Withholding Tax Forms WV State Tax Department 2006

What is the Withholding Tax Forms WV State Tax Department

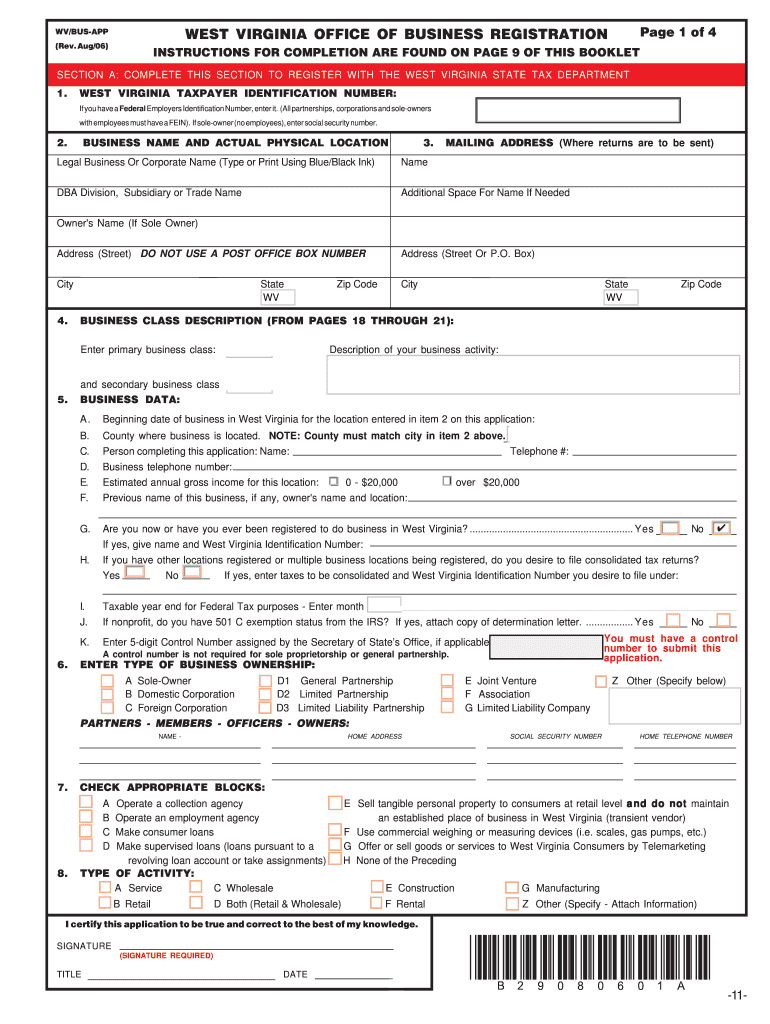

The Withholding Tax Forms from the WV State Tax Department are essential documents used by employers and businesses to report and remit state income taxes withheld from employees' wages. These forms ensure that the correct amount of tax is deducted and submitted to the state, helping maintain compliance with state tax laws. The forms are specifically designed to facilitate accurate reporting and payment of withheld taxes, which is crucial for both the employer and the employee.

Steps to complete the Withholding Tax Forms WV State Tax Department

Completing the Withholding Tax Forms involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including employee details and wage information.

- Calculate the total amount of state income tax to be withheld based on the employee's earnings.

- Fill out the appropriate form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to the WV State Tax Department by the specified deadline.

How to obtain the Withholding Tax Forms WV State Tax Department

Employers can obtain the Withholding Tax Forms from the WV State Tax Department through several methods:

- Visit the official WV State Tax Department website to download the forms directly.

- Request physical copies by contacting the department via phone or email.

- Access forms through tax preparation software that includes state tax functionalities.

Legal use of the Withholding Tax Forms WV State Tax Department

The legal use of the Withholding Tax Forms is governed by state tax regulations. Employers are required to use these forms to accurately report withheld taxes, ensuring compliance with state laws. Failure to use the correct forms or to submit them on time can result in penalties and interest charges. It is essential for employers to understand their obligations and ensure that all forms are completed and submitted according to the guidelines set forth by the WV State Tax Department.

Filing Deadlines / Important Dates

Filing deadlines for the Withholding Tax Forms are critical for compliance. Employers must be aware of the following important dates:

- Quarterly filing deadlines for submitting withheld taxes.

- Annual reconciliation deadlines, typically at the end of the tax year.

- Any specific deadlines for amended returns or corrections.

Form Submission Methods (Online / Mail / In-Person)

Employers have various options for submitting the Withholding Tax Forms to the WV State Tax Department:

- Online submission through the state tax department's e-filing system.

- Mailing paper forms to the designated address provided by the department.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete withholding tax forms wv state tax department

Complete Withholding Tax Forms WV State Tax Department effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Withholding Tax Forms WV State Tax Department on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Withholding Tax Forms WV State Tax Department effortlessly

- Locate Withholding Tax Forms WV State Tax Department and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you'd like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your device of choice. Modify and eSign Withholding Tax Forms WV State Tax Department and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax forms wv state tax department

Create this form in 5 minutes!

How to create an eSignature for the withholding tax forms wv state tax department

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What are Withholding Tax Forms for WV State Tax Department?

Withholding Tax Forms for the WV State Tax Department are documents required for reporting taxes withheld from employee wages. These forms help employers comply with state tax regulations and ensure employees’ taxes are accurately reported. Utilizing airSlate SignNow can simplify the generation and submission of these forms to the WV State Tax Department.

-

How can airSlate SignNow help with Withholding Tax Forms for WV State Tax Department?

airSlate SignNow offers an easy-to-use platform that allows businesses to create, send, and eSign Withholding Tax Forms for the WV State Tax Department. This ensures that you can efficiently manage your tax documentation without the hassle of physical paperwork. The solution saves time and reduces the risk of errors in your tax submissions.

-

Are there any costs associated with using airSlate SignNow for Withholding Tax Forms for WV State Tax Department?

Yes, there are subscription plans available for using airSlate SignNow, which vary based on features and usage. However, the cost is often justified by the time saved and reduced errors in handling Withholding Tax Forms for the WV State Tax Department. You can choose a plan that best fits your business needs.

-

What features does airSlate SignNow provide for handling Withholding Tax Forms for WV State Tax Department?

airSlate SignNow provides a range of features including customizable templates, secure eSigning, and automated workflows that streamline the process of managing Withholding Tax Forms for the WV State Tax Department. The platform also offers tracking capabilities to ensure that all documents are signed and submitted on time.

-

Can I integrate airSlate SignNow with other software for Withholding Tax Forms for WV State Tax Department?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and payroll software, allowing for smooth management of Withholding Tax Forms for the WV State Tax Department. These integrations help centralize your tax management and enhance overall efficiency in your business operations.

-

What are the benefits of using airSlate SignNow for Withholding Tax Forms for WV State Tax Department?

Using airSlate SignNow for Withholding Tax Forms for the WV State Tax Department offers numerous benefits such as increased efficiency, reduced paperwork, and improved compliance with state tax requirements. The platform minimizes the risk of human error and ensures timely submissions, helping your business stay in good standing with the WV State Tax Department.

-

Is airSlate SignNow secure for handling Withholding Tax Forms for WV State Tax Department?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Withholding Tax Forms for the WV State Tax Department are handled with the highest level of protection. The platform employs encryption and secure data management practices, keeping your sensitive tax information safe from unauthorized access.

Get more for Withholding Tax Forms WV State Tax Department

- High adventure activity medical form health examination to be ahgonline

- Health form network

- Medical encounter form

- Excellus authorization to print out 2007 form

- Fillable mra form

- Midland national beneficiary change form

- Dexcom order form certificate of medical necessity

- Disability benefit claim form

Find out other Withholding Tax Forms WV State Tax Department

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract