Rc7191 on 2013

What is the Rc7191 On

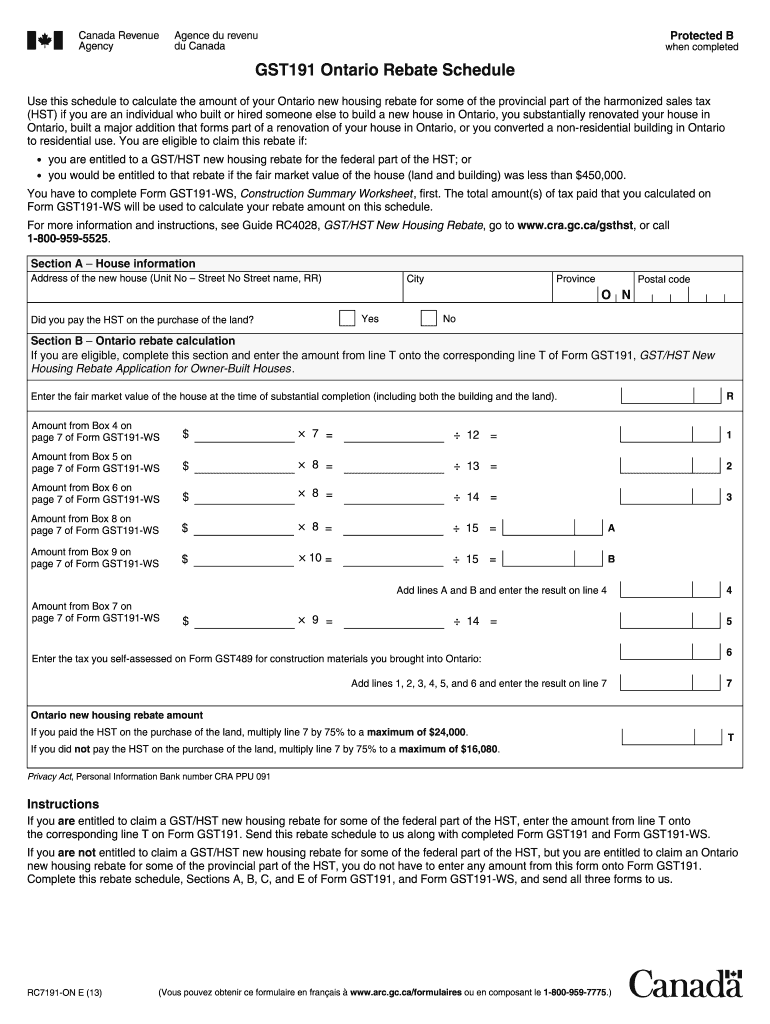

The Rc7191 On is a specific form used for various purposes related to tax filings and rebates in the United States. It is often associated with the processing of specific financial transactions or claims, ensuring compliance with federal regulations. Understanding this form is crucial for individuals and businesses looking to navigate the complexities of tax obligations and benefits.

How to use the Rc7191 On

Using the Rc7191 On involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including personal details and financial data relevant to the form. Next, fill out the form carefully, ensuring all fields are completed accurately. It is advisable to review the form for any errors before submission to avoid delays in processing.

Steps to complete the Rc7191 On

Completing the Rc7191 On can be accomplished by following these steps:

- Obtain the Rc7191 On form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including name, address, and Social Security number.

- Provide any required financial information accurately.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Rc7191 On

The Rc7191 On is legally recognized when filled out and submitted according to established guidelines. Compliance with regulations such as the ESIGN Act ensures that electronically signed forms are valid. It is important to retain a copy of the submitted form for your records, as it may be required for future reference or audits.

Key elements of the Rc7191 On

Several key elements are essential for the Rc7191 On to be considered complete and valid:

- Personal Information: Accurate identification details of the individual or business.

- Financial Data: Relevant financial information that supports the claims made on the form.

- Signature: A valid signature or electronic signature that confirms the authenticity of the form.

- Submission Date: The date on which the form is submitted, which can affect processing timelines.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Rc7191 On to avoid penalties. These deadlines may vary based on the specific purpose of the form, such as tax filings or rebate claims. Staying informed about these dates ensures timely submission and compliance with regulations.

Quick guide on how to complete rc7191 on

Prepare Rc7191 On seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage Rc7191 On on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Rc7191 On without stress

- Access Rc7191 On and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Rc7191 On while ensuring excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rc7191 on

Create this form in 5 minutes!

How to create an eSignature for the rc7191 on

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is form rc7191 on and how can airSlate SignNow assist with it?

Form rc7191 on is a specific document used for various business processes. airSlate SignNow streamlines the completion and signing of this form, enabling users to manage it efficiently online. With our platform, you'll save time and reduce errors while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow to complete form rc7191 on?

Yes, there is a pricing structure for airSlate SignNow, which offers different plans based on your business needs. Each plan provides access to features that facilitate the effective management of documents like form rc7191 on. We ensure our solutions are cost-effective to fit various budgets.

-

What features does airSlate SignNow offer for managing form rc7191 on?

airSlate SignNow provides a suite of features designed to enhance productivity for documents like form rc7191 on. Features include customizable templates, in-app signing, real-time tracking, and integration capabilities with other tools, ensuring you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other applications for handling form rc7191 on?

Yes, airSlate SignNow offers seamless integrations with numerous applications like Google Drive, Salesforce, and Zapier. This allows you to automate workflows and better manage associated tasks with form rc7191 on, boosting overall efficiency.

-

How does airSlate SignNow ensure the security of form rc7191 on?

At airSlate SignNow, we prioritize your security. We utilize advanced encryption standards and adhere to industry regulations to protect documents, including form rc7191 on. This ensures that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for form rc7191 on?

Utilizing airSlate SignNow for form rc7191 on provides numerous benefits, including ease of use, faster turnaround times, and reduced paper usage. Our platform promotes a more efficient workflow, allowing teams to focus on what matters while improving overall productivity.

-

Is there a mobile app available for airSlate SignNow to handle form rc7191 on?

Yes, airSlate SignNow offers a mobile application that enables users to fill out and eSign form rc7191 on from anywhere. This mobile access enhances flexibility, allowing you to manage your documents on-the-go without compromising on functionality.

Get more for Rc7191 On

- Antrag auf beurkundung einer auslandseheschlieung im eheregister 34 pstg form

- Writing today johnson sheehan pdf form

- Layaway agreement v1 repeat boutique form

- Get www2 palomar form

- Motion picture industry health plans beneficiaryenrollment form ww mpiphp

- How to get my transcripts from mott community college 2017 2019 form

- Nps form 10 660 rev

- Service above self award form

Find out other Rc7191 On

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online