any supporting documentation, such as pay stubs or time sheets, if applicable.

- Review the completed form for accuracy before submission.

- Submit the form to your payroll department or designated authority for processing.

Legal use of the payroll correction form

The payroll correction form must be used in accordance with federal and state regulations. Legally, it serves as an official record of changes made to an employee's payroll information. Compliance with laws such as the Fair Labor Standards Act (FLSA) is vital to avoid potential penalties. Ensuring that the form is filled out correctly and submitted in a timely manner helps protect both the employer and employee from legal repercussions related to payroll discrepancies.

Key elements of the payroll correction form

Several key elements must be included in the payroll correction form to ensure its effectiveness:

- Employee's full name and identification number.

- Description of the error being corrected.

- Details of the correction, including revised amounts or adjustments.

- Signatures of both the employee and the authorized personnel.

- Date of the correction request.

Form submission methods

The payroll correction form can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online submission through a secure payroll portal.

- Mailing the completed form to the payroll department.

- In-person delivery to the HR or payroll office.

Employers should specify their preferred submission method to ensure timely processing of corrections.

Quick guide on how to complete payroll correction form

Complete PAYROLL CORRECTION FORM effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features you require to generate, amend, and electronically sign your documents swiftly without any hold-ups. Manage PAYROLL CORRECTION FORM on any system with airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to alter and eSign PAYROLL CORRECTION FORM effortlessly

- Obtain PAYROLL CORRECTION FORM and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Alter and eSign PAYROLL CORRECTION FORM and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll correction form

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow's approach to handling payroll correction documents?

airSlate SignNow offers a seamless way to create, send, and eSign payroll correction documents. Our platform provides templates for payroll corrections that simplify the process and reduce the risk of errors. By leveraging our service, businesses can ensure timely and accurate payroll adjustments.

-

How does airSlate SignNow reduce costs related to payroll correction?

By using airSlate SignNow, businesses can signNowly cut down on the costs associated with payroll correction processes. Our easy-to-use platform streamlines document management, reducing the time and resources needed for payroll corrections. This efficiency leads to notable savings for organizations.

-

Can I integrate airSlate SignNow with my existing payroll system for payroll correction?

Yes, airSlate SignNow easily integrates with various payroll systems, making payroll correction processes more efficient. This integration ensures that all necessary documents are quickly accessible and can be signed promptly. Streamlining your payroll correction workflow has never been easier.

-

What features does airSlate SignNow offer for effective payroll correction?

airSlate SignNow includes features specifically beneficial for payroll corrections, such as customizable templates, real-time status tracking, and secure eSigning capabilities. These features collectively enhance the speed and reliability of document management for payroll corrections. This focus on efficiency ensures that your payroll system remains accurate and up-to-date.

-

Are there any specific industries that benefit from using airSlate SignNow for payroll correction?

Various industries can benefit from airSlate SignNow when it comes to payroll correction, particularly those with high employee turnover or complex payroll structures. Sectors like retail, healthcare, and finance can greatly enhance their operational efficiency through our solution. Our platform addresses the unique challenges faced in payroll corrections across these industries.

-

What security measures does airSlate SignNow implement for payroll correction documents?

Security is paramount at airSlate SignNow, especially when handling sensitive payroll correction documents. We utilize advanced encryption and compliance measures to protect your data during transmission and storage. This ensures that all payroll correction information remains confidential and secure.

-

Is there a trial period for airSlate SignNow to assess payroll correction features?

Yes, airSlate SignNow offers a trial period that allows you to assess our platform's features, including those for payroll correction. During this trial, you'll experience the full functionality of our solution, helping you determine if it meets your payroll needs. This risk-free assessment is an excellent way to explore your options.

Get more for PAYROLL CORRECTION FORM

- Ergonomic assessment checklist occupational safety and health osha form

- Form 8974 january 2017 quarterly small business payroll tax credit for increasing research activities irs

- Amd 23e form

- Nutrition of the north american porcupine erethizon glenoakzoo form

- Mkbhavunieduin form

- Cms 855r form 2016 2019

- Vaccine administration record var for children and teens public health oregon form

- Imm5533 form

Find out other PAYROLL CORRECTION FORM

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free