it 204 Ll 2015

What is the IT 204 LL?

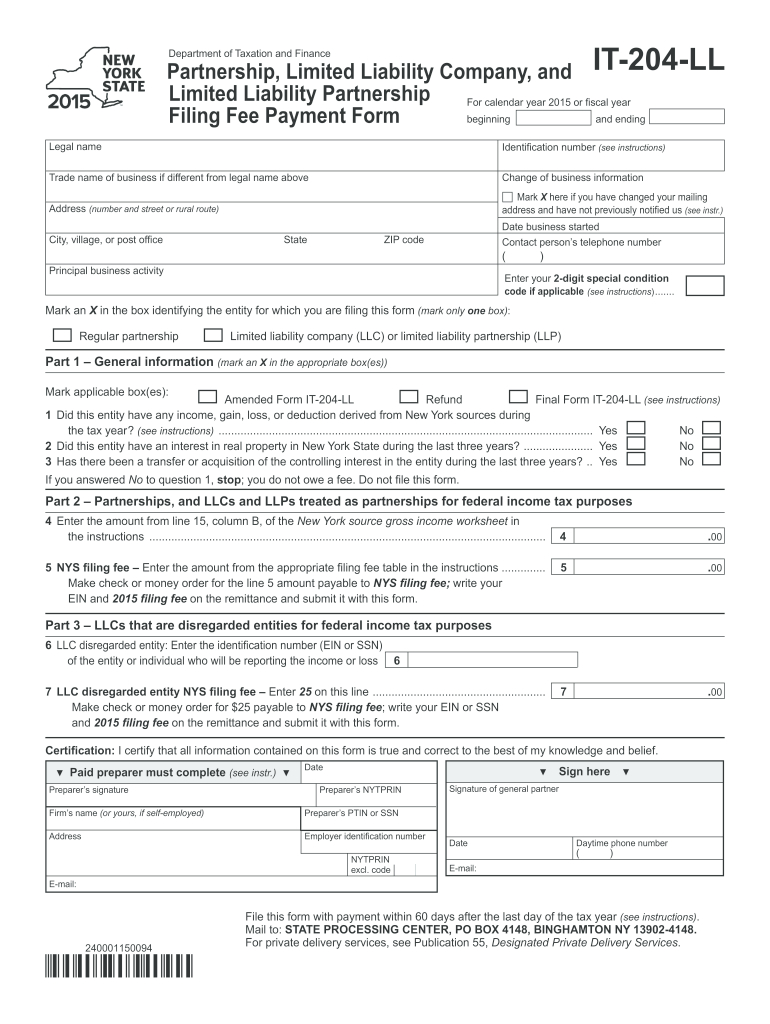

The IT 204 LL is a New York State tax form specifically designed for limited liability companies (LLCs) and certain partnerships. This form is used to report and pay the annual filing fee for LLCs that are classified as partnerships or disregarded entities for federal tax purposes. Understanding the purpose of the IT 204 LL is essential for compliance with state tax regulations.

How to use the IT 204 LL

Using the IT 204 LL involves a few straightforward steps. First, gather all necessary financial information regarding your LLC's income and expenses for the tax year. Next, complete the form by accurately reporting your total income and calculating the applicable filing fee based on your income bracket. Finally, ensure that you sign and date the form before submission to validate it.

Steps to complete the IT 204 LL

Completing the IT 204 LL requires careful attention to detail. Follow these steps:

- Obtain the IT 204 LL form, available online or through tax professionals.

- Fill in your LLC's name, address, and identification number.

- Report your total income for the year as required.

- Calculate the filing fee based on your income level, using the provided fee schedule.

- Review your entries for accuracy.

- Sign and date the form before submitting it.

Legal use of the IT 204 LL

The IT 204 LL is legally binding when completed and submitted according to New York State tax regulations. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. Compliance with the submission deadlines is also critical to avoid additional fees.

Required Documents

To complete the IT 204 LL, you will need several documents, including:

- Your LLC's financial statements for the tax year.

- Records of any income and expenses incurred.

- Your LLC's federal Employer Identification Number (EIN).

- Any previous IT 204 LL forms, if applicable.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IT 204 LL to ensure compliance. Typically, the form must be filed by the last day of the month following the close of the tax year. For example, if your tax year ends on December 31, the form should be submitted by January 31 of the following year. Missing this deadline can result in penalties.

Quick guide on how to complete it 204 ll

Complete It 204 Ll effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage It 204 Ll on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign It 204 Ll effortlessly

- Locate It 204 Ll and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you want to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign It 204 Ll and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 204 ll

Create this form in 5 minutes!

How to create an eSignature for the it 204 ll

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to it 204 ll 2016?

airSlate SignNow is a powerful platform that allows businesses to send and e-sign documents efficiently. By utilizing features specified in the it 204 ll 2016 guidelines, the solution ensures compliance with necessary electronic signature laws, making document handling easier and more secure.

-

How much does airSlate SignNow cost with reference to it 204 ll 2016?

airSlate SignNow offers various pricing plans that cater to different business needs, including features that align with it 204 ll 2016 standards. Pricing is competitive, ensuring that even small businesses can benefit from an easy-to-use e-signature solution. For detailed pricing, it’s best to visit our website.

-

What key features does airSlate SignNow provide that support it 204 ll 2016 compliance?

airSlate SignNow includes features such as secure cloud storage, audit trails, and customizable templates, all of which are important for it 204 ll 2016 compliance. These features not only streamline the signing process but also ensure that your documents are legally binding and tamper-proof.

-

How does airSlate SignNow improve business efficiency in relation to it 204 ll 2016?

By harnessing airSlate SignNow's capabilities, businesses can drastically reduce the time spent on document processing. It helps align with it 204 ll 2016 guidelines by enabling instant access to e-signed documents, thus facilitating faster decision-making and improving overall operational efficiency.

-

Can airSlate SignNow integrate with other applications in light of it 204 ll 2016?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as CRM systems and cloud storage solutions while adhering to it 204 ll 2016 standards. This integration allows users to manage documents effortlessly across different platforms, enhancing productivity and workflow.

-

What benefits does airSlate SignNow offer specifically for remote teams regarding it 204 ll 2016?

For remote teams, airSlate SignNow offers the flexibility and accessibility needed to sign documents from anywhere, which is essential in today’s work environment. By complying with it 204 ll 2016, it ensures that electronic signatures captured remotely are valid and secure, reducing the challenges remote teams typically face.

-

What support resources are available for users of airSlate SignNow related to it 204 ll 2016?

Users of airSlate SignNow can access a variety of support resources, including detailed documentation, video tutorials, and customer support teams ready to help. These resources provide guidance on ensuring compliance with it 204 ll 2016 requirements, helping users maximize the platform's potential.

Get more for It 204 Ll

Find out other It 204 Ll

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now