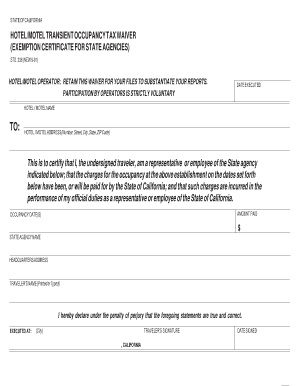

California Federal Hotel Tax Exempt Form 1991

What is the California Federal Hotel Tax Exempt Form

The California Federal Hotel Tax Exempt Form is a document used by certain organizations to claim exemption from hotel taxes in California. This form is primarily utilized by federal government agencies, non-profit organizations, and other qualifying entities that are exempt under specific tax laws. By submitting this form, eligible organizations can avoid paying hotel occupancy taxes, which can significantly reduce travel expenses for official business.

How to Use the California Federal Hotel Tax Exempt Form

To effectively use the California Federal Hotel Tax Exempt Form, organizations must first ensure they meet the eligibility criteria. Once eligibility is confirmed, the form should be filled out accurately, providing all required information such as the name of the organization, the purpose of the stay, and the details of the hotel. After completing the form, it should be presented to the hotel at the time of check-in to ensure tax exemption is applied correctly.

Steps to Complete the California Federal Hotel Tax Exempt Form

Completing the California Federal Hotel Tax Exempt Form involves several key steps:

- Gather necessary information about your organization, including its name, address, and tax identification number.

- Clearly state the purpose of the hotel stay, ensuring it aligns with the exemption criteria.

- Fill out the form completely, ensuring all fields are accurate and legible.

- Review the completed form for any errors or omissions before submission.

- Present the form to the hotel staff upon check-in to ensure tax exemption is processed.

Key Elements of the California Federal Hotel Tax Exempt Form

Several key elements must be included in the California Federal Hotel Tax Exempt Form for it to be valid:

- Organization Information: Full name, address, and tax identification number.

- Purpose of Stay: A clear explanation of the reason for the hotel stay.

- Signature: An authorized representative must sign the form to validate it.

- Date: The date of the form's completion should be included.

Eligibility Criteria

Eligibility for using the California Federal Hotel Tax Exempt Form generally includes federal government agencies, non-profit organizations, and certain educational institutions. To qualify, the organization must be recognized as tax-exempt under federal law. Additionally, the purpose of the hotel stay must align with the organization's mission, such as attending conferences, training, or official meetings.

Form Submission Methods

The California Federal Hotel Tax Exempt Form can be submitted in various ways, depending on the hotel’s policies. Common submission methods include:

- In-Person: Presenting the completed form directly at the hotel during check-in.

- Online: Some hotels may allow electronic submission of the form through their booking systems.

- Fax or Email: Certain establishments may accept the form via fax or email prior to arrival.

Quick guide on how to complete california federal hotel tax exempt form

Complete California Federal Hotel Tax Exempt Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage California Federal Hotel Tax Exempt Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign California Federal Hotel Tax Exempt Form hassle-free

- Locate California Federal Hotel Tax Exempt Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign California Federal Hotel Tax Exempt Form and ensure effective communication at every step of your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california federal hotel tax exempt form

Create this form in 5 minutes!

How to create an eSignature for the california federal hotel tax exempt form

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the California federal hotel tax exempt form?

The California federal hotel tax exempt form is a document used by eligible organizations to claim an exemption from paying hotel taxes in California. This form is essential for nonprofits, government entities, and other qualifying groups seeking to avoid additional expenses during their stays at hotels.

-

How can airSlate SignNow help me manage the California federal hotel tax exempt form?

airSlate SignNow provides a streamlined solution for managing the California federal hotel tax exempt form. Our platform allows users to easily create, fill out, and electronically sign the form, ensuring a smooth and efficient process for submitting tax-exempt requests.

-

Are there any fees associated with using airSlate SignNow for the California federal hotel tax exempt form?

airSlate SignNow offers a cost-effective solution with various pricing plans to suit your needs. Users can start with a free trial to evaluate the platform, and our subscription models ensure you can manage the California federal hotel tax exempt form without incurring unexpected costs.

-

What features does airSlate SignNow offer for the California federal hotel tax exempt form?

With airSlate SignNow, you can utilize features such as templates, eSignature capabilities, and secure document storage for the California federal hotel tax exempt form. These features simplify the process of managing tax-exempt forms and help maintain digital records that are easily accessible.

-

Can I track the status of my California federal hotel tax exempt form using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your California federal hotel tax exempt form. You'll receive notifications when the form is viewed, signed, or completed, which provides peace of mind in managing your documentation.

-

Is airSlate SignNow compliant with legal regulations for the California federal hotel tax exempt form?

Absolutely! airSlate SignNow adheres to various legal standards, ensuring that the California federal hotel tax exempt form is processed in compliance with applicable regulations. This compliance protects your organization by ensuring that all electronic signatures are legally binding.

-

What types of organizations can use the California federal hotel tax exempt form?

The California federal hotel tax exempt form is available for various types of organizations, including nonprofits, educational institutions, and government agencies. By using this form, these entities can save on costs associated with lodging and travel expenses.

Get more for California Federal Hotel Tax Exempt Form

Find out other California Federal Hotel Tax Exempt Form

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast