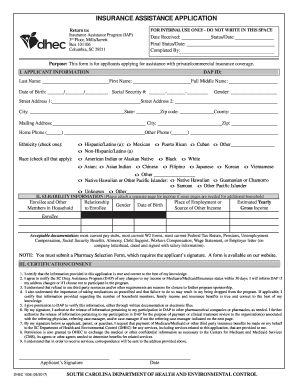

INSURANCE ASSISTANCE APPLICATION 2017-2026

What is the insurance assistance application?

The insurance assistance application is a formal document used to request financial support or benefits related to insurance policies. This application is essential for individuals seeking assistance with claims, coverage, or other insurance-related matters. It typically requires detailed personal information, including the applicant's name, contact details, and specifics about the insurance policy in question. Understanding the purpose and requirements of this application is crucial for ensuring a smooth process in obtaining the necessary assistance.

Key elements of the insurance assistance application

When filling out the insurance assistance application, several key elements must be included to ensure its validity. These elements typically consist of:

- Personal Information: Full name, address, and contact information of the applicant.

- Insurance Policy Details: Policy number, type of insurance, and coverage specifics.

- Reason for Assistance: A clear explanation of the need for assistance, including any relevant circumstances.

- Signature: A signature to verify the authenticity of the application.

Including these elements accurately will help facilitate the review and approval process by the insurance provider.

Steps to complete the insurance assistance application

Completing the insurance assistance application involves several straightforward steps:

- Gather Required Information: Collect all necessary personal and insurance-related information before starting the application.

- Fill Out the Application: Carefully complete each section of the application, ensuring accuracy and completeness.

- Review the Application: Double-check all entries for errors or omissions to avoid delays in processing.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in person.

Following these steps will help ensure that the application is processed efficiently.

Legal use of the insurance assistance application

The insurance assistance application must comply with various legal standards to be considered valid. This includes adherence to federal and state regulations regarding personal data protection and the use of electronic signatures. The application must also meet the requirements set forth by the insurance provider to ensure that it is legally binding. Understanding these legal aspects is essential for both applicants and insurers to maintain compliance and protect sensitive information.

Eligibility criteria

Eligibility for submitting the insurance assistance application typically depends on several factors, including:

- Type of Insurance: Different insurance policies may have specific eligibility requirements.

- Personal Circumstances: Applicants may need to demonstrate financial need or other qualifying conditions.

- Policy Status: The applicant's insurance policy must be active and in good standing.

Understanding these criteria can help applicants determine their eligibility before initiating the application process.

Form submission methods

There are several methods available for submitting the insurance assistance application, including:

- Online Submission: Many insurance providers offer online portals for quick and efficient submission.

- Mail: Applicants can print the completed application and send it via postal service to the designated address.

- In-Person Submission: Some applicants may prefer to deliver the application directly to their insurance agent or local office.

Choosing the appropriate submission method can help ensure timely processing of the application.

Quick guide on how to complete insurance assistance application

Fill out INSURANCE ASSISTANCE APPLICATION effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and save it securely online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle INSURANCE ASSISTANCE APPLICATION on any device using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and eSign INSURANCE ASSISTANCE APPLICATION with ease

- Obtain INSURANCE ASSISTANCE APPLICATION and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign INSURANCE ASSISTANCE APPLICATION and maintain effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct insurance assistance application

Create this form in 5 minutes!

How to create an eSignature for the insurance assistance application

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the INSURANCE ASSISTANCE APPLICATION offered by airSlate SignNow?

The INSURANCE ASSISTANCE APPLICATION from airSlate SignNow is a powerful tool that simplifies the process of sending and signing insurance documents. This application is designed to help businesses manage their insurance forms efficiently, ensuring a smooth workflow and compliance with all necessary regulations.

-

How can the INSURANCE ASSISTANCE APPLICATION benefit my business?

The INSURANCE ASSISTANCE APPLICATION can signNowly streamline your document management processes. By using this application, you can reduce turnaround time on important documents, improve accuracy, and enhance customer satisfaction through quicker service responses.

-

What features are included in the INSURANCE ASSISTANCE APPLICATION?

The INSURANCE ASSISTANCE APPLICATION includes features such as customizable templates, real-time tracking of document status, and secure eSignature options. These features work together to simplify the signing process and ensure that your important insurance documents are handled efficiently.

-

Is there a free trial available for the INSURANCE ASSISTANCE APPLICATION?

Yes, airSlate SignNow offers a free trial for the INSURANCE ASSISTANCE APPLICATION. This allows businesses to explore its features and assess its effectiveness before committing to a paid plan, helping ensure it fits their needs.

-

What are the pricing options for the INSURANCE ASSISTANCE APPLICATION?

The INSURANCE ASSISTANCE APPLICATION has flexible pricing plans designed to accommodate businesses of various sizes. You can choose from monthly or annual subscriptions, and there are options for single users or teams, providing scalability as your needs grow.

-

Can the INSURANCE ASSISTANCE APPLICATION integrate with other software?

Absolutely! The INSURANCE ASSISTANCE APPLICATION is designed to seamlessly integrate with various platforms and applications, such as CRM systems and document management tools. This interoperability ensures that you can easily incorporate it into your existing workflows.

-

How secure is the INSURANCE ASSISTANCE APPLICATION for document management?

Security is a top priority for airSlate SignNow, and the INSURANCE ASSISTANCE APPLICATION employs advanced encryption and secure cloud storage. This means your important insurance documents will be safeguarded against unauthorized access, ensuring compliance with industry standards.

Get more for INSURANCE ASSISTANCE APPLICATION

- Request for service expansion doc templatepdffiller form

- Request for claim reconsideration geisinger form

- H i paa acknowledgment form

- Colonial life forms 2019

- Association for clinical pastoral education application form

- Aflac claims authorization form

- 1199seiu pension funds form

- Microbiologymolecular infectious diseaserequisition form

Find out other INSURANCE ASSISTANCE APPLICATION

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU