T2sch4 2011

What is the T2sch4?

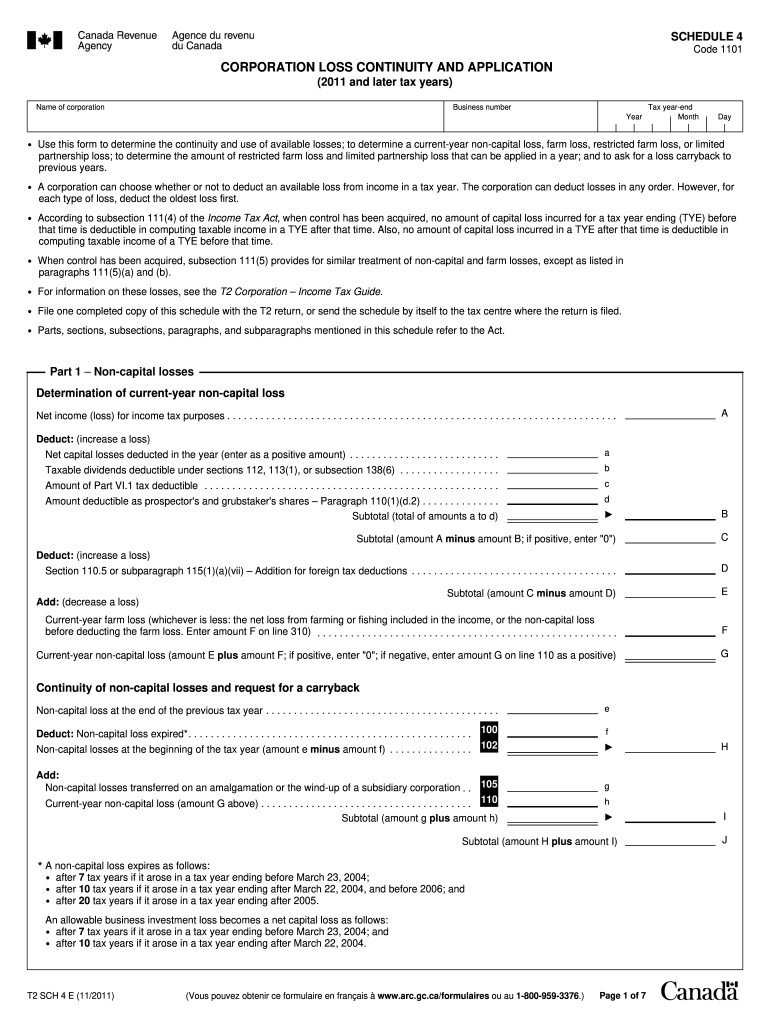

The T2sch4, or Corporation Loss Continuity and Application, is a form used by corporations in Canada to report and apply for the continuity of losses. This form is essential for businesses that have incurred losses in previous tax years and wish to carry those losses forward to offset taxable income in future years. Understanding the T2sch4 is crucial for corporations aiming to optimize their tax positions and ensure compliance with tax regulations.

How to use the T2sch4

Using the T2sch4 involves several steps to ensure accurate reporting of loss continuity. Corporations must first gather relevant financial data, including previous years' losses and current income projections. The form requires detailed information about the corporation's financial history, including the nature of the losses and how they will be applied. It is important to follow the guidelines precisely to avoid errors that could lead to penalties or delays in processing.

Steps to complete the T2sch4

Completing the T2sch4 requires careful attention to detail. Here are the key steps:

- Gather financial statements and documentation of previous losses.

- Fill out the form with accurate data, ensuring all sections are completed.

- Review the form for any discrepancies or missing information.

- Submit the form electronically or via mail, following the submission guidelines provided by the tax authority.

Legal use of the T2sch4

The legal use of the T2sch4 is governed by tax laws that dictate how losses can be reported and applied. Corporations must ensure that they are compliant with the Income Tax Act and related regulations. This includes understanding the time limits for carrying forward losses and the specific requirements for documentation. Proper legal use of the T2sch4 can help corporations mitigate tax liabilities and avoid potential legal issues.

Key elements of the T2sch4

The T2sch4 contains several key elements that are essential for its completion:

- Identification of the corporation, including business number and fiscal period.

- Details of loss amounts from prior years.

- Information on how the losses will be applied to future income.

- Signature of an authorized representative to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the T2sch4 are critical to ensure compliance and avoid penalties. Corporations must submit the form within the specified time frame following the end of their fiscal year. It is advisable to keep track of these deadlines and prepare the form in advance to allow for any necessary revisions or additional documentation that may be required.

Eligibility Criteria

To utilize the T2sch4, corporations must meet specific eligibility criteria. This includes being a registered corporation in Canada and having incurred losses in previous tax years that are eligible for carryforward. Additionally, corporations must ensure that they have maintained proper records and documentation to support their claims on the form.

Quick guide on how to complete t2sch4

Complete T2sch4 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage T2sch4 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign T2sch4 effortlessly

- Obtain T2sch4 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or blackout sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign T2sch4 to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2sch4

Create this form in 5 minutes!

How to create an eSignature for the t2sch4

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is corporation loss continuity and application in the context of eSigning?

Corporation loss continuity and application relates to how businesses can maintain operational integrity during transitions. With airSlate SignNow, your eSigning process is secure, ensuring continuity in the documentation of sensitive transactions, which aligns with effective corporation continuity strategies.

-

How does airSlate SignNow support corporation loss continuity?

airSlate SignNow supports corporation loss continuity by providing a reliable platform for electronic signatures. Our solution ensures that crucial documents are signed securely and stored safely, allowing organizations to manage their corporation continuity plans effectively.

-

What are the pricing options for airSlate SignNow?

Our pricing for airSlate SignNow is designed to be cost-effective, catering to businesses big and small. We offer various plans that allow for flexibility, ensuring that you invest appropriately while securing your corporation loss continuity and application needs.

-

Can airSlate SignNow integrate with other software to enhance corporation loss continuity?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM and project management tools. This integration is vital for businesses looking to enhance their corporation loss continuity and application processes, making document management more efficient.

-

What features does airSlate SignNow offer for improving document security?

airSlate SignNow includes advanced features like audit trails, encryption, and customizable workflows to ensure document security. By enhancing your corporation loss continuity and application processes with these features, you can trust that your sensitive data remains protected.

-

How can airSlate SignNow benefit a company's workflow?

Implementing airSlate SignNow streamlines workflows by reducing the time it takes to get documents signed and approved. This efficiency is critical for maintaining corporation loss continuity and application, allowing you to focus on strategic business operations.

-

What type of support does airSlate SignNow provide to users?

We offer comprehensive support through various channels, including live chat, email, and a robust knowledge base. Our goal is to assist users in navigating corporation loss continuity and application processes seamlessly, ensuring you maximize the potential of our eSigning solutions.

Get more for T2sch4

Find out other T2sch4

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors