Revocable Trusts Vs Irrevocable Trusts Whats the Form

What is the Revocable Trusts Vs Irrevocable Trusts Whats The

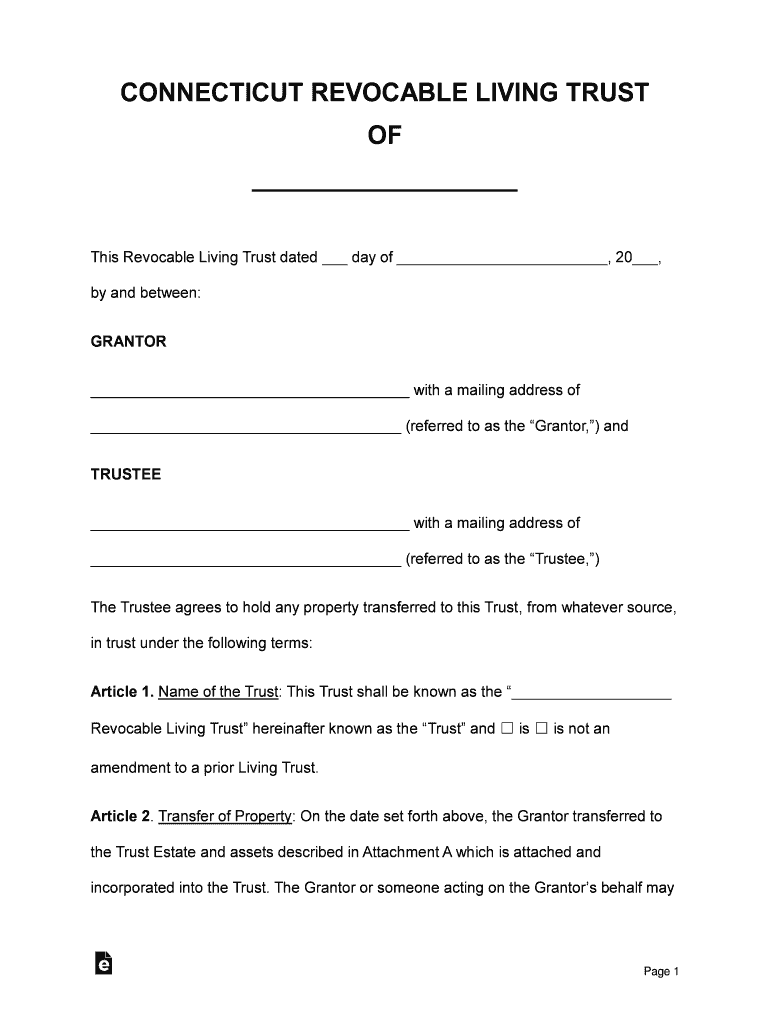

A revocable trust, often referred to as a living trust, allows the grantor to maintain control over the assets within it during their lifetime. The grantor can modify or revoke the trust at any time. In contrast, an irrevocable trust cannot be changed or revoked once established, meaning the grantor relinquishes control over the assets placed within it. This fundamental difference impacts how each type of trust is treated for tax purposes and asset protection, making it essential to understand their unique characteristics.

Key elements of the Revocable Trusts Vs Irrevocable Trusts Whats The

Several key elements distinguish revocable trusts from irrevocable trusts:

- Control: The grantor retains full control over a revocable trust, while an irrevocable trust limits the grantor's control.

- Tax Implications: Income generated by assets in a revocable trust is taxed to the grantor, whereas irrevocable trusts may have different tax treatments.

- Asset Protection: Assets in an irrevocable trust are generally protected from creditors, while those in a revocable trust are not.

- Estate Planning: Revocable trusts facilitate the transfer of assets upon death without going through probate, while irrevocable trusts can also serve specific estate planning goals.

Steps to complete the Revocable Trusts Vs Irrevocable Trusts Whats The

Completing the revocable trusts vs irrevocable trusts form involves several steps:

- Determine your goals: Identify whether you need flexibility (revocable) or asset protection (irrevocable).

- Gather necessary information: Collect details about your assets, beneficiaries, and any specific instructions.

- Draft the trust document: Use a legal professional or trusted software to create the trust document, ensuring it meets state-specific requirements.

- Sign the document: Execute the trust in accordance with state laws, which may require notarization or witnesses.

- Fund the trust: Transfer assets into the trust to ensure they are governed by its terms.

Legal use of the Revocable Trusts Vs Irrevocable Trusts Whats The

Both revocable and irrevocable trusts serve legal purposes in estate planning. A revocable trust allows for the seamless management of assets during the grantor's lifetime and simplifies the transfer of those assets upon death, avoiding probate. An irrevocable trust, on the other hand, can be utilized for more complex estate planning strategies, such as protecting assets from creditors or qualifying for government benefits. Understanding the legal implications of each type is crucial for effective estate management.

State-specific rules for the Revocable Trusts Vs Irrevocable Trusts Whats The

Trust laws vary significantly by state, affecting how revocable and irrevocable trusts are created and managed. Some states have specific requirements for trust documentation, execution, and funding. It's important to consult state-specific legal resources or professionals to ensure compliance with local laws. Additionally, certain states may have unique tax implications related to the administration of trusts, which can influence your choice between a revocable and an irrevocable trust.

Examples of using the Revocable Trusts Vs Irrevocable Trusts Whats The

Examples illustrate the practical applications of both trust types:

- Revocable Trust: A couple creates a revocable trust to manage their assets during their lifetime and ensure their children inherit without going through probate.

- Irrevocable Trust: An individual establishes an irrevocable trust to protect their assets from potential lawsuits while also qualifying for Medicaid benefits.

Quick guide on how to complete revocable trusts vs irrevocable trusts whats the

Prepare Revocable Trusts Vs Irrevocable Trusts Whats The effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Revocable Trusts Vs Irrevocable Trusts Whats The on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Revocable Trusts Vs Irrevocable Trusts Whats The without any hassle

- Locate Revocable Trusts Vs Irrevocable Trusts Whats The and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow efficiently meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Revocable Trusts Vs Irrevocable Trusts Whats The and guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revocable trusts vs irrevocable trusts whats the

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What are the key differences between revocable trusts and irrevocable trusts?

Revocable trusts vs irrevocable trusts: What's the fundamental difference? A revocable trust allows you to make changes at any time, while an irrevocable trust cannot be modified once established. Understanding these distinctions is crucial for effective estate planning.

-

How do revocable trusts impact estate taxes?

Understanding revocable trusts vs irrevocable trusts: what's the tax implication? Revocable trusts typically do not provide tax benefits during your lifetime, since assets are still part of your estate. In contrast, irrevocable trusts can help reduce estate tax exposure, as assets transferred to them are no longer considered part of your estate.

-

What are the benefits of using a revocable trust?

When comparing revocable trusts vs irrevocable trusts, one notable advantage of a revocable trust is flexibility. You can modify, add, or remove assets without legal complications. This adaptability provides peace of mind for those looking to maintain control over their assets as circumstances change.

-

Are there costs associated with setting up a trust?

In the realm of revocable trusts vs irrevocable trusts, the costs can vary. Typically, setting up a revocable trust may involve attorney fees, while an irrevocable trust might incur additional costs due to its complexity. Always consider these factors to make a financially sound decision.

-

How do I choose between a revocable and an irrevocable trust?

Deciding between revocable trusts vs irrevocable trusts: what's the best choice for you? It largely depends on your financial goals, control preferences, and estate planning needs. Consulting with an estate planning professional can help clarify the most suitable option.

-

Can revocable trusts help in avoiding probate?

Yes, revocable trusts vs irrevocable trusts do play a signNow role in probate avoidance. A revocable trust allows your assets to be distributed directly to beneficiaries, bypassing the lengthy probate process. This efficiency can save time and costs for your heirs.

-

What features should I look for when selecting a trust management service?

When evaluating services related to revocable trusts vs irrevocable trusts, it’s essential to look for features like user-friendly documentation, e-signature capabilities, and robust customer support. These aspects enable a seamless trust management experience that meets your specific needs.

Get more for Revocable Trusts Vs Irrevocable Trusts Whats The

- Uncontested copetitioner divorce application form

- Jv 457 twenty four month permanency california courts form

- Jv 732 s commitment to the california department of corrections and rehabilitation division of juvenile facilities spanish form

- Fl 530 governmental agency under family code 1740017406 telephone no courts ca form

- Fl 915 order on request of minor to marry or establish a domestic partnership judicial council forms courts ca

- Fl 688 form

- Fl 347 form

- What is form fl 615

Find out other Revocable Trusts Vs Irrevocable Trusts Whats The

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast