Irs Form 5074 2018

What is the IRS Form 5074

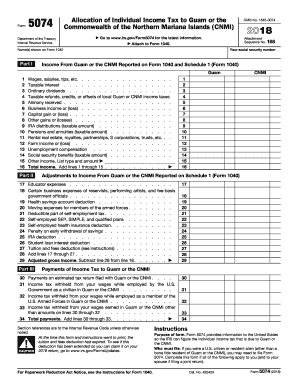

The IRS Form 5074 is a tax form specifically designed for residents of Guam who are required to report their income and tax obligations to the Internal Revenue Service. This form helps determine the eligibility for the Guam tax credit and is crucial for ensuring compliance with U.S. tax laws. The 5074 form is particularly relevant for individuals who may have income sourced from both Guam and the mainland United States, as it assists in calculating the appropriate tax liabilities.

How to use the IRS Form 5074

Using the IRS Form 5074 involves several key steps. First, gather all necessary financial documents, including income statements and any previous tax returns. Next, accurately fill out the form, ensuring that all income sources are reported. It is important to follow the instructions provided by the IRS closely to avoid errors that could lead to penalties. Once completed, the form must be submitted to the IRS, either electronically or by mail, depending on your preference and the guidelines set forth by the IRS.

Steps to complete the IRS Form 5074

Completing the IRS Form 5074 requires a methodical approach. The following steps can help ensure accuracy:

- Gather all relevant financial documents, including W-2s and 1099s.

- Begin filling out the form by entering personal information, such as your name and Social Security number.

- Report all income sources, including wages, self-employment income, and any other taxable income.

- Calculate the Guam tax credit based on your income and the applicable tax rates.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS, ensuring that you keep a copy for your records.

Legal use of the IRS Form 5074

The legal use of the IRS Form 5074 is essential for compliance with U.S. tax regulations. This form must be filled out accurately to reflect your income and tax obligations. Failure to use the form correctly can result in penalties, including fines or additional tax liabilities. It is advisable to consult with a tax professional if you have questions regarding the legal implications of your tax situation or the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5074 are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth of each year. However, if you are a resident of Guam, specific deadlines may vary. It is important to stay informed about any changes to tax laws or deadlines that may affect your filing requirements.

Required Documents

To complete the IRS Form 5074, certain documents are required. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or self-employed income.

- Previous year’s tax returns for reference.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready will streamline the process of completing your form and ensure that all information is accurate and complete.

Quick guide on how to complete form 5074 2018 2019

Effortlessly Prepare Irs Form 5074 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Irs Form 5074 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Irs Form 5074 With Ease

- Locate Irs Form 5074 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 5074 to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5074 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the form 5074 2018 2019

How to generate an eSignature for your Form 5074 2018 2019 online

How to generate an eSignature for your Form 5074 2018 2019 in Chrome

How to make an eSignature for signing the Form 5074 2018 2019 in Gmail

How to generate an eSignature for the Form 5074 2018 2019 from your mobile device

How to create an electronic signature for the Form 5074 2018 2019 on iOS

How to generate an electronic signature for the Form 5074 2018 2019 on Android

People also ask

-

What is IRS Form 5074 and when should I use it?

IRS Form 5074 is used by individuals who have received a distribution from a retirement plan or an annuity and need to report the income correctly. If you’ve received such payments and are unsure how to report them on your tax return, this form is essential. Make sure to complete IRS Form 5074 to ensure compliance with tax regulations.

-

How can airSlate SignNow help me with IRS Form 5074?

airSlate SignNow streamlines the process of signing and sharing IRS Form 5074 digitally, making it easier to manage your tax documents. With our easy-to-use platform, you can send the form for eSignature and track its status in real time. This efficiency helps you stay organized and compliant with tax requirements.

-

Is airSlate SignNow cost-effective for managing IRS Form 5074?

Yes, airSlate SignNow provides a cost-effective solution for managing IRS Form 5074 and other documents. Our pricing plans are designed to accommodate various business needs, allowing you to send and sign documents without breaking the bank. This affordability makes it an ideal choice for individuals and businesses alike.

-

What features does airSlate SignNow offer for IRS Form 5074 processing?

airSlate SignNow offers features like document templates, customizable workflows, and secure eSigning, making it perfect for handling IRS Form 5074. You can easily create a template for your form, ensuring you have a quick and efficient way to send it out for signatures. Additionally, our platform ensures that all documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other platforms for IRS Form 5074?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems, allowing you to manage IRS Form 5074 and other documents in one place. These integrations enhance your workflow, saving you time and effort when handling your tax documents.

-

What are the benefits of using airSlate SignNow for IRS Form 5074?

Using airSlate SignNow for IRS Form 5074 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform ensures that your sensitive tax information remains protected while allowing you to expedite the signing process. This means you can focus more on your business and less on paperwork.

-

How secure is airSlate SignNow for submitting IRS Form 5074?

airSlate SignNow prioritizes your security, implementing industry-leading encryption and compliance standards to protect your IRS Form 5074 and other sensitive documents. Our platform ensures that your data is always safe during transmission and storage, giving you peace of mind when handling important tax paperwork.

Get more for Irs Form 5074

- Asse 1015 field test report form american society of sanitary asse plumbing

- Asse 1020 field test report form american society of sanitary asse plumbing

- State of nebraska substitute form w 9 amp ach enrollment form

- Doh 250 form

- Affidavit license and certificate of marriage new york form

- Ca application duplicate title dmv 227pdffillercom 2015 2019 form

- Hcd 433a form

- 488c form

Find out other Irs Form 5074

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later