204 2018

What is the NYC 204 Form?

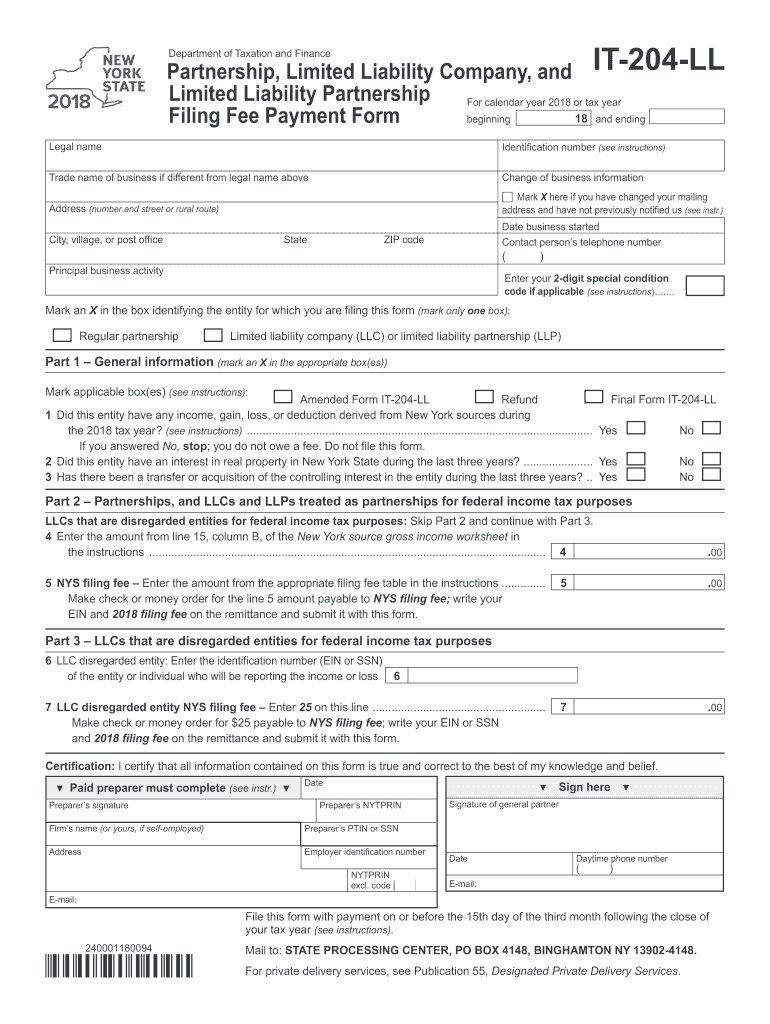

The NYC 204 form, officially known as the New York City Unincorporated Business Tax (UBT) Return, is a tax document that must be filed by unincorporated businesses operating within New York City. This form is essential for reporting income and calculating the tax owed to the city. It is specifically designed for sole proprietors, partnerships, and limited liability companies (LLCs) that do not elect to be treated as corporations for tax purposes. Understanding the NYC 204 form is crucial for ensuring compliance with local tax laws and for accurately reporting business income.

Steps to Complete the NYC 204 Form

Completing the NYC 204 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation related to business operations. Next, fill out the form by entering your business income, deductions, and any applicable credits. Be sure to review the specific instructions provided with the form, as they outline how to calculate your taxable income and the tax owed. Finally, double-check all entries for accuracy before submitting the form to avoid potential penalties.

Legal Use of the NYC 204 Form

The NYC 204 form is legally binding and must be filed according to the deadlines set by the New York City Department of Finance. Filing this form is a legal requirement for unincorporated businesses operating in NYC, and failure to comply can result in penalties and interest on unpaid taxes. It is important to ensure that all information provided on the form is accurate and complete, as discrepancies can lead to audits or further legal action. Utilizing a reliable eSignature platform can enhance the security and legality of submitting the form electronically.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 204 form are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the form is due by April 15. It is essential to keep track of these deadlines to avoid late fees and penalties. Additionally, if you need to file an extension, be aware of the separate deadlines associated with that process to ensure timely submission.

Required Documents

When preparing to file the NYC 204 form, certain documents are necessary to support your claims and calculations. These documents include:

- Income statements detailing total revenue

- Expense records to substantiate deductions

- Previous year’s tax returns for reference

- Documentation of any tax credits claimed

Having these documents readily available will streamline the process of completing the form and ensure that all reported figures are accurate.

Form Submission Methods

The NYC 204 form can be submitted through various methods, providing flexibility for business owners. You can file the form online through the New York City Department of Finance's website, which offers a secure and efficient way to submit your tax return. Alternatively, you can mail a paper copy of the form to the designated address provided in the filing instructions. In-person submissions may also be possible at specific city offices, but it is advisable to check current policies regarding in-person filings.

Quick guide on how to complete 204

Effortlessly Prepare 204 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the required format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 204 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign 204 with Ease

- Find 204 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 204 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 204

Create this form in 5 minutes!

How to create an eSignature for the 204

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the NYC 204 form and why is it important?

The NYC 204 form is a crucial document required for businesses operating in New York City to report their business income. Completing the NYC 204 form accurately ensures compliance with city tax regulations and avoids potential penalties. It's essential for maintaining good standing with local authorities.

-

How can airSlate SignNow help with the NYC 204 form?

AirSlate SignNow simplifies the process of completing and signing the NYC 204 form by providing an intuitive platform for electronic signatures and document management. With airSlate SignNow, you can securely eSign the NYC 204 form and share it instantly, streamlining your workflow. This saves time and reduces errors associated with paper forms.

-

What are the costs associated with using airSlate SignNow for the NYC 204 form?

AirSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. By choosing a plan that suits your requirements, you can easily manage documents like the NYC 204 form cost-effectively. Users can start with a free trial to explore the features before committing to a subscription.

-

Are there any specific features for handling the NYC 204 form within airSlate SignNow?

Yes, airSlate SignNow offers features specifically designed for handling the NYC 204 form, including customizable templates, automated workflows, and secure storage. These features make it easier to fill out, sign, and manage your NYC 204 form efficiently. You'll benefit from enhanced security and tracking options as well.

-

Can I integrate airSlate SignNow with other software for processing the NYC 204 form?

Absolutely! AirSlate SignNow supports integrations with various software solutions to enhance your document management processes, including accounting and tax preparation platforms. This seamless integration allows you to pull data directly into the NYC 204 form, reducing manual data entry and improving accuracy.

-

How does airSlate SignNow ensure the security of the NYC 204 form?

AirSlate SignNow prioritizes the security of all documents, including the NYC 204 form. We utilize advanced encryption techniques and comprehensive security protocols to protect your sensitive information. Additionally, our platform is compliant with industry standards to keep your data safe and confidential.

-

Is the NYC 204 form eSigning process user-friendly?

Yes, the eSigning process for the NYC 204 form on airSlate SignNow is designed to be user-friendly and straightforward. Users can easily navigate the platform to sign documents electronically without any technical expertise. Our intuitive interface ensures a smooth experience for all users.

Get more for 204

Find out other 204

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application