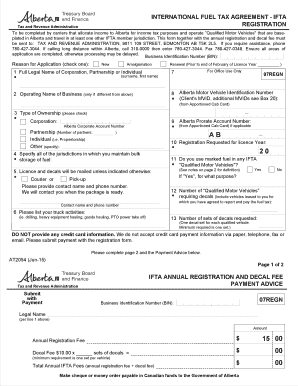

INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax and Revenue 2020

What is the International Fuel Tax Agreement IFTA Tax and Revenue

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces designed to simplify the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under this agreement, carriers pay fuel taxes based on the miles driven in each jurisdiction rather than having to file separate tax returns in each state or province. This streamlined process helps reduce paperwork and ensures that fuel tax revenues are distributed fairly among the jurisdictions involved.

Steps to Complete the International Fuel Tax Agreement IFTA Tax and Revenue

Completing the IFTA tax and revenue form involves several key steps:

- Gather necessary information, including your business details, vehicle information, and fuel purchase records.

- Calculate total miles driven in each jurisdiction and the total fuel purchased.

- Determine the tax owed based on the jurisdiction's tax rates and your fuel consumption.

- Complete the IFTA tax form accurately, ensuring all calculations are correct.

- Submit the form by the deadline, either electronically or via mail, depending on your jurisdiction's requirements.

How to Use the International Fuel Tax Agreement IFTA Tax and Revenue

To effectively use the IFTA tax and revenue form, it is essential to maintain accurate records of your fuel purchases and mileage. This involves:

- Tracking miles driven in each state or province.

- Keeping receipts for all fuel purchases.

- Using software or tools that can assist in calculating taxes owed based on your records.

By following these practices, you can ensure compliance with IFTA regulations and simplify the filing process.

Legal Use of the International Fuel Tax Agreement IFTA Tax and Revenue

The IFTA tax and revenue form is legally binding when completed and submitted according to the regulations set forth by the participating jurisdictions. To ensure legal use, it is crucial to:

- Provide accurate and truthful information on the form.

- Retain copies of all submitted documents and supporting records.

- Adhere to filing deadlines to avoid penalties.

Understanding these legal requirements helps protect your business from potential audits or disputes.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA tax and revenue form vary by jurisdiction but generally follow a quarterly schedule. Important dates to remember include:

- Quarterly filing deadlines, typically at the end of January, April, July, and October.

- Due dates for any payments owed based on your fuel tax calculations.

Staying aware of these dates is essential to maintain compliance and avoid late fees.

Required Documents

When completing the IFTA tax and revenue form, you will need to gather several documents, including:

- Records of mileage driven in each jurisdiction.

- Receipts for all fuel purchases.

- Previous IFTA tax returns, if applicable.

Having these documents ready will facilitate a smoother filing process and ensure accuracy in your calculations.

Quick guide on how to complete international fuel tax agreement ifta tax and revenue

Prepare INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and eSign INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue without hassle

- Locate INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select how you'd like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct international fuel tax agreement ifta tax and revenue

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement ifta tax and revenue

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue?

The INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue is a tax collection agreement among U.S. states and Canadian provinces aimed at simplifying the reporting of fuel taxes for interjurisdictional carriers. It allows trucking companies to report and pay fuel taxes in a consolidated manner, improving compliance and efficiency.

-

How can airSlate SignNow assist with IFTA reporting?

airSlate SignNow offers an efficient way to manage and eSign documents related to the INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue. With easy-to-use features, you can streamline your IFTA reporting process, ensuring accurate and timely submissions, reducing administrative workload.

-

What features does airSlate SignNow provide for managing IFTA documents?

airSlate SignNow provides features such as customizable templates, secure eSignature options, and document tracking to manage your IFTA documents effectively. These features ensure you stay compliant with the INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue requirements safely and efficiently.

-

Is airSlate SignNow cost-effective for small businesses handling IFTA taxes?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises handling INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue compliance. By reducing paperwork and administrative tasks, companies can save money while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for IFTA processing?

Absolutely! airSlate SignNow can be integrated with various accounting and transportation management systems, making it easier to handle the INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue reporting. This integration helps enhance efficiency by automating data transfer and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for IFTA compliance?

Using airSlate SignNow for INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue compliance provides numerous benefits, including improved accuracy, reduced processing time, and enhanced collaboration between team members. These advantages lead to smoother workflows and timely submissions.

-

How secure is airSlate SignNow for handling sensitive IFTA information?

airSlate SignNow employs robust security measures to protect sensitive information related to the INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue. With encryption and secure cloud storage, your data remains safe while you manage your IFTA documentation and submissions.

Get more for INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue

- Acvf form

- Family and medical leave request form the university of

- San jac transcript request form

- Scholarship disbursement form

- Paid medical director of surgical services agreement and duties form

- Chemistry 3331 olafs daugulis olafs chem uh form

- West contra costa unified school district interdistrict transfer renewal form

- Sick leave pool request packet stephen f austin state university form

Find out other INTERNATIONAL FUEL TAX AGREEMENT IFTA Tax And Revenue

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free