How insurance experts benefit from electronic signatures

Insurance workflow trends and stats as of 2025

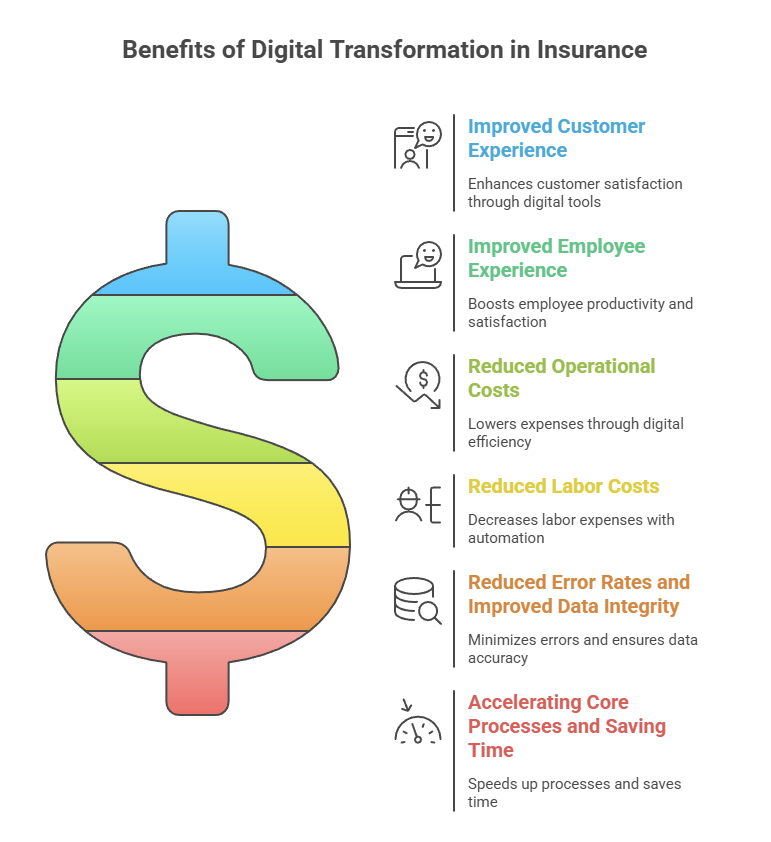

The insurance sector in 2025 is undergoing a sweeping digital transformation. According to industry data, 85% of insurance companies have accelerated their digital initiatives since 2020, signaling that modernization is now a strategic imperative rather than an optional upgrade. Simultaneously, the global digital insurance platform market is projected at US $148.15 billion in 2025, with forecasts estimating growth to US $255.43 billion by 2030 (CAGR ≈ 11.5 %).

Within this broader digital shift, electronic workflows—and especially e-signatures—are emerging as a leading lever of transformation. Research shows that approximately 48% of policies are now touchless or fully digital, significantly reducing reliance on paper-based processes. For insurers, the urgency is high: policy volumes, remote interactions, regulatory demands, and customer expectations for speed and transparency are converging to render legacy, paper-based workflows increasingly untenable.

The shift from paperwork to digital processes in the insurance industry

For decades, the insurance process depended on physical paperwork—printing, signing, mailing, and scanning. This traditional approach consumed resources and time. The global move to remote operations and sustainability in the early 2020s pushed insurers to adopt fully digital workflows.

Now, SignNow and similar platforms let professionals complete applications, renewals, and claims online from any device. This not only improves processing speed but also meets customer expectations for convenience and transparency.

Why electronic signatures are a game-changer

Electronic signatures have become a cornerstone of insurance modernization. They allow teams to execute contracts quickly, securely, and with full legal validity. With SignNow, insurance professionals can send and sign documents in minutes, with audit trails and authentication for compliance.

Features such as multi-signer support, automatic reminders, and centralized storage eliminate the need for manual tracking. Insurers now experience faster deal closures, improved recordkeeping, and higher customer satisfaction.

Key features of eSignature solutions for insurers

Leading e-signature solutions, such as SignNow, offer advanced security and workflow capabilities tailored to the needs of the insurance industry.

These features, along with industry-leading security and compliance standards, collectively reduce manual effort, ensure accuracy, and strengthen compliance.

Streamlining policy applications and renewals

Policy applications and renewals often involve multiple steps and approvals. eSignatures simplify this by connecting all parties in a unified workflow. Customers can sign from their phones, agents receive instant notifications, and back-office teams gain real-time visibility.

SignNow enables insurers to prefill data, reuse templates, and enforce standard fields, minimizing human error. What once took several days can now be completed within hours, enhancing both efficiency and policyholder satisfaction.

Enhancing claims processing efficiency

Claims are the backbone of any insurance business, yet they are also the most paperwork-heavy. Electronic signatures help insurers manage claims more efficiently by allowing claimants, adjusters, and agents to sign off on key documents digitally.

Automation ensures that each step—from initial submission to settlement—is tracked and timestamped. This enhances internal accountability and accelerates resolution, resulting in lower operational costs and improved customer experiences.

Legal compliance and data security considerations

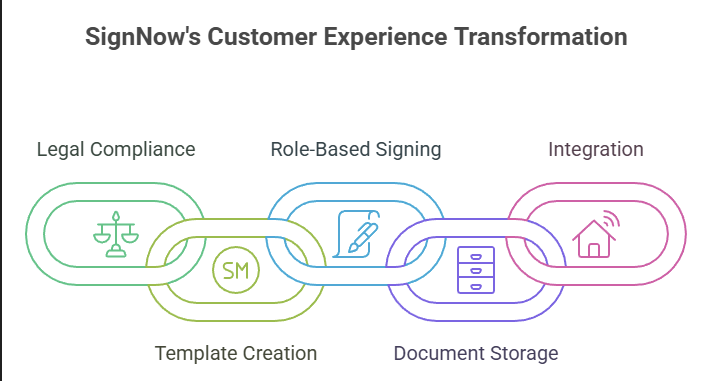

Insurance companies handle sensitive personal and financial data, making security and compliance top priorities. Electronic signature platforms like SignNow adhere to global regulations, including ESIGN, UETA, and eIDAS, ensuring that signatures are legally binding.

Advanced encryption, secure cloud storage, and audit trails protect all transactions from tampering or unauthorized access. Compliance officers can monitor document integrity and access logs, reducing legal risk while improving transparency.

Integrations with existing insurance platforms

Modern insurers rely on software ecosystems that include CRM, ERP, and claims management systems. SignNow integrates seamlessly with platforms like Salesforce, Guidewire, and Microsoft 365, allowing insurers to embed eSignatures directly into existing workflows.

This reduces context switching and eliminates the need to manually move files. Integrated systems also allow automated record updates and instant notifications when a document is signed, maintaining an accurate audit trail.

Customer experience transformation through eSignatures

Customer satisfaction in insurance is driven by speed, transparency, and trust. eSignatures address all three. Clients appreciate being able to sign policies or claims remotely and securely from their preferred device.

SignNow offers branded signing experiences and multilingual support, enabling insurers to provide global services with a consistent user interface. Faster turnaround not only improves experience but also increases policy conversion and retention rates.

Real-world use cases in insurance operations

Professionals use electronic signatures across multiple insurance functions:

- Policy issuance and renewals

- Claims processing and settlements

- Agent onboarding and compliance documentation

- Partner contracts and reinsurance agreements

Each of these workflows benefits from reduced processing time and better accuracy. Insurance leaders report savings of up to 60% in document management costs after adopting eSignature solutions.

Example of SignNow workflow on insurance document signing

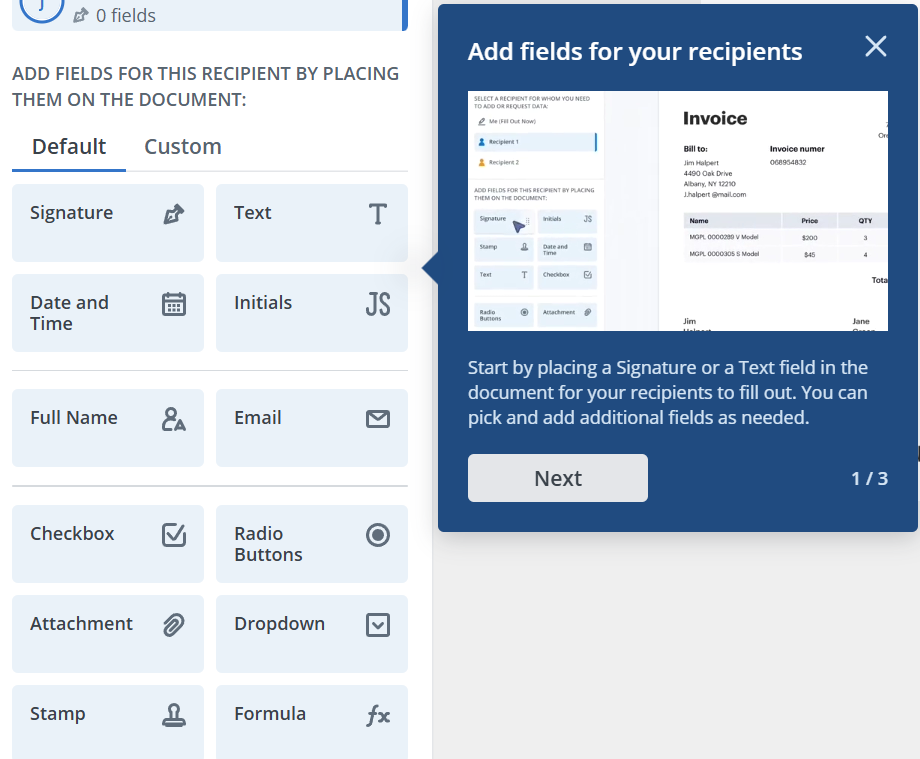

- Prepare the document

The insurance agent selects a ready-made policy or claim template in SignNow and adds necessary form fields — such as customer details, policy numbers, and signature boxes.

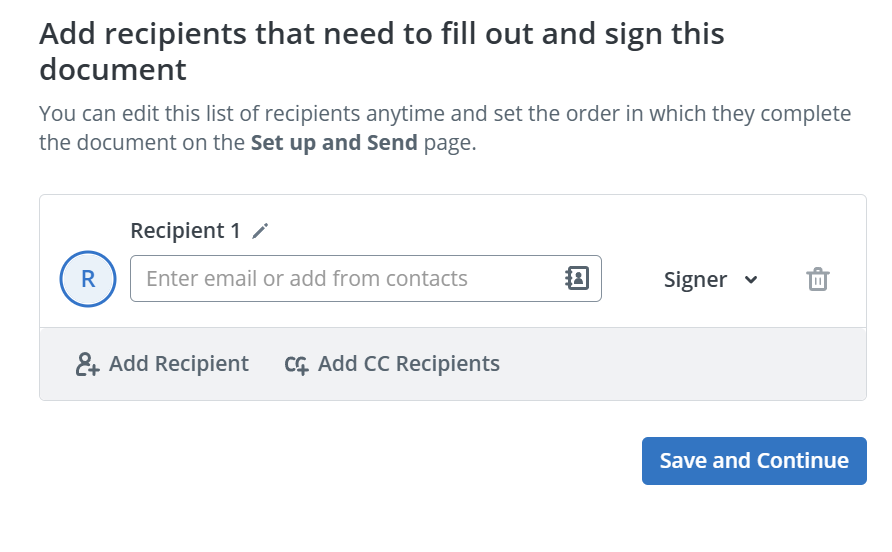

2. Assign roles and send

The agent assigns signing roles (e.g., customer, broker, underwriter) and sends the document via secure SignNow links. Each participant receives a personalized, encrypted invitation.

- The policyholder reviews and signs electronically from any device. SignNow records time, date, IP address, and authentication details to create a tamper-proof audit trail.

- Internal approval

Once the customer signs, SignNow routes the document to the agent or manager for countersignature. Notifications keep all parties updated in real time. - Completion and storage

When all signatures are collected, SignNow finalizes the document, generates a legally binding certificate, and automatically stores it in the insurer’s connected CRM or cloud system.

Result: Insurance workflows that once took days are now completed in under an hour, with full compliance under ESIGN, UETA, and eIDAS laws — improving customer satisfaction and reducing costs.

Future trends in insurance

Looking ahead, the insurance industry is expected to integrate AI and predictive analytics with eSignature solutions. This will allow smart workflows that auto-route documents, verify signers using biometrics, and analyze approval patterns for compliance insights.

Having been one of the largest electronic signatures’ market shares as of 2024, the insurance industry keeps going digital. Digital signatures will likely be standard across all insurance transactions in the near future, from micro-policies to commercial risk underwriting. The focus will shift from simple digitization to intelligent automation and continuous compliance monitoring.

If you are an insurance professional looking to streamline your document signing processes, time to try SignNow for free!

Glossary

- Electronic Signature: A digital method of signing documents that ensures identity verification and legal validity.

- eIDAS: European regulation governing electronic identification and trust services.

- UETA: U.S. law validating the use of electronic signatures in commerce.

- Audit Trail: A timestamped record of actions taken on a document, used for verification and compliance.

FAQ

Q: Are electronic signatures legally valid in the insurance industry?

A: Yes, electronic signatures are fully recognized under ESIGN, UETA, and eIDAS. These regulations ensure that digitally signed insurance documents carry the same legal weight as handwritten signatures.

Q: Can customers sign insurance documents on mobile devices?

A: Absolutely — modern eSignature platforms support secure signing on smartphones and tablets. This lets customers review and complete forms from anywhere with an internet connection.

Q: How do eSignatures improve claim processing?

A: They eliminate manual paperwork and reduce delays caused by physical document handling. As a result, claim approvals are processed more efficiently and maintain complete audit traceability.

Q: Is SignNow compliant with global standards?

A: Yes, SignNow adheres to major international compliance frameworks, including GDPR, SOC 2 Type II, and HIPAA, where applicable. This ensures strong data protection and security for insurance-related information.

- Insurance workflow trends and stats as of 2025

- The shift from paperwork to digital processes in the insurance industry

- Why electronic signatures are a game-changer

- Key features of eSignature solutions for insurers

- Streamlining policy applications and renewals

- Enhancing claims processing efficiency

- Legal compliance and data security considerations

- Integrations with existing insurance platforms

- Customer experience transformation through eSignatures

- Future trends in insurance

- Glossary

- FAQ