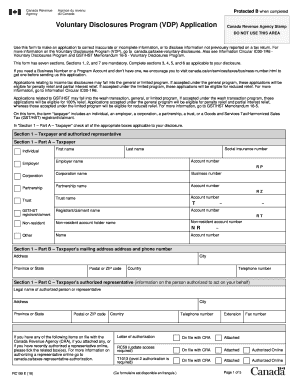

Voluntary Disclosures Program VDP Application Canada Ca 2018

What is the Voluntary Disclosures Program VDP Application Canada ca

The Voluntary Disclosures Program (VDP) Application in Canada is a tax initiative designed to encourage taxpayers to come forward and correct their tax affairs without facing penalties. This program allows individuals and businesses to disclose previously unreported income or rectify errors in their tax filings. By participating in the VDP, taxpayers can gain relief from penalties and interest on the amounts owed, provided they meet specific eligibility criteria. The program aims to promote transparency and compliance while offering a second chance for those who may have inadvertently failed to meet their tax obligations.

Steps to complete the Voluntary Disclosures Program VDP Application Canada ca

Completing the Voluntary Disclosures Program VDP Application involves several key steps to ensure that your submission is accurate and compliant. First, gather all relevant financial documents, including income statements, previous tax returns, and any records of unreported income. Next, carefully fill out the VDP application form, providing detailed information about the discrepancies in your tax filings. Once completed, review the application for accuracy and completeness. Finally, submit the application to the appropriate tax authority, either online or by mail, depending on the submission methods available. It is essential to keep copies of all documents for your records.

Eligibility Criteria for the Voluntary Disclosures Program VDP Application Canada ca

To qualify for the Voluntary Disclosures Program VDP Application, taxpayers must meet specific eligibility criteria. The disclosure must be voluntary, meaning it should be made before the tax authority initiates any audit or investigation. Additionally, the application must involve the correction of a previous error or omission related to income or deductions. Taxpayers should also ensure that they are not currently under investigation for tax-related issues. Meeting these criteria is crucial for obtaining the benefits offered by the program, including the potential for penalty relief.

Required Documents for the Voluntary Disclosures Program VDP Application Canada ca

When preparing to submit the Voluntary Disclosures Program VDP Application, it is important to gather all necessary documentation. Required documents typically include:

- Previous tax returns for the relevant years.

- Income statements and records of unreported income.

- Any correspondence with tax authorities related to the discrepancies.

- Supporting documents that validate the corrections being made.

Having these documents ready will facilitate a smoother application process and help ensure that all necessary information is provided to the tax authorities.

Form Submission Methods for the Voluntary Disclosures Program VDP Application Canada ca

The Voluntary Disclosures Program VDP Application can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission via the tax authority's secure portal.

- Mailing the completed application to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can affect the processing time, so it is advisable to consider the options carefully.

Legal use of the Voluntary Disclosures Program VDP Application Canada ca

The legal use of the Voluntary Disclosures Program VDP Application is grounded in the principles of tax compliance and accountability. By voluntarily disclosing previously unreported income or correcting errors, taxpayers can mitigate potential legal repercussions, such as penalties or interest charges. The program is designed to encourage honest reporting and foster a cooperative relationship between taxpayers and tax authorities. It is essential for participants to adhere to the guidelines and requirements set forth by the tax authority to ensure that their disclosures are accepted and processed legally.

Quick guide on how to complete voluntary disclosures program vdp application canadaca

Effortlessly Prepare Voluntary Disclosures Program VDP Application Canada ca on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Voluntary Disclosures Program VDP Application Canada ca on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Edit and Electronically Sign Voluntary Disclosures Program VDP Application Canada ca with Ease

- Find Voluntary Disclosures Program VDP Application Canada ca and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring you to print new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Edit and electronically sign Voluntary Disclosures Program VDP Application Canada ca to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct voluntary disclosures program vdp application canadaca

Create this form in 5 minutes!

How to create an eSignature for the voluntary disclosures program vdp application canadaca

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the Voluntary Disclosures Program VDP Application Canada ca?

The Voluntary Disclosures Program VDP Application Canada ca is designed to help individuals and businesses correct past tax errors without facing penalties. By using the program, you can disclose unreported income or claim deductions you missed, ensuring compliance with Canadian tax laws.

-

How can airSlate SignNow assist with the Voluntary Disclosures Program VDP Application Canada ca?

airSlate SignNow simplifies the process of submitting your Voluntary Disclosures Program VDP Application Canada ca by allowing you to electronically sign and send necessary documents securely. This efficient process saves time and reduces the risk of errors in your application.

-

What features does airSlate SignNow offer for the Voluntary Disclosures Program VDP Application Canada ca?

airSlate SignNow provides essential features such as electronic signatures, document templates, and cloud storage, which are crucial for completing the Voluntary Disclosures Program VDP Application Canada ca efficiently. These tools enhance collaboration and ensure all parties have access to necessary documents.

-

Is there a cost associated with using airSlate SignNow for the Voluntary Disclosures Program VDP Application Canada ca?

Yes, there is a subscription fee for airSlate SignNow, which is cost-effective compared to traditional methods of processing the Voluntary Disclosures Program VDP Application Canada ca. Plans vary, so you can choose one that best fits your needs and budget.

-

What are the benefits of using airSlate SignNow for the Voluntary Disclosures Program VDP Application Canada ca?

Using airSlate SignNow for the Voluntary Disclosures Program VDP Application Canada ca offers numerous benefits including enhanced security, faster processing times, and improved accuracy in document handling. This ultimately leads to a smoother experience and better compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for the Voluntary Disclosures Program VDP Application Canada ca?

Absolutely! airSlate SignNow supports integration with various CRM and document management systems, which can help streamline your Voluntary Disclosures Program VDP Application Canada ca. This flexibility allows you to tailor your workflow to fit your business needs.

-

How secure is the airSlate SignNow platform for handling Voluntary Disclosures Program VDP Application Canada ca?

airSlate SignNow takes security seriously, employing industry-standard encryption protocols to protect your data while processing the Voluntary Disclosures Program VDP Application Canada ca. You can trust that your sensitive information is secure throughout the signing and document management process.

Get more for Voluntary Disclosures Program VDP Application Canada ca

- Lyme tap form 2014 2019

- Lyme tap form 2014

- Images for what aboutpatient namedate of birthuse of disclosure i hereby authorize hoag memorial hospital presbyterian to form

- Outpatient review pdf beacon health options form

- Visual acuity form visual acuity form

- Hch 551 form 2017 2019

- 3udfwlwlrqhu ssolfdwlrq form

- Edi registration form new empire blue cross blue shield

Find out other Voluntary Disclosures Program VDP Application Canada ca

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free