Rc7191 on 2018-2026

What is the Rc7191 On

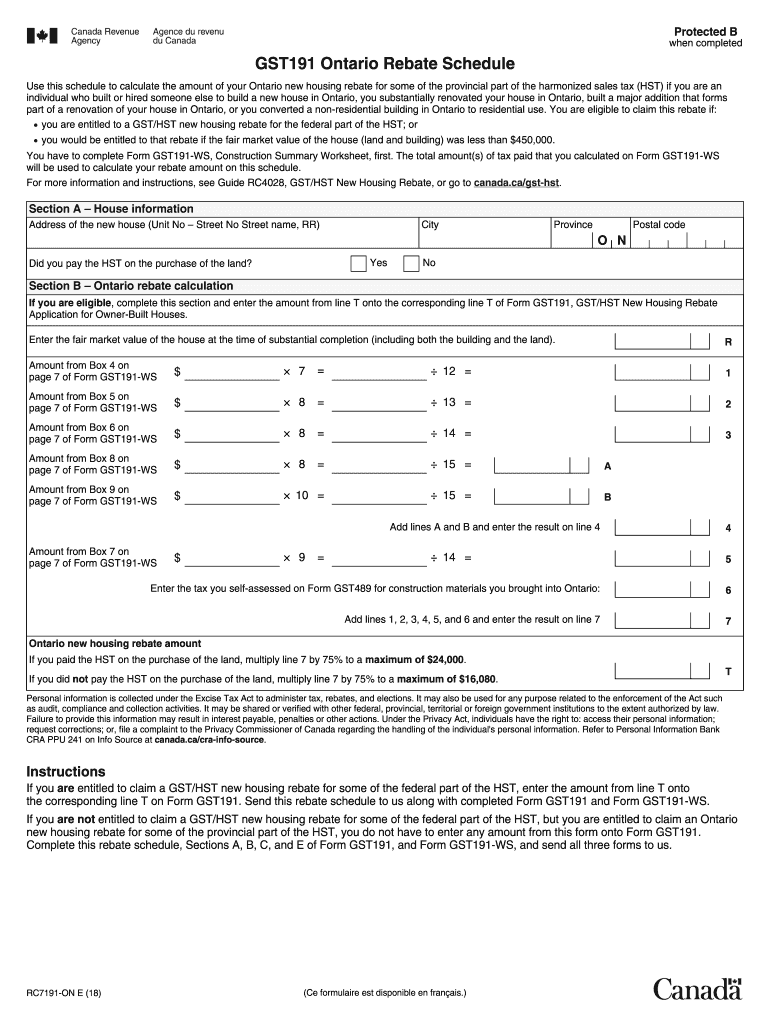

The Rc7191 On is a specific form used in Canada for claiming various rebates and credits, particularly related to the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST). This form is essential for individuals and businesses seeking to recover taxes paid on eligible purchases. Understanding the Rc7191 On is crucial for ensuring compliance and maximizing potential refunds.

How to obtain the Rc7191 On

To obtain the Rc7191 On form, individuals can visit the official Canada Revenue Agency (CRA) website, where the form is available for download. It can also be requested through local tax offices or by contacting the CRA directly. Ensuring you have the most current version of the form is important, as updates may occur periodically.

Steps to complete the Rc7191 On

Completing the Rc7191 On involves several key steps:

- Gather all necessary documentation, including receipts and proof of purchases.

- Fill out the form accurately, providing all required personal and financial information.

- Ensure that all calculations are correct to avoid delays in processing.

- Review the completed form for accuracy before submission.

Legal use of the Rc7191 On

The Rc7191 On is legally binding when completed correctly and submitted according to the guidelines set forth by the CRA. It is essential to adhere to the rules regarding eligibility and documentation to ensure that the claim is valid. Failure to comply with these regulations may result in penalties or denial of the rebate.

Eligibility Criteria

Eligibility for using the Rc7191 On varies based on individual circumstances. Generally, individuals must have incurred eligible expenses related to goods and services subject to GST/HST. It is important to review the specific criteria outlined by the CRA to determine if you qualify for the rebate.

Filing Deadlines / Important Dates

Filing deadlines for the Rc7191 On are critical to ensure timely processing of rebate claims. Typically, forms must be submitted within a specific period following the end of the fiscal year or the quarter in which the expenses were incurred. Keeping track of these dates helps avoid missing out on potential refunds.

Form Submission Methods (Online / Mail / In-Person)

The Rc7191 On can be submitted through various methods, including online submission via the CRA's portal, mailing a physical copy to the appropriate tax office, or delivering it in person. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs for efficiency.

Quick guide on how to complete rc7191 on 444034758

Complete Rc7191 On effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without delays. Manage Rc7191 On on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Rc7191 On with ease

- Find Rc7191 On and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Rc7191 On and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rc7191 on 444034758

Create this form in 5 minutes!

How to create an eSignature for the rc7191 on 444034758

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the form rc7191 on and how can I use it with airSlate SignNow?

The form rc7191 on is a specific document format used for various official purposes. With airSlate SignNow, you can easily upload, fill out, and eSign the form rc7191 on, streamlining your document management process.

-

Is there a cost associated with using the form rc7191 on in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to essential features for working with the form rc7191 on. Depending on your chosen plan, you can take advantage of cost-effective solutions that suit your business needs.

-

Can I integrate the form rc7191 on with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integrations with various applications, enabling you to utilize the form rc7191 on within your existing workflow. Common integrations include CRM systems, cloud storage services, and productivity tools.

-

What are the benefits of using airSlate SignNow for handling the form rc7191 on?

Using airSlate SignNow for the form rc7191 on provides a range of benefits, including quick document turnaround, enhanced security, and easy tracking of document status. This ensures that your business remains efficient and compliant with all necessary regulations.

-

Is airSlate SignNow user-friendly for completing the form rc7191 on?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to complete the form rc7191 on. The platform features intuitive navigation and helpful tools that guide you through the eSigning process effortlessly.

-

How secure is the form rc7191 on when using airSlate SignNow?

Security is a top priority for airSlate SignNow, ensuring that your form rc7191 on is protected by advanced encryption methods. Additionally, the platform complies with industry standards to ensure that your confidential information remains safe during the eSigning process.

-

Can I access the form rc7191 on from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to access and manage the form rc7191 on on the go. This mobile access is ideal for busy professionals who need to eSign documents quickly and conveniently.

Get more for Rc7191 On

Find out other Rc7191 On

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed