T2sch4 2015-2026

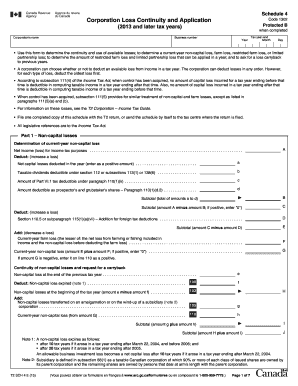

What is the T2sch4

The T2sch4, or T2 Schedule 4, is a form used by corporations in the United States to report their loss continuity and application. This schedule is integral to the T2 corporate tax return, allowing businesses to detail their non-capital losses and how these losses can be applied against future income. Understanding the T2sch4 is crucial for corporations seeking to maximize their tax benefits and ensure compliance with IRS regulations.

How to use the T2sch4

Using the T2sch4 involves accurately filling out the form with relevant financial information. Corporations must gather their financial statements and any previous loss data to complete the schedule effectively. The form requires details on the nature of losses, their amounts, and the years in which they were incurred. Properly utilizing the T2sch4 can help businesses apply losses to offset taxable income, thereby reducing their overall tax liability.

Steps to complete the T2sch4

Completing the T2sch4 involves several key steps:

- Gather necessary financial documents, including prior year tax returns and loss statements.

- Identify the types of losses to report, such as non-capital losses.

- Fill in the required information on the T2sch4, ensuring accuracy in loss amounts and applicable years.

- Review the completed form for any discrepancies or missing information.

- Attach the T2sch4 to the T2 corporate tax return before submission.

Legal use of the T2sch4

The T2sch4 must be used in accordance with IRS regulations to ensure its legal validity. Corporations must adhere to the guidelines set forth by the IRS regarding loss applications. Misuse or incorrect reporting on the T2sch4 can lead to penalties or audits. It is essential for businesses to maintain accurate records and consult with a tax professional if there are uncertainties regarding the legal implications of their reported losses.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the T2sch4 to avoid penalties. Generally, the T2 corporate tax return, along with the T2sch4, is due within six months after the end of the corporation's fiscal year. It is important to mark these dates on the calendar to ensure timely submission and compliance with tax obligations.

Required Documents

To complete the T2sch4, corporations need several essential documents:

- Prior year tax returns, including any previously filed T2 schedules.

- Financial statements that detail income and loss amounts.

- Documentation supporting the nature of losses claimed, such as accounting records.

Eligibility Criteria

Eligibility to use the T2sch4 is typically limited to corporations that have incurred non-capital losses. These losses must be documented and reported accurately to be applied against future taxable income. Corporations must ensure they meet the IRS criteria for loss continuity to utilize the T2sch4 effectively.

Quick guide on how to complete t2sch4 439363712

Complete T2sch4 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Handle T2sch4 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to adjust and eSign T2sch4 without hassle

- Obtain T2sch4 and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign T2sch4 and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2sch4 439363712

Create this form in 5 minutes!

How to create an eSignature for the t2sch4 439363712

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is t2sch4 and how does it relate to airSlate SignNow?

t2sch4 refers to a specific solution offered by airSlate SignNow that enables users to digitally send and eSign documents. With t2sch4, businesses can streamline their document management processes, ensuring efficiency and security in their transactions.

-

What are the pricing options for t2sch4?

airSlate SignNow offers various pricing plans for t2sch4, catering to different business needs. By choosing the plan that suits your budget and requirements, organizations can leverage the full potential of eSigning without incurring unnecessary costs.

-

What features can I expect from t2sch4?

t2sch4 includes a variety of essential features such as customizable templates, real-time tracking, and integrations with other applications. These features allow users to enhance their workflow and improve collaboration among team members.

-

How can t2sch4 benefit my business?

Integrating t2sch4 into your operations can signNowly boost productivity by reducing the time spent on document management. Additionally, the secure signing process enhances trust, ensuring that your business transactions are both fast and safe.

-

Is it easy to integrate t2sch4 with existing software?

Yes, t2sch4 is designed to seamlessly integrate with many popular applications and platforms. This ensures that businesses can continue using their preferred tools while benefiting from the eSigning capabilities provided by airSlate SignNow.

-

Can t2sch4 support multiple users?

Absolutely! t2sch4 is built to accommodate teams of all sizes, allowing multiple users to collaborate and sign documents simultaneously. This feature promotes teamwork and ensures that workflows are not hindered by document signing delays.

-

What types of documents can I send using t2sch4?

With t2sch4, you can send a wide range of documents for eSignature, including contracts, agreements, and proposals. The flexibility offered by this solution means you can manage virtually any paperwork digitally.

Get more for T2sch4

- Anthem blue cross application form 2015 2019

- Group short term disability statement of employee lincoln financial form

- Nj hint supplemental enrollment form hint supplemental enrollment form

- Aetna form 2016 2019

- Portlandmaine form

- Pinnacol first report of injury form 2015 2019

- Download fillable of 306 addendum 2018 form

- Authorization for disclosure of health information stony brook

Find out other T2sch4

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile