FORM M APPENDIX Home IRAS Iras Gov

What is the FORM M APPENDIX Home IRAS Iras Gov

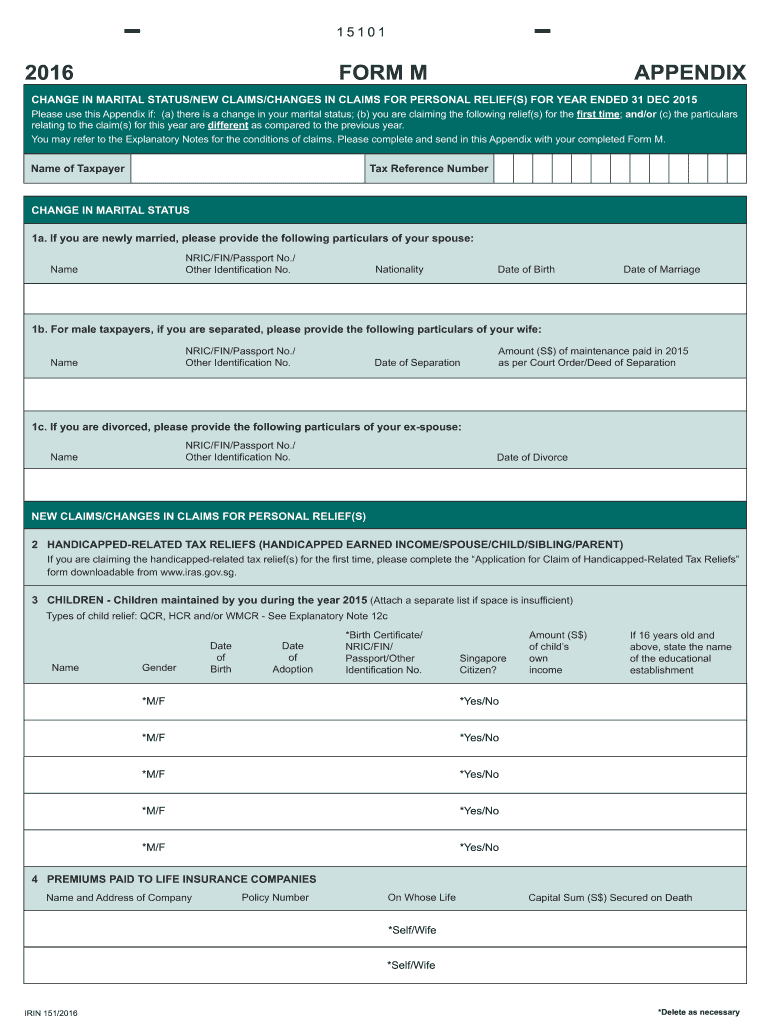

The FORM M APPENDIX is a specific document used within the framework of the Internal Revenue Service (IRS) regulations. It serves as an essential part of tax reporting for individuals and businesses, particularly those involved in certain financial activities or investments. This form is crucial for ensuring compliance with federal tax laws and helps in accurately reporting income and deductions related to IRAs (Individual Retirement Accounts).

How to use the FORM M APPENDIX Home IRAS Iras Gov

Using the FORM M APPENDIX involves understanding the specific requirements outlined by the IRS. Individuals must gather relevant financial information and fill out the form accurately. It is important to ensure that all sections are completed, as incomplete forms may lead to delays or penalties. Once filled out, the form can be submitted electronically or via mail, depending on the guidelines provided by the IRS.

Steps to complete the FORM M APPENDIX Home IRAS Iras Gov

Completing the FORM M APPENDIX requires several key steps:

- Gather necessary documentation, including previous tax returns and financial statements.

- Fill out the form carefully, ensuring all required fields are completed.

- Review the form for accuracy to avoid mistakes that could lead to penalties.

- Submit the form through the appropriate channels, either electronically or by mail, based on IRS instructions.

Legal use of the FORM M APPENDIX Home IRAS Iras Gov

The FORM M APPENDIX is legally binding when filled out and submitted in accordance with IRS regulations. To ensure its legal validity, it must be signed and dated by the individual or authorized representative. Additionally, compliance with eSignature laws, such as the ESIGN Act, is crucial when submitting the form electronically.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the FORM M APPENDIX. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, extensions may be available, and it's essential to check the IRS website for the most current dates and any updates regarding deadlines.

Required Documents

When preparing to complete the FORM M APPENDIX, individuals should have the following documents ready:

- Previous tax returns for reference.

- Financial statements related to IRA contributions and distributions.

- Any supporting documentation that verifies income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The FORM M APPENDIX can be submitted through various methods. Taxpayers may choose to file online using IRS-approved e-filing software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission options may also be available at designated IRS offices, depending on local regulations.

Quick guide on how to complete 2015 form m appendix home iras iras gov

Complete FORM M APPENDIX Home IRAS Iras Gov seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly, without interruptions. Manage FORM M APPENDIX Home IRAS Iras Gov on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign FORM M APPENDIX Home IRAS Iras Gov effortlessly

- Find FORM M APPENDIX Home IRAS Iras Gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and eSign FORM M APPENDIX Home IRAS Iras Gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 form m appendix home iras iras gov

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is FORM M APPENDIX Home IRAS Iras Gov and why is it important?

FORM M APPENDIX Home IRAS Iras Gov is a crucial document used for compliance with local tax regulations. It provides essential information related to your business’s financial activities, making it important for accurate tax reporting and avoidance of penalties.

-

How does airSlate SignNow facilitate the completion of FORM M APPENDIX Home IRAS Iras Gov?

airSlate SignNow streamlines the process of filling out FORM M APPENDIX Home IRAS Iras Gov by providing an intuitive platform that allows you to complete and eSign documents easily. With our templates and user-friendly design, you can ensure accuracy and efficiency.

-

What pricing plans does airSlate SignNow offer for businesses needing FORM M APPENDIX Home IRAS Iras Gov?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs, including those requiring FORM M APPENDIX Home IRAS Iras Gov. Our cost-effective solutions ensure that you get the most value while maintaining compliance with necessary documentation.

-

Can I integrate airSlate SignNow with other tools for FORM M APPENDIX Home IRAS Iras Gov?

Yes, airSlate SignNow supports various integrations that enhance your capabilities when handling FORM M APPENDIX Home IRAS Iras Gov. Our platform seamlessly connects with popular tools, allowing for efficient data transfer and document management.

-

What are the benefits of using airSlate SignNow for signing FORM M APPENDIX Home IRAS Iras Gov?

Using airSlate SignNow for signing FORM M APPENDIX Home IRAS Iras Gov ensures a secure and legally binding signature process. It simplifies document workflows, reduces turnaround time, and provides a complete audit trail, all while keeping your data safe.

-

Is airSlate SignNow suitable for small businesses dealing with FORM M APPENDIX Home IRAS Iras Gov?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses needing to manage FORM M APPENDIX Home IRAS Iras Gov. Its cost-effective and user-friendly features empower small business owners to handle their documentation efficiently.

-

How does airSlate SignNow ensure the security of documents like FORM M APPENDIX Home IRAS Iras Gov?

airSlate SignNow prioritizes the security of your documents, including FORM M APPENDIX Home IRAS Iras Gov, by using advanced encryption technologies and strict access controls. This provides peace of mind that your sensitive data is well-protected throughout the eSigning process.

Get more for FORM M APPENDIX Home IRAS Iras Gov

- Planilla 4811 06 jun 18 planilla 4811 06 jun 18 form

- Ty 2019 502 ty 2019 502 individual taxpayer form

- Dependents information attach to form 502 505 or 515

- Personal tax payment voucher for form 502505

- Instructions for form 8379 112019internal revenue service

- Section a section b comptroller of maryland form

- Maryland form 502 502b maryland resident income tax

- Ao contributivo taxable year form

Find out other FORM M APPENDIX Home IRAS Iras Gov

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy