California Hotel Tax Exempt Form PDF 2019-2026

What is the California Hotel Tax Exempt Form PDF

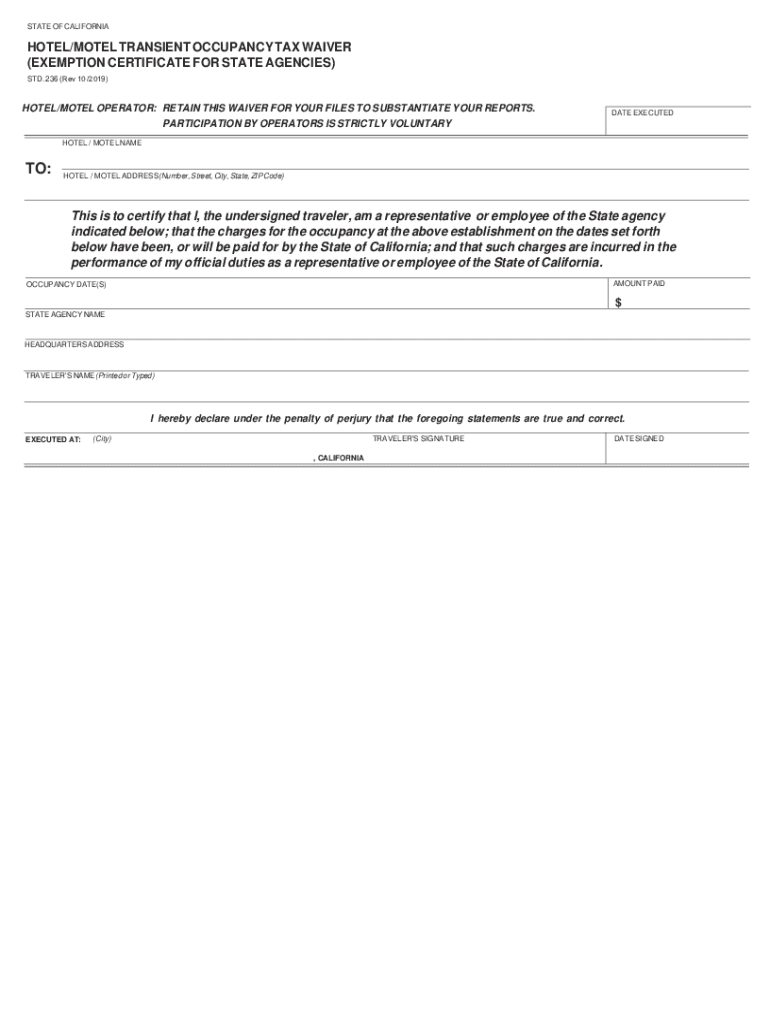

The California Hotel Tax Exempt Form PDF is a crucial document for federal employees and certain government officials who wish to claim tax exemptions on hotel accommodations. This form certifies that the individual is traveling on official government business, thus allowing them to avoid paying state and local taxes on lodging expenses. The form must be completed accurately to ensure compliance with tax regulations and to facilitate the exemption process.

How to Use the California Hotel Tax Exempt Form PDF

To use the California Hotel Tax Exempt Form PDF, individuals must first download the form from a reliable source. After obtaining the form, it should be filled out with the required information, including the name of the traveler, the purpose of the trip, and the hotel details. Once completed, the form must be presented to the hotel at the time of check-in to ensure that the tax exemption is applied to the lodging charges.

Steps to Complete the California Hotel Tax Exempt Form PDF

Completing the California Hotel Tax Exempt Form PDF involves several key steps:

- Download the form from an official source.

- Fill in your personal information, including your name and government agency.

- Provide details about the travel, such as the destination and purpose.

- Include the hotel information, including the name and address of the establishment.

- Sign and date the form to validate it.

Legal Use of the California Hotel Tax Exempt Form PDF

The legal use of the California Hotel Tax Exempt Form PDF is governed by state tax laws. Federal employees must ensure that the form is used strictly for official government travel. Misuse of the form can lead to penalties, including fines or denial of tax exemption. It is essential to understand the legal implications and ensure that all information provided is truthful and accurate.

Eligibility Criteria

Eligibility to use the California Hotel Tax Exempt Form PDF generally includes federal employees and certain government officials traveling for business purposes. Individuals must be able to demonstrate that their travel is officially sanctioned by their respective government agency. It is important to verify eligibility before attempting to use the form to avoid complications during the check-in process.

Who Issues the Form

The California Hotel Tax Exempt Form PDF is typically issued by the government agency for which the employee works. Each agency may have its own process for distributing the form, so it is advisable for employees to consult their agency’s travel department or financial office for guidance on obtaining and using the form correctly.

Required Documents

When using the California Hotel Tax Exempt Form PDF, it may be necessary to present additional documentation to the hotel. This can include a government-issued identification card, a travel order, or other proof of official travel status. Having these documents readily available can help facilitate the tax exemption process and ensure a smooth check-in experience.

Quick guide on how to complete california hotel tax exempt form pdf

Complete California Hotel Tax Exempt Form Pdf effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage California Hotel Tax Exempt Form Pdf on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign California Hotel Tax Exempt Form Pdf with ease

- Obtain California Hotel Tax Exempt Form Pdf and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign California Hotel Tax Exempt Form Pdf and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california hotel tax exempt form pdf

Create this form in 5 minutes!

How to create an eSignature for the california hotel tax exempt form pdf

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a hotel tax exempt form PDF?

A hotel tax exempt form PDF is a document that allows eligible individuals or organizations to waive certain taxes when booking hotel accommodations. This form is essential for government officials or non-profit entities traveling on official business. It is crucial to ensure that the hotel accepts this form to avoid extra charges.

-

How can I obtain a hotel tax exempt form PDF?

You can easily obtain a hotel tax exempt form PDF through the website of the hotel you plan to stay at or your organization's finance department. Many hotels have a standard form available for download. Additionally, using airSlate SignNow, you can create customized templates for your specific needs.

-

Is there a fee for using the hotel tax exempt form PDF service?

Using airSlate SignNow to manage your hotel tax exempt form PDF does not come with hidden fees. Our platform offers transparent pricing plans that cater to businesses of all sizes. You will find our solution to be cost-effective while enhancing your document signing process.

-

What features does airSlate SignNow offer for managing hotel tax exempt form PDFs?

airSlate SignNow provides robust features for managing hotel tax exempt form PDFs, including document templates, eSignature capabilities, and secure cloud storage. You can also track document statuses and send reminders for signatures. Our platform is designed to streamline your document management process.

-

What are the benefits of using airSlate SignNow for hotel tax exempt form PDFs?

By using airSlate SignNow, you benefit from a quick and easy eSignature process for your hotel tax exempt form PDFs. This improves efficiency, saves time, and reduces paper waste. Additionally, our platform ensures compliance and security, giving you peace of mind during your transactions.

-

Can I customize my hotel tax exempt form PDF on airSlate SignNow?

Yes, airSlate SignNow allows you to customize your hotel tax exempt form PDF to meet your specific requirements. You can add your organization’s logo, modify text fields, and set signing order preferences. This flexibility is ideal for ensuring that the document meets all necessary criteria.

-

Does airSlate SignNow integrate with other applications for hotel tax exempt form PDFs?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Salesforce. This integration capability allows you to streamline the process of managing your hotel tax exempt form PDFs across different platforms, enhancing overall productivity.

Get more for California Hotel Tax Exempt Form Pdf

Find out other California Hotel Tax Exempt Form Pdf

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online