Personal Tax Credit Return Bc 2017

What is the Personal Tax Credit Return BC

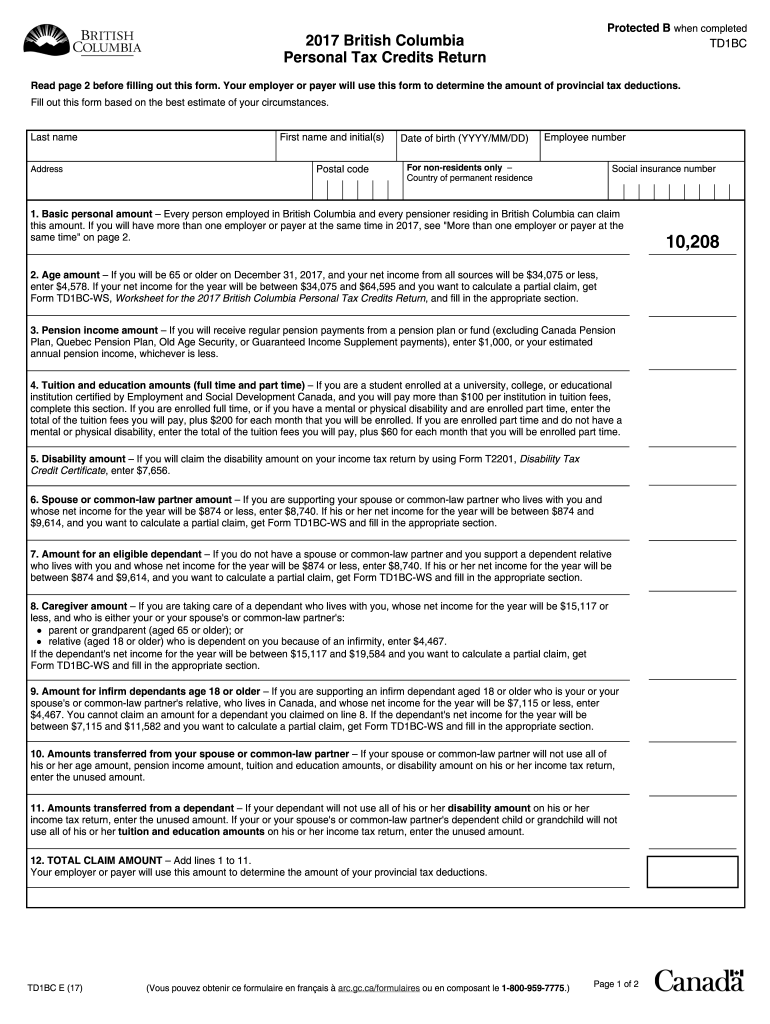

The Personal Tax Credit Return BC is a specific form used by individuals in British Columbia to claim personal tax credits. These credits can reduce the amount of tax owed, making it an essential part of the tax filing process. The form collects information regarding the taxpayer's eligibility for various credits, including those related to dependents, education, and disability. Understanding this form is crucial for maximizing potential tax benefits and ensuring compliance with local tax regulations.

Steps to complete the Personal Tax Credit Return BC

Completing the Personal Tax Credit Return BC involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including income statements and information about dependents. Next, fill out the form with personal details, ensuring that all information is current and accurate. Pay special attention to sections that pertain to specific credits, as these may require additional documentation. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference.

How to obtain the Personal Tax Credit Return BC

The Personal Tax Credit Return BC can be obtained through various channels. Individuals can download the form directly from the official tax authority's website or request a physical copy through mail. Additionally, tax preparation software often includes this form, allowing for easy access and completion. It is advisable to ensure that you are using the most current version of the form to avoid any issues with your tax filing.

Legal use of the Personal Tax Credit Return BC

For the Personal Tax Credit Return BC to be legally valid, it must be completed in accordance with applicable tax laws and regulations. This includes providing accurate information and ensuring that all required signatures are present. Electronic submissions are legally recognized, provided they comply with eSignature laws such as ESIGN and UETA. Utilizing a reliable electronic signing platform can enhance the legal standing of your submission, ensuring that it meets all necessary criteria.

Eligibility Criteria

Eligibility for claiming credits on the Personal Tax Credit Return BC typically depends on various factors, including income level, residency status, and specific circumstances such as having dependents or being a student. Each credit may have its own set of requirements, so it is essential to review these criteria carefully before completing the form. Understanding your eligibility can help maximize your tax benefits and avoid potential issues during the filing process.

Form Submission Methods

The Personal Tax Credit Return BC can be submitted through multiple methods, catering to different preferences. Individuals may choose to file the form electronically via approved tax software, which often streamlines the process and ensures compliance with filing requirements. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face assistance.

Quick guide on how to complete personal tax credit return bc

Effortlessly complete Personal Tax Credit Return Bc on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as it allows you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Personal Tax Credit Return Bc on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Effortlessly edit and electronically sign Personal Tax Credit Return Bc

- Obtain Personal Tax Credit Return Bc and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Select important sections of your documents or redact sensitive information using specialized tools from airSlate SignNow tailored for this purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Personal Tax Credit Return Bc ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal tax credit return bc

Create this form in 5 minutes!

How to create an eSignature for the personal tax credit return bc

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a personal tax credit return BC?

A personal tax credit return BC is a document that allows individuals in British Columbia to claim various tax credits they are eligible for. By submitting this return, you can potentially reduce your tax liabilities and receive refunds. Understanding this process is crucial for maximizing your savings during tax season.

-

How can airSlate SignNow help with my personal tax credit return BC?

airSlate SignNow simplifies the process of preparing and submitting your personal tax credit return BC by providing a user-friendly eSigning platform. You can easily send documents to clients or team members for signatures, streamlining your workflow. This efficiency ensures you meet deadlines while keeping your data secure.

-

Is there a cost associated with using airSlate SignNow for my personal tax credit return BC?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. These plans are cost-effective, allowing you to choose one that best fits your budget while managing your personal tax credit return BC efficiently. Consult our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing personal tax credit return BC?

airSlate SignNow provides essential features such as customizable templates, secure eSigning, and document tracking to assist you in managing your personal tax credit return BC. These features enhance your productivity and ensure you have everything you need to submit your return accurately and on time.

-

Can I integrate airSlate SignNow with other software for my personal tax credit return BC?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including accounting and tax preparation tools, to enhance your workflow. This integration will facilitate the management of your personal tax credit return BC and help keep your records organized.

-

What are the benefits of using airSlate SignNow for my personal tax credit return BC?

Using airSlate SignNow for your personal tax credit return BC offers numerous benefits including time savings, increased accuracy, and improved compliance. The easy-to-use platform minimizes the risk of errors during document signing and ensures that all necessary paperwork is handled efficiently.

-

How does airSlate SignNow ensure the security of my personal tax credit return BC?

airSlate SignNow prioritizes security with advanced encryption and compliance with regulations such as GDPR and HIPAA. Your personal tax credit return BC is protected every step of the way, giving you peace of mind that your sensitive information remains confidential and secure.

Get more for Personal Tax Credit Return Bc

Find out other Personal Tax Credit Return Bc

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form